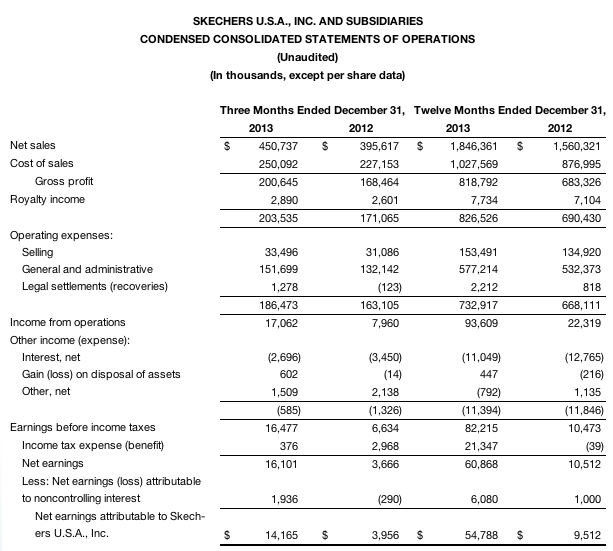

Skechers USA, Inc. reported fourth-quarter earnings more than tripled to $14.2 million, or 28 cents a share, compared

to net earnings of $4.0 million, or 8 cents, in the fourth quarter of 2012. Revenues rose 13.9 percent to $450.7 million compared to $395.6 million in the fourth quarter of 2012.

Earnings more than doubled to Earnings from operations in the fourth quarter of 2013 were $17.1

million compared to earnings from operations of $8.0 million in the

fourth quarter of 2012.

Gross profit for the fourth quarter of 2013 was $200.6 million or 44.5 percent of net sales compared to $168.5 million or 42.6 percent of net sales in the fourth quarter of 2012. Earnings from operations in the fourth quarter of 2013 were $17.1 million compared to earnings from operations of $8.0 million in the fourth quarter of 2012. The company's effective tax rate for the year-ended December 31, 2013, was 26.0 percent, which was down from the forecasted rate of 31.9 percent at the close of the third quarter 2013. This was due to increased international and slightly decreased domestic profitability. The Company expects improved international sales and profitability to continue to have a positive impact on its 2014 effective tax rate, which is expected to be between 25 percent and 30 percent.

“The momentum we experienced in the first nine months of 2013 continued in the fourth quarter, which resulted in the second highest fourth quarter sales in the company's history and a 13.9 percent net sales increase for the period on top of last year's fourth quarter net sales gain of 39.7 percent,” began David Weinberg, Skechers chief operating officer and chief financial officer. “The growth is related to the strong product successes we are experiencing across our men's, women's, and kids' categories, which resulted in double-digit increases in our company-owned retail and domestic wholesale businesses, and single-digit increases in our international and e-commerce businesses. Further indication of the strength of our product is the 12.8 percent comp store sales increases in our worldwide Company-owned retail stores during the fourth quarter.”

Net earnings for the fourth quarter of 2013 were $14.2 million compared to net earnings of $4.0 million in the fourth quarter of 2012. Net earnings per diluted share in the fourth quarter of 2013 were 28 cents based on 50.7 million weighted average shares outstanding compared to 8 cents based on 50.3 million weighted average shares outstanding in the fourth quarter of 2012.

Fiscal year 2013 net sales were $1.846 billion compared to net sales of $1.560 billion in 2012. Gross profit for 2013 was $818.8 million or 44.4 percent of net sales compared to $683.3 million or 43.8 percent of net sales in 2012. Earnings from operations for 2013 were $93.6 million compared to $22.3 million in 2012.

Net earnings for 2013 were $54.8 million compared to $9.5 million in 2012. Net earnings per diluted share for fiscal year 2013 were $1.08 based on 50.6 million weighted average shares outstanding versus $0.19 based on 49.9 million weighted average shares outstanding in the prior year.

Robert Greenberg, Skechers chief executive officer, commented: “Skechers has always been a product focused company, but in 2013, we challenged ourselves to deliver key styles from every one of our divisions. This more diversified product approach resulted in strong sales across our distribution channels. With our broad assortment of products, we weathered the unseasonably cold winter in the Midwest and Northeast thanks to one of our strongest boot collections, and the unseasonably warm weather in the West thanks to one of our strongest Sport collections. We were also honored as Brand of the Year for Skechers GO from Footwear News, and received the 2013 Excellence in Design Awards for Running and Kids footwear from Footwear Plus–two significant recognitions from leading trade magazines. The momentum we have been experiencing in the United States reached multiple markets around the world, resulting in sales improvements in Europe, Asia, the Middle East, Australia and South America. We supported our many divisions with a multi-level marketing campaign centered around television advertising. In the fourth quarter, these included campaigns with Brooke Burke-Charvet for both Relaxed Fit from Skechers and Bobs from Skechers campaigns, and two spots featuring sports icons Joe Montana and Mark Cuban for our men's Relaxed Fit by Skechers footwear. This quarter, we launched a new commercial for Skechers GOrun Ride 3 featuring elite runner and Olympic medalist Meb, who won the Houston Half Marathon last month. Our focus is to continue to deliver innovative, in-demand footwear that consumers around the globe will seek out, and support our product with impactful marketing. We are confident we can achieve this efficiently and continue to profitably grow our business through 2014.”

David Weinberg continued: “We believe 2013, with our second highest annual net sales ever, was the beginning of a growth trend for Skechers that we see continuing through 2014. Key performance indicators of this momentum are the approximately 30 percent increase in our combined worldwide backlogs at year-end, and our healthy January 2014 sales, including mid-single-digit comp store sales increases in our worldwide retail stores–in spite of the weather impacting a large portion of the United States. We are committed to maintaining this positive trend through product development, growth in our emerging and established international markets, deeper penetration in key domestic accounts, and the planned opening of 60 to 70 new company-owned stores this year. With $372.0 million in cash as of year-end, in-line inventory and strong double-digit backlogs, we believe the momentum we experienced since the end of 2012 will continue through 2014, and we are comfortable with the consensus numbers currently reported for the first quarter and full year.”