Winnebago Industries, Inc. reported fiscal 2025 first quarter revenues amounted to $625.6 million, a decrease of 18.0 percent compared to $763.0 million in the first quarter of last year, driven primarily by lower unit volume and a reduction in average selling price per unit related to product mix.

Gross profit was $76.8 million, a decrease of 33.7 percent compared to $115.8 million in the first quarter of last year. Gross profit margin decreased 290 basis points in the quarter to 12.3 percent, reflecting deleverage, higher warranty experience compared to the prior year and product mix, partially offset by operational efficiencies.

Operating expenses were $77.7 million, an increase of 1.3 percent compared to $76.7 million in the first quarter of last year. This increase was primarily driven by strategic investments, partially offset by cost containment efforts.

Operating loss was $0.9 million, compared to operating income of $39.1 million in the first quarter of last year.

Net loss was $5.2 million, compared to net income of $25.8 million in the first quarter of last year. Reported net loss per diluted share was 18 cents, compared to reported net earnings per diluted share of 78 cents in the first quarter of last year. Adjusted loss per diluted share was 3 cents, compared to adjusted earnings per diluted share of 95 cents in the first quarter of last year.

Consolidated Adjusted EBITDA was $14.4 million, a decrease of 73.4 percent, compared to $54.1 million in the first quarter of last year.

“As expected, the RV and marine operating environment remained challenging in the first quarter, marked by subdued consumer demand and a cautious dealer network reluctant to make significant commitments on new orders ahead of the historically slow winter season,” said Michael Happe, president and CEO, Winnebago Industries. “These industry challenges highlight the critical importance of our strategic focus on disciplined production, effective cost management and targeted investments in new products and technologies. These strategies, complemented by our healthy balance sheet, prudent capital spending and robust liquidity, enhance our competitive position for an anticipated market recovery in the second half of fiscal 2025.”

First Quarter Fiscal 2025 Segments Summary

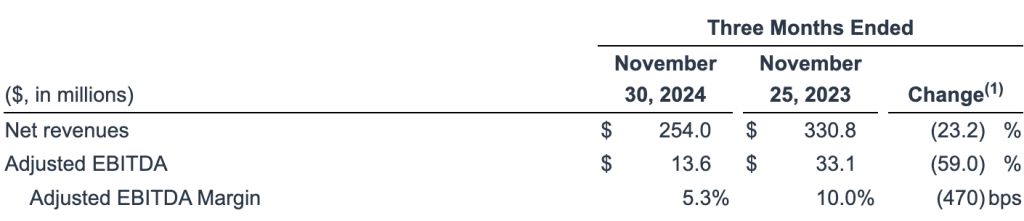

Towable Segment

- Revenues for the Towable RV segment were down compared to the prior year, primarily driven by lower unit volume and a shift in product mix toward lower price-point models.

- Segment Adjusted EBITDA margin decreased compared to the prior year, primarily driven by volume deleverage and product mix, partially offset by cost containment efforts.

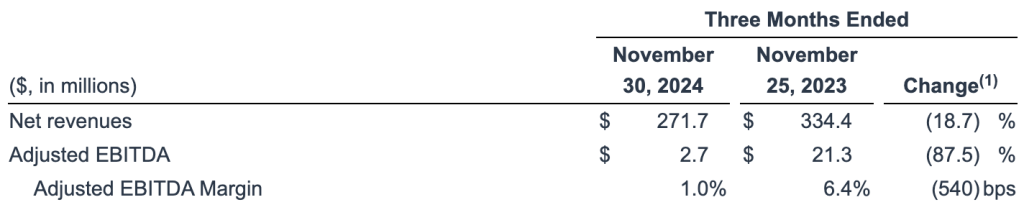

Motorhome RV Segment

- Revenues for the Motorhome RV segment were down from the prior year, primarily due to lower unit volume related to market conditions.

- Segment Adjusted EBITDA margin decreased compared to the prior year, primarily driven by volume deleverage, higher discounts and allowances, and higher warranty experience compared to the prior year, partially offset by operational efficiencies.

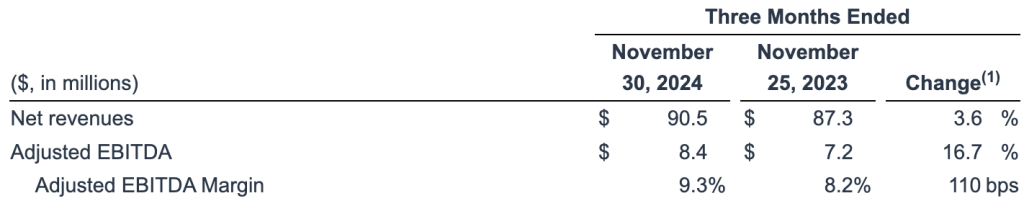

Marine Segment

- Revenues for the Marine segment were up from the prior year, primarily due to targeted price increases and higher unit volume, partially offset by a reduction in average selling price per unit related to product mix.

- Segment Adjusted EBITDA margin increased compared to the prior year, primarily driven by targeted price increases, partially offset by product mix and higher warranty expense.

Balance Sheet and Cash Flow

As of November 30, 2024, the company had total outstanding debt of $696.9 million ($709.3 million of debt, net of debt issuance costs of $12.4 million) and working capital of $556.1 million.

Cash flow used in operations was $16.7 million in the Fiscal 2025 first quarter.

Quarterly Cash Dividend and Share Repurchases

On December 18, 2024, the company’s Board of Directors approved a quarterly cash dividend of 34 cents per share, payable on January 29, 2025, to common stockholders of record at the close of business on January 15, 2025. Winnebago Industries executed share repurchases of $30.0 million during the first quarter.

Outlook

For fiscal 2025, Winnebago Industries is reaffirming its expectation for consolidated revenues in the range of $2.9 billion to $3.2 billion. Based on its first-quarter 2025 results, and its outlook for the balance of the year, the company is narrowing its fiscal 2025 reported EPS and adjusted EPS outlook while leaving the midpoints unchanged. The company now expects reported earnings per diluted share of $2.50 to $3.80, compared with the prior range of $2.40 to $3.90 per diluted share, and adjusted earnings per share of $3.10 to $4.40, compared with a prior range of $3.00 to $4.50 per diluted share. The company’s outlook takes into account prevailing trends in the RV sector, including competitive dynamics, shifts in consumer preferences, and key macroeconomic factors that may influence overall demand.

“We remain confident in our fiscal 2025 guidance,” said Happe. “Although the first half of the fiscal year comes with its typical seasonality and challenging market conditions, we are prepared to capitalize on the anticipated rise in demand as the RV and marine markets enter the spring selling season. This confidence comes from our robust lineup of new products, healthy channel relationships and strong financial foundation, all of which equip us to effectively serve our customers and navigate the current market landscape.”

Image and data tables courtesy Winnebago Industries, Inc.