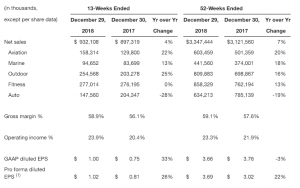

Garmin Ltd. reported fourth-quarter earnings that came in well above Wall Street’s targets with a boost from higher demand for its outdoor and aviation gadgets. Revenues improved 4 percent, led by a 25 percent gain in its outdoor segment and 22 percent in aviation.

Highlights for the fourth quarter 2018 include:

- Total revenue of $932 million, a 4 percent increase, with aviation, marine, outdoor and fitness collectively increasing 13 percent over the prior year quarter

- Gross margin improved to 58.9 percent compared to 56.1 percent in the prior year quarter

- Operating margin improved to 23.9 percent compared to 20.4 percent in the prior year quarter

Operating income of $223 million, representing 21 percent growth over the prior year

GAAP EPS was $1.00 and pro forma EPS was $1.02 for fourth quarter 2018, representing growth of 26 percent over the prior year - Recently signed an agreement to acquire Tacx, a leading provider of indoor bike trainers

- Launched its first marine chartplotters with a combined Garmin and Navionics chart database, offering industry leading breadth and depth of coverage

The adjusted earnings of $1.02 per share easily topped the average analyst estimate of 80 cents. Sales of $932 million also topped average targets of $891 million.

Highlights for the fiscal year 2018 include:

- Total revenue of $3,347 million, a 7 percent increase, with aviation, marine, outdoor and fitness collectively increasing 16 percent over the prior year

- Gross margin improved to 59.1 percent compared to 57.6 percent in the prior year

- Operating margin improved to 23.3 percent compared to 21.9 percent in the prior year

- Operating income of $778 million, representing 14 percent growth over the prior year

GAAP EPS was $3.66 and pro forma EPS(1) was $3.69, representing 22 percent growth over the prior year - Launched new categories of innovative wearables including Instinct, a GPS smartwatch that expands the market for adventure watches, and Descent™, a dive computer in a watch style design for recreational, technical and free divers

- Expanded its portfolio of music compatible devices and integrated seven music providers into its Connect IQ app store including Spotify, Deezer and KKBOX

- Shipped nearly 15 million units and over 205 million since inception, including over one million certified aviation products.

- Completed the strategic acquisitions of FltPlan, a leading electronic flight planning and service provider, and Trigentic, a privately-held worldwide provider of marine electronic digital switching

- Opened a new aviation manufacturing facility in Olathe, Kansas, more than doubling its North American manufacturing capacity

Cliff Pemble, president and chief executive officer, said, “2018 was another remarkable year of revenue and operating income growth driven by strong performance in our aviation, marine, outdoor and fitness segments,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “Entering 2019, we see many opportunities ahead and believe that we are well positioned to seize these opportunities with a strong lineup of products across all of our segments.”

Aviation:

Revenue from the aviation segment grew 22 percent in the quarter with contributions from both the aftermarket and OEM categories. Gross and operating margins were 73 percent and 33 percent, respectively, resulting in 27 percent operating income growth. Aftermarket systems and ADS-B solutions contributed to the positive results as Garmin moves toward the ADS-B mandate deadline. Garmin received the supplier of the year award from Airbus Helicopters, and recently ranked #1 in avionics support for the 15th consecutive year by both Professional Pilot Magazine and Aviation International News.

Marine:

Revenue from the marine segment grew 13 percent in the quarter driven by a new lineup of chartplotters, advanced sonars, and cartography offerings that combine the best of both Garmin and Navionics content. Gross and operating margins improved to 58 percent and 9 percent, respectively. Garmin recently began shipping the 2019 lineup of marine electronics including the GPSMAP® 8600 series, its flagship product line with combined Garmin and Navionics chart content.

Outdoor:

Revenue from the outdoor segment grew 25 percent in the quarter with significant contributions from adventure watches. Gross and operating margins improved to 67 percent and 38 percent, respectively, resulting in 31 percent operating income growth. During the quarter, Garmin launched Instinct, its newest line of adventure watch, and the GPSMAP 66 series of outdoor handhelds.

Fitness:

Revenue from the fitness segment was flat in the quarter compared to a strong prior year quarter. Gross and operating margins increased to 52 percent and 21 percent, resulting in 2 percent operating income growth. Garmin recently introduced the vívoactive 3 Music with 4G LTE, bringing connected safety features to the wrist. The pending acquisition of Tacx is an exciting opportunity to expand into the year-round indoor cycling and training market.

Auto:

The auto segment recorded revenue decline of 28 percent in the quarter, primarily due to the ongoing PND market contraction and lower year-over-year OEM sales. Gross margin improved to 43 percent and operating margin declined to 5 percent. At the recent Consumer Electronics Show, Garmin announced a new line of Drive navigators with simplified, road trip-ready features and an updated OEM scalable infotainment platform.

Additional Financial Information:

Total operating expenses in the quarter were $326 million, a 2 percent increase from the prior year. Research and development increased 10 percent, primarily due to engineering personnel costs. Selling, general and administrative expenses decreased 2 percent, due primarily to reduced litigation related costs. Advertising decreased 6 percent, primarily due to lower media spend as Garmin strategically focused on promotions.

The effective tax rate in the fourth quarter of 2018 was 18.0 percent compared to the pro forma effective tax rate of 20.5 percent in the prior year quarter. The decrease in the current quarter effective tax rate is primarily due to the benefits from U.S. tax reform.

In the fourth quarter of 2018, Garmin generated approximately $185 million of free cash flow (see attached table for reconciliation of this non-GAAP measure). Garmin ended the quarter with cash and marketable securities of approximately $2.7 billion.

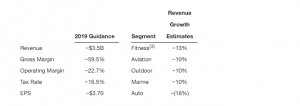

2019 Guidance:

Garmin said it currently expects 2019 revenue of approximately $3.5 billion as growth in fitness, aviation, outdoor and marine is partially offset by declines in the auto segment. The company currently expects its full year EPS will be approximately $3.70 based upon improved gross margin of approximately 59.5 percent, operating margin of approximately 22.7 percent and a full year effective tax rate of approximately 16.5 percent.

Image courtesy Garmin