By Eric Smith

The transformation that Crocs Inc. began a few years ago has included everything from shuttering stores to adjusting its channel strategy to closing its company-owned manufacturing facilities.

Those efforts to slash costs have paid off for the Niwot, CO-based footwear maker. After shedding $80 million in selling, general and administrative (SG&A) expenses in that timeframe, the company can now focus on the next leg of its journey.

“We’re well-positioned for global growth,” said Crocs President and CEO Andrew Rees.

Rees spoke earlier this week at the ICR Conference in Orlando, FL, where he and CFO Anne Mehlman outlined the ways that Crocs has successfully repositioned itself for significant growth and improved margins.

In a fireside chat hosted by Baird analyst Jonathan Komp, Rees and Mehlman dug into the achievements of 2018 and where the focus shifts in 2019 and beyond.

First, Rees laid out the path that Crocs has been traveling to get back on solid footing, a three-part strategy the team laid out at last year’s ICR Conference and one that Crocs has been rigorously pursuing:

- Simplify the business to reduce costs

- Improve the quality of revenues and improve gross margin

- Generate sustainable, profitable revenue growth

The first two are largely accomplished and have been successful, Rees said. The company was able to execute the SG&A reduction plan it implemented two years ago to save $75 million to $80 million thanks to store closings and the sale of smaller markets to distributors.

Next, Rees outlined the next phase. He said Crocs’ growth strategy can be broken out by three levers—Product, Channel and Region—and here’s a breakdown of each:

- Product. Crocs aims to innovate and grow clog relevance while tapping into significant long-term growth potential with sandals and emphasizing its visible comfort technology.Clogs are a $4 billion a year global category, and Crocs is the market leader around the world. This is also the company’s highest margin category, and it aims to grow its presence here through more collaborations (like the recent successful one with Post Malone), optimizing color options and adding more personalization.Meanwhile, sandals is a $23 billion a year global market with no real leader and runway for Crocs to grow in the casual, outdoor and fashion spaces. “We think sandals represent a significant long-term growth opportunity for the Crocs brand to scale beyond where it’s been in the past,” Rees said.

- Channel. Crocs is seeing double-digit e-commerce growth—15 percent CAGR—which has been driven by its own sites (11 around the world) and has benefited from the continued shift from brick-and-mortar to digital. However, the greatest upside is on the wholesale side (specifically to e-tailers and distributors as opposed to traditional brick-and-mortar), Rees said, and the company is prioritizing its most profitable retail outlets as it closed non-outlet stores. The company has also ventured into global marketplaces. It now sells directly on five sites and plans to add five or more sites in 2019. “We feel this is incredibly important as marketplaces build tremendous traction with their consumers,” Rees said. “By selling on those marketplaces, we’re not spending money, time and effort trying to drive consumers to our own site but taking advantage of the platform that other companies have built.”

- Region. Asia presents the largest long-term growth potential (primarily China, Korea and Japan) for Crocs high growth and underpenetrated markets, while the Americas is seeing strong momentum.

Crocs enters this growth phase with plenty of momentum. Prior to ICR, the company released updated guidance for the fourth quarter and full year ended December 31.

For Q4, the company now anticipates fourth quarter revenues of $211 million to $214 million, up from the prior guidance of $195 million to $205 million; revenues were $199.1 million in the fourth quarter of 2017.

The company continues to expect gross margin to increase by 80 to 100 basis points over 45.4 percent in the fourth quarter of 2017. And it now expects SG&A to be approximately 54 percent of revenues compared to 60.6 percent of revenues in the fourth quarter of 2017.

And for 2018, the company now anticipates 2018 revenues to grow 6 percent, up from Crocs’ prior guidance of 4 percent to 5 percent revenue growth over 2017 revenues of $1 billion.

The company continues to expect gross margin to increase approximately 100 basis points over the 50.5 percent rate in 2017, and it now expects SG&A to be approximately 46 percent of revenues compared to 48.8 percent of revenues in 2017.

Read more: Crocs Raises Fourth-Quarter Revenue Guidance

Wall Street has reacted positively to Crocs. The company’s shares were up 48 cents, or 1.6 percent, to $30.53 Wednesday after seeing some larger climbs last week. And analysts have been mostly favorable in their research notes that followed the updated guidance announcement and ICR presentation.

Komp, who hosted the conference event, wrote in a note to investors that sustainability is the key for Crocs as it moves from repositioning to growth mode.

“Management’s presentation and commentary at our Baird-hosted meeting highlighted the substantial progress made in simplifying/improving operations and re-focusing the brand to drive sustainable growth,” Komp wrote. “With top-line accelerating over the course of 2018 (ending on a strong note), investors primarily are focused on sustainability. We are more optimistic about the pipeline of initiatives into 2019, though we wait for pullbacks or signs that revenue over-delivery can continue before becoming more constructive following the sharp run up.”

Jim Duffy of Stifel wrote: “The multi-year turnaround is complete and appetite for the classic clog silhouette from young consumers is supporting regained momentum in North America. With the distribution realignment largely in the rear view, focus has turned to disciplined growth and achievement of double-digit EBIT margins. While momentum could support revenue upside near-term, consensus estimates for 5 percent two-year CAGR (inclusive of 3.7ppt. headwind in 2019 from retail closures and FX) and an 11 percent operating margin appear rational.”

And Sam Poser of Susquehanna Financial Group LLLP, which upgraded the company to a “buy” earlier this month, wrote: “We believe the company’s upward revision to 4Q18/FY18 guidance and reiterated preliminary FY19 guidance ahead of the ICR conference is clear evidence that turnaround efforts are working. Crocs continues to: 1) streamline processes; 2) improve product; 3) control distribution; 4) engage in collaborations and marketing efforts to elevate the brand; and 5) methodically grow outside of North America. All of which are leading to sustainable profitable MSD [mid-single-digit] revenue growth. While the stock is up 15 percent since our upgrade on Jan. 2, we believe there is further upside.”

The optimism was evident from Rees, who closed his ICR presentation with a upbeat assessment of where Crocs has been and where it’s going.

“This is a very important pivot point for Crocs and the brand,” Rees said. “We’ve moved from repositioning the company and the brand, we’ve moved from reducing SG&A and improving the quality of revenues to really driving growth. We have an emerging track record for growth as you can see in our recent quarters. And we feel very strongly that we have the product platform, marketing credentials and distribution strategy that will allow us to be successful in the future, so we’re incredibly optimistic.”

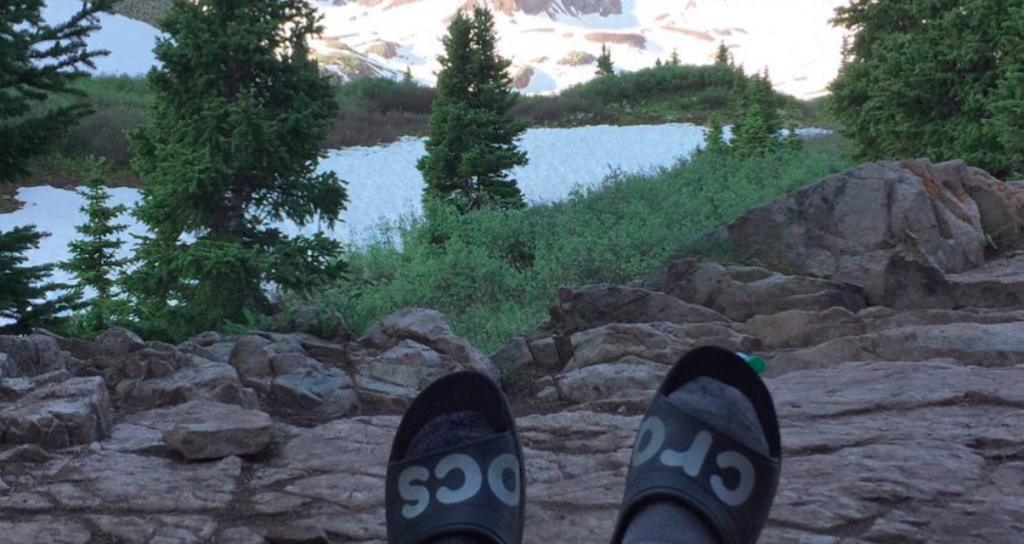

Photo courtesy Crocs Inc.

[author] [author_image timthumb=’on’]https://s.gravatar.com/avatar/dec6c8d990a5a173d9ae43e334e44145?s=80[/author_image] [author_info]Eric Smith is Senior Business Editor at SGB Media. Reach him at eric@sgbonline.com or 303-578-7008. Follow on Twitter or connect on LinkedIn.[/author_info] [/author]