While British retailers generally have a poor track record finding success in the U.S. retail marketplace, JD has the potential to create a strong number two beyond Foot Locker in U.S. sneaker retailing with the company’s pending acquisition of Finish Line. That is, according to a few analysts in the U.K. who closely follow JD.

JD agreed on March 26 to buy Finish Line for $588 million, or $13.50 a share, a 28 percent premium over the prior trading-day’s closing price. The transaction has been approved by Finish Line’s board and is expected to close by June 2018, subject to approval by both shareholder bases. Finish Line’s management team, including CEO Sam Sato, will continue to run the U.S. business.

JD’s annual sales are about £2.4 billion ($3.4 bn) versus $1.8 billion for Finish Line.

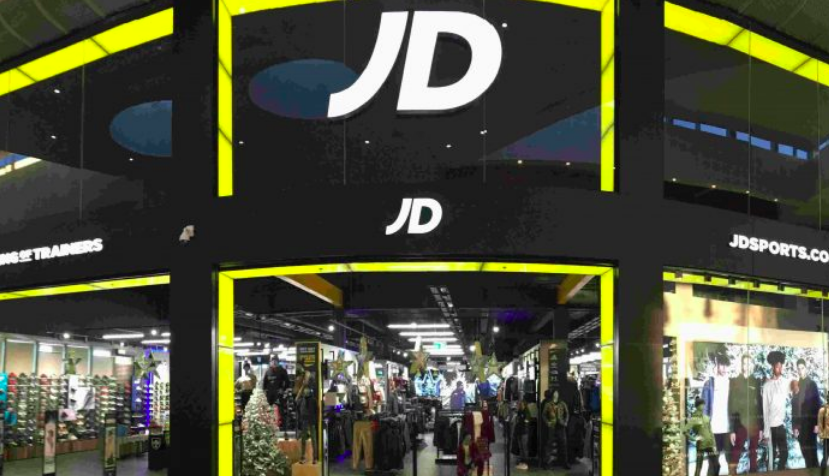

With nearly 1,300 stores in the U.K. and Europe, JD Sports is seen as the premier seller of sneakers in the U.K. with the JD flagship chain. The acquisition of Finish Line, with 930 branded locations in U.S. malls and branded shops inside Macy’s department stores, would quickly provide a strong foothold in the world’s largest sneaker market to move the company toward the goal of becoming a global player.

“This is a significant acquisition for JD Sports, giving it access to the largest sportswear market in the world with a significant player,” wrote Clive Black at Shore Capital Markets in a note following news of the deal.

Black noted that in recent years, JD has established a presence in Europe both organically and more recently with the acquisition of Sport Zone in Spain and Portugal and organic openings in Singapore and Australia “but this is a significant bolt-on opportunity.”

In an interview with SGB, Russ Mould, a stock market expert at investment platform AJ Bell, described JD as a “clear leader in branded sport and fashion wear including trainers (sneakers), offering a big range of leading brands on a multi-channel basis.”

Mould said JD’s sales, profits, dividends and stock have “all soared” in the last five years, even allowing for a recent pullback in shares over concerns over the impact of Brexit and weak U.K. wage growth. The retailer has raised earnings guidance twice since last fall.

In mid-January, JD Sports reported that due to online momentum and continuing overseas space expansion, interim results for the second half showed comparable-store sales expanding 3 percent. JD said at the time, “The performance is particularly encouraging when considered against the challenging comparatives provided by the significant levels of sales increases achieved in each of the last three years.”

The company is scheduled to report full results for the year ended February 3 on April 17.

Mould further said JD Sports has a “good” track record on M&A deals. Beyond the acquisition of Sport Zone in Spain and Portugal, past larger acquisitions included Go Outdoors in November 2016 as well as Blacks Leisure and Millets in the outdoor space out of bankruptcy proceedings in 2012. The company has also made a number of smaller acquisitions across Europe.

For JD operationally, Mould expects Finish Line will critically help further improve the U.K. retailer’s access to brands.

“Finish Line brings U.S. presence and scale,” said Mould. “The combination brings global scale in buying deals/marketing deals with brands.”

At Peel Hunt, Jonathan Pritchard cited four rationales for the acquisition for JD. First, he said it would be “almost impossible” for JD to build a major presence in the U.S. market organically, given the many stores closings seen in the region in recent years.

“An acquisition was always going to be the best way in,” wrote Pritchard in a note. “Finish Line fits the bill nicely, at a sensible price for a material presence in the market via some assets that need a shot in the arm.”

He also expects to see JD stores in the U.S. down the road.

Second, the deal provides JD with a “big name with scale but issues.” He noted that Finish Line had “lost its way” with negative comps over the past few years, although recent results have shown some improvement. He suggested that with 70 percent of sales stemming from Nike, Finish Line would likely benefit from more exclusive product. Pritchard added, “JD’s relationships with key suppliers, and its greater ability to create theatre in-store, make uplifts in sales densities highly viable.”

Third, improving JD’s overall leverage with key suppliers was seen as a critical component to the merger.

“It is crucial that retailers stay on their short list if they want to access the key launches and A-list product,” said Pritchard. “We’ve already seen retailers drop off the ‘preferred list’ and, by increasing its global reach, JD has ensured further that it is inside the tent with the big brands, and not on the outside looking in.”

Pritchard noted that JD and Zalando were the only strategic partners called out by Nike on the sneaker giant’s conference call on March 22.

Finally, Pritchard cited the potential for earnings enhancement, although likely not in the near-term.

“The deal is predicated more on strategic progress than short-term earnings enhancement, and there will be limited cost savings (existing management is staying on),” wrote Pritchard. “However, the improved product and store standards/theatre should ensure a good medium-term return on the investment, not to mention the less tangible benefits of building status.”

While the benefits of mergers may not materialize for a number of reasons, British press coverage of the deal have called out several failures by U.K. chains entering the U.S. marketplace.

The most recent was Tesco, which launched its Fresh & Easy grocery concept in California in 2006, only to fold it by 2013 after logging heavy losses. The U.K.’s largest grocer had found success in other markets.

Another often-mentioned failed U.S. entry was attempted by Marks & Spencer, which bought Brooks Brothers only to sell the company 13 years later for less than a third of the price it paid. Sainsbury, WH Smith, Dixons and HMV have also all stumbled in the U.S. marketplace as well.

While some of the failures have been traced partly to timing with economic downspins, the U.S. is seen as a competitive and cluttered market and subtle cultural differences present some challenges.

“The acquisition record of British firms in the U.S. is generally pretty poor,” said Mould. “Two peoples divided by a common language, bigger cultural differences than expected, different time zones (so management effort to run the business is greater than thought) and Brits tend to underestimate how different the U.S.’ individual states are from each other and how one size/approach does not necessarily fit with all.”

Mould suspects that moving to keep Finish Line’s team in place was “designed to tackle all of these issues.”

Pritchard believes JD has the potential to revive Finish Line’s top-line growth by bringing more “theater” to its stores and providing the chain with better access to product.

He believes JD will be able to help further bring an “elevation” of product to Finish Line’s locations, believing “the heart” of JD’s recent success has been the company’s efforts to improve the merchandising of brands. He believes that brands like to sell in multi-branded environment that offer a contrast to the companies’ efforts either in the companies’ own flagships or online, but want to see the brands “properly merchandised.”

He added, “It won’t happen overnight, but shopping environment will improve.”

Pritchard also feels Finish Line’s renovated stores “look good at first glance, but there will be plenty of aspects of retail theatre that JD can add.” He expects to see JD trial some of its own stores: some former Finish Line locations and some new outlets.

On the allocation side, Pritchard believes Finish Line’s recent underperformance can be partly traced to the company’s challenges securing exclusive or “must have” product. He noted that that those challenges likely won’t let up, as the major brands push their own DTC growth. But he said JD’s ability to secure “strong allocation of the most sought-after product” has been “very helpful” as the company has entered new markets in the past, and should help Finish Line.

He also said JD’s stores are more balanced with brands, and wondered whether the Finish Line will feature a better balance in time.

“JD’s relationships with suppliers will be a big benefit to the product range available at Finish Line,” wrote Pritchard. He noted that JD also has relationships with the likes of North Face, Lacoste, Emporio Armani’s EA7 line and Boss. While Finish Line sells some of these brands, “the relationships won’t be as deep, and the likes of Nike and Adidas love proximity to these sorts of brands as they attempt to tap in to some of the luxury parts of the market.”

As far as the hurdles of entering U.S. retailing, Pritchard said JD has demonstrated the company’s ability to enter new countries successfully, particularly in areas such as Europe and Malaysia, although the company has faced some headwinds in Australia. He’s confident the “fast-growing, ambitious company” is up for the U.S. challenge.

“The USA is a different wicket entirely to Europe and the Far East and there will be investors that take time to fall in love with the move West,” said Pritchard. “We can’t deny that the risk profile has changed with the deal, but we are far more glass half full: the deal makes sense in its own right and also, crucially, on a wider, global positioning’ perspective.”

Photo courtesy JD Sports