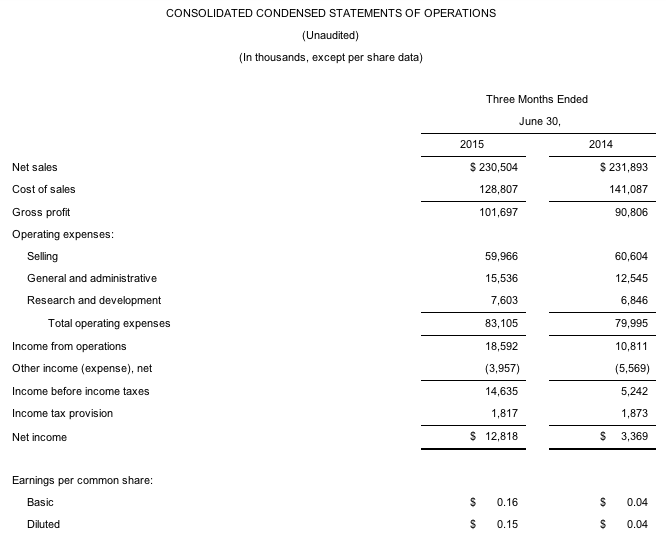

Callaway Golf Co. reported second-quarter earnings more than tripled to $12.8 million, or 15 cents a share, from $3.4 million, or 4 cents, a year ago. The company also revised its full year financial outlook.

For the second quarter, despite headwinds from unfavorable changes in foreign currency exchange rates and softer than anticipated international market conditions (particularly in Asia), the company achieved second quarter net sales essentially flat with 2014 but growing over 6 percent on a constant currency basis. Due to significantly improved gross margins, the company also increased second quarter 2015 operating income by 72 percent compared to the same period in 2014 and increased earnings per share by $0.11 to $0.15.

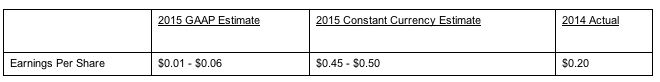

As a result of the more challenging international market conditions and the higher than anticipated profitability, the company revised its full year net sales estimates to $830 – $840 million (as compared to its prior estimate of $840 – $860 million) and increased its earnings outlook to 1 to 6 cents earnings per share (as compared to its prior estimate of a loss of 3 cents to earnings of 4 cents per share).

“Overall, we are pleased with our performance in the second quarter and the progress we have made turning our business around,” commented Chip Brewer, President and Chief Executive Officer of Callaway Golf company. “Foreign currency exchange rates and softer than expected market conditions in Asia have proved challenging this year; however, our brand momentum and market shares have continued to increase, we have made substantial progress improving our profitability, and our product pipeline remains robust. Looking forward, despite a continued rebalancing of retail inventory in Asia, we are encouraged by the overall fundamentals of the golf industry with less overall promotional activity, more reasonable production and inventory levels, and a general stabilization of participation in golf.”

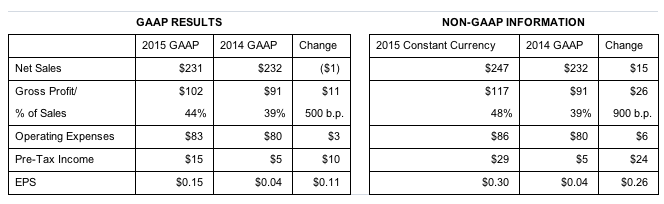

Summary of Second Quarter 2015 Financial Results

GAAP and Constant Currency Results

In addition to the company's results prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), the company also provided additional information concerning its results on a non-GAAP basis. This non-GAAP information presents the company's financial results on a constant currency basis, which is calculated by excluding the offsetting hedging gains and losses recorded during the period and applying the prior period exchange rates to the adjusted current period local currency results. The manner in which this constant currency information is derived is discussed in more detail toward the end of this release, and the company has provided in the tables to this release a reconciliation of the non-GAAP information to the most directly comparable GAAP information.

For the second quarter of 2015, the company announced the following GAAP and constant currency financial results, as compared to the same period in 2014 (in millions, except eps):

The company's $231 million in net sales for the second quarter of 2015 were essentially flat with net sales of $232 million for the same period in 2014 despite unfavorable changes in foreign currency rates and softer than anticipated market conditions in the international markets, particularly Asia. Unfavorable changes in foreign currency exchange rates negatively affected 2015 second quarter net sales by approximately $16 million. On a constant currency basis, net sales for the second quarter of 2015 grew by over 6 percent compared to 2014.

The company's earnings per share for the second quarter of 2015 increased by $0.11 per share to $0.15 compared to $0.04 for the same period in 2014. Despite flat sales, the company was able to significantly improve its earnings as a result of a 500 basis point improvement in gross margins due to more favorable product pricing and mix of higher margin products as well as improved operational efficiencies. This significant improvement in gross margins more than offset a slight increase in operating expenses. On a constant currency basis, the company's earnings per share would have been $0.30. Compared to 2014, the company's earnings per share for the second quarter of 2015 were also adversely affected by an increase of over 16 million common equivalent shares in the earnings per share calculation.

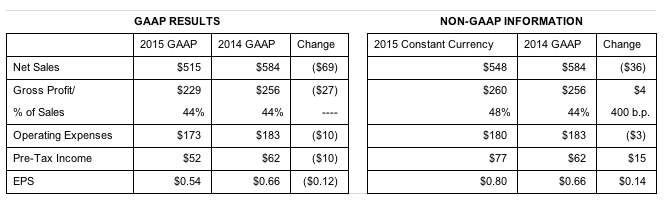

Summary of First Half 2015 Financial Results

GAAP and Constant Currency Results

As noted above, in addition to the company's results prepared in accordance with GAAP, the company also provided additional information concerning its results on a non-GAAP basis. This non-GAAP information presents the company's financial results on a constant currency basis, which is calculated by excluding the offsetting hedging gains and losses recorded during the period and applying the prior period exchange rates to the adjusted current period local currency results. The manner in which this constant currency information is derived is discussed in more detail toward the end of this release and the company has provided in the tables to this release a reconciliation of the non-GAAP information to the most directly comparable GAAP information.

For the first half of 2015, the company announced the following GAAP and constant currency financial results, as compared to the same period in 2014 (in millions, except eps):

For the first half of 2015, the company's net sales decreased 12 percent (or 6 percent on a constant currency basis), compared to the same period in 2014. The decrease was largely the result of unfavorable changes in foreign currency exchange rates, a strategic shift in product launch timing which adversely affected first quarter net sales, and softer than expected market conditions in the company's international markets, particularly in Asia. The effects of the strategic shift in launch timing should smooth out as the year progresses.

The company's earnings per share for the first half of 2015 decreased $0.12 compared to the first half of 2014 primarily due to unfavorable changes in foreign currency exchange rates, which adversely affected 2015 first half earnings per share by $0.26. On a constant currency basis, the company's first half earnings per share increased 21 percent to $0.80 due to a 400 basis point constant currency improvement in gross margins and a decrease in operating expenses.

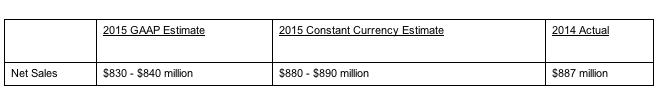

Business Outlook for 2015

Given the softer than anticipated market conditions in the company's international markets and the company's significantly improved gross margins, the company is revising its full year sales estimates and increasing its full year earnings estimates. Given the significant effects that foreign currencies will have on the company's GAAP results in 2015, the company has provided guidance on both a GAAP and constant currency basis. The GAAP guidance is generally based upon a blend of current foreign currency exchange rates and the exchange rates at which the company entered into hedging transactions. The company's hedging program will mitigate but not eliminate the effects of future foreign currency rate changes and therefore any such future changes will affect the company's GAAP guidance. The constant currency estimates are derived by taking the estimated 2015 local currency results and translating them into U.S. Dollars based upon the foreign currency exchange rates for the comparable period in 2014.

Full Year

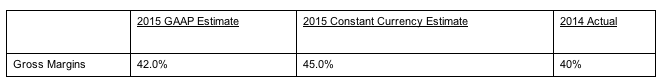

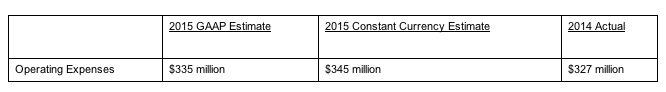

The company currently estimates the following full year results for 2015:

The decline in the company's estimates for full year net sales from its previous GAAP guidance of $840 – $860 million is due to softer than anticipated international market conditions. A further strengthening of the U.S. Dollar for the balance of the year would also negatively affect the company's GAAP sales estimates.

The company estimates that its 2015 GAAP gross margins as a percent of sales will improve approximately 100 basis points from its previous guidance of 41.0 percent due to a stronger sales mix and continued operational improvements.

The company estimates that its 2015 GAAP operating expenses will remain consistent with its previous guidance, despite the decrease in first half operating expenses. Much of the first half decrease reflects a timing shift of marketing expense to support second half product launches and incremental marketing support for the Chrome Soft golf balls.

The company estimates that its 2015 Pre-tax income will increase from its previous guidance of $4 – $11 million due to improved gross margins more than offsetting the lower net sales estimates.

The company estimates that its fully diluted earnings per share will increase from its previous guidance of ($0.03) – $0.04 due to improved gross margins more than offsetting the softer than expected international market conditions. The company's 2015 earnings per share estimates assume a base of 80 million shares as compared to 78 million shares in 2014.