The National Retail Federation (NRF) reported on Friday, July 11, that retail sales slowed in June amid continued consumer concerns about the impact of government policies on the economy, according to data compiled in the May 2025 Edition of the CNBC/NRF Retail Monitor report.

“June numbers indicate that prolonged uncertainty surrounding the economy, tariffs and trade policy could be pushing consumers to adopt a ‘wait-and-see’ approach with their household budgets,” offered NRF President and CEO Matthew Shay. “This was the first monthly decline since February, and spending was down across almost all sectors. Economic fundamentals haven’t been disrupted yet, and shoppers still have the ability to spend on priorities, but the economy is gradually slowing and there has been an impact on the psyche of consumers. While passage of the ‘Big Beautiful Bill’ is clearly supportive of economic growth, unresolved and restrictive trade policies remain a significant headwind.”

The CNBC/NRF Retail Monitor estimated that Total Retail Sales, which excludes autos and gas, were down 0.33 percent seasonally adjusted month-over-month (m/m) but up 3.2 percent unadjusted year-over-year (y/y) in June. That compares with increases of 0.49 percent m/m and 4.4 percent y/y in May and a 6.8 percent y/y increase in April.

SGB Media rounds all variance percentages under 1 percent to the closest one-hundredth of a percent and any variances 1 percent or higher to the nearest one-tenth of a percent.

The CNBC/NRF report’s calculation of Core Retail Sales, excluding restaurants, auto dealers and gas stations, was down 0.32 percent m/m in June but up 3.4 percent y/y. That compares with increases of 0.23 percent m/m and 4.2 percent y/y in May, and increases of 0.9 percent m/m and 7.1 percent y/y in April.

The month-over-month drops were the first since February, when both Total and Core sales declined 0.22 percent from January.

Total Retail Sales were up 4.7 percent y/y for the six-month year-to-date period (YTD, H1), and Core Retail Sales were up 4.9 percent for the YTD period, both showing evidence of moderation from the five-month YTD period.

The CNBC/NRF Retail Monitor reports actual, anonymized credit and debit card purchase data compiled by Affinity Solutions, which tabulates its report results without the need for monthly or annual revisions.

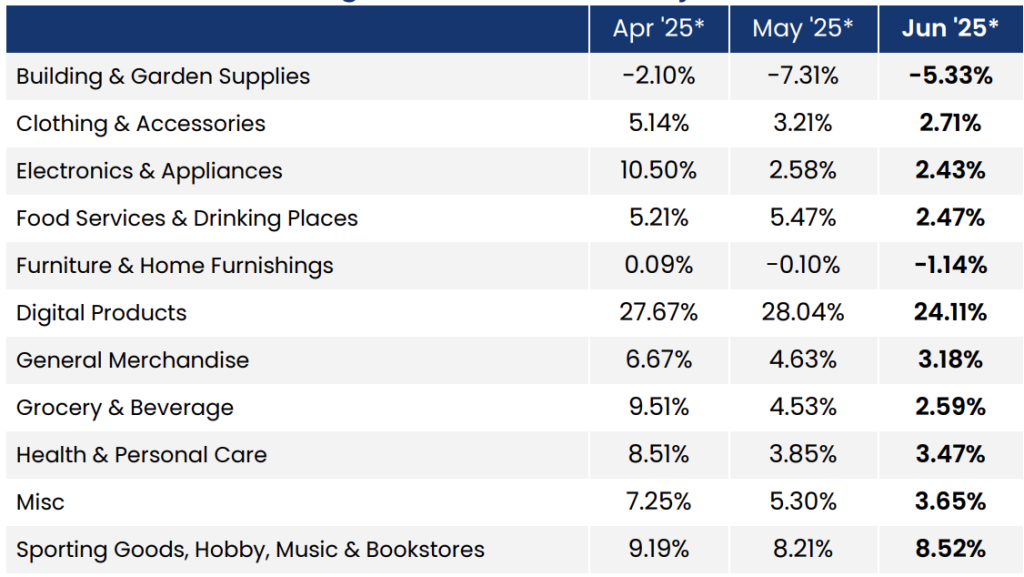

The NRF reported that June sales increased in seven out of nine categories on a year-over-year basis, led by digital products (E-Commerce), Sporting Goods stores, and Health and Personal Care stores. However, sales were down in all categories except e-commerce on a month-over-month basis.

Growth in the Clothing, Footwear and Accessories stores sector again decelerated from the year-over-year trend in May, while the sector that includes Sporting Goods stores saw growth accelerate to 8.5 percent in June from the 8.2 percent trend in May but fell short of the strong 9.2 percent y/y gain in April. June E-commerce (Digital Products) sales decelerated sharply from the very strong May trend.

Year-Over-Year Change in Retail Sales, Unadjusted

The CNBC/NRF Retail Monitor Report for June 2025, can be downloaded here.

Image courtesy Mall of America, Data/Chart courtesy CNBC/NRF Retail Monitor