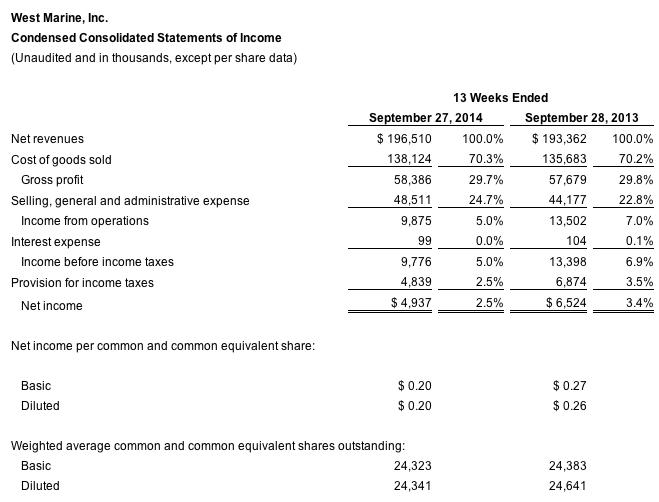

West Marine reported net revenues were $196.5 million, an increase of 1.6 percent compared to last year. Comparable store sales increased by 0.6 percent. Earnings slumped 24.6 percent to $4.9 million, or 20 cents a share, from $6.5 million, or 26 cents, a year ago.

Excluding the $0.8 million tax valuation allowance related to our

Canadian operations, net income was $5.8 million, or $0.23 per share. As

a result, for full year 2014 earnings per share are now expected to be

in the range of approximately $0.15 to $0.20. Pre-tax income was $9.8 million, compared to pre-tax income of $13.4 million last year.

The company is re-affirming its 2014 full-year pre-tax income and EBITDA guidance, with pre-tax income expected to be in the range of approximately $8.5 million to $11.0 million and EBITDA expected to be in the range of approximately $27.5 million to $30.0 million. In the prior year, EBITDA was $30.7 million.

Matt Hyde, West Marine’s CEO, commented: “Comparable stores sales showed slight gains for the quarter and we experienced stronger results from our growth strategies in merchandise expansion and store optimization. We remain focused on repositioning West Marine into a broader, waterlife outfitter and growing sales of core boating products.”

Progress on our growth strategies year-to-date was as follows:

- eCommerce: Sales from our eCommerce website were down by 1.6 percent as compared to last year, and represented 7.0 percent of total sales, compared to 7.1 percent for the same period last year. Overall our results this year have been affected by the replatform of our eCommerce website. However, with the replatform behind us, our eCommerce sales returned to positive year-over-year growth in mid-July and continued to improve throughout the quarter. We remain committed to our three to five-year goal for eCommerce to represent 15 percent of total sales.

- Store optimization: Sales through our optimized stores increased to 41.0 percent of total sales compared to 33.6 percent last year. This year-over-year increase supports our three to five-year goal to deliver 50 percent of our total sales through optimized stores.

- Merchandise expansion: Sales in these product lines, which include footwear, apparel, clothing accessories, fishing products and paddle sports equipment, were up by 13.7 percent, with core product sales down 1.9 percent, compared to last year.

Net revenues for the 39 weeks ended September 27, 2014 were $546.3 million, an increase of 0.4 percent, compared to net revenues of $544.4 million for the 39 weeks ended September 28, 2013. Comparable store sales decreased by 0.5 percent for the first nine months of 2014 versus the 2.3 percent decrease reported for the same period last year.

Net income for the first nine months was $12.2 million, or $0.50 per diluted share, compared to net income of $19.0 million, or $0.78 per diluted share, for the first nine months last year. Excluding the impact of the $0.8 million tax valuation allowance related to our Canadian operations, net income was $13.1 million, or $0.53 per share.

Total inventory at the end of the third quarter was $215.2 million, a $1.4 million, or 0.6 percent decrease versus the balance at September 28, 2013, and a 0.8 percent decrease on an inventory per square foot basis. Inventory turns for 2014 were down 1.1 percent versus the first nine months of last year.

Return on Invested Capital (“ROIC”) for the 52-week period ended September 27, 2014 was 4.4 percent, which compares to 5.5 percent ROIC for the 52-week period ended September 28, 2013. ROIC based on GAAP net income was 2.3 percent and 5.0 percent for the 52-week periods ended September 27, 2014 and September 28, 2013, respectively. Earnings before interest, taxes, depreciation and amortization (“EBITDA”) for the third quarter of 2014 was $14.6 million, compared to $17.2 million for the same period last year.

2014 Guidance

We are reaffirming our expectation for pre-tax income to be in a range of approximately $8.5 million to $11.0 million. We are also reaffirming our guidance for EBITDA to be in the range of approximately $27.5 million to $30.0 million. Our GAAP diluted earnings per share is now expected to be in the range of approximately $0.15 to $0.20 due to the establishment of a valuation allowance against our Canadian net deferred tax assets during the third quarter of 2014. We still anticipate comparable store sales for full-year 2014 to range from down 1.0 percent to up 1.5 percent, with total revenues expected to be in the range of $665 million to $680 million. We also continue to anticipate capital expenditures for fiscal 2014 to be in the range of $28 million to $32 million.