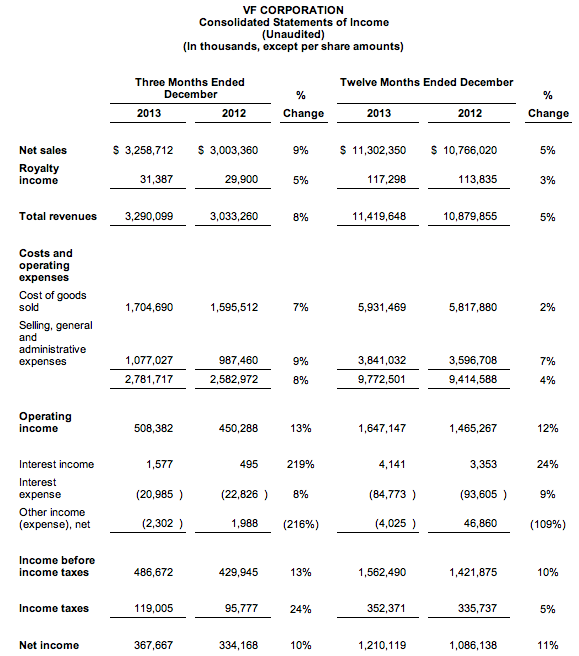

VF Corp reported revenues rose 8 percent in its fourth quarter to $3.3 billion, compared with the same period of 2012, driven by double-digit growth in its Outdoor & Action Sports, Sportswear, international and direct-to-consumer businesses, and high single-digit percentage growth in our Imagewear coalition.

The company also reported healthy full-year results and 2014 guidance. Highlights included:

- Full year 2013 adjusted EPS up 13 percent (up 12 percent on a GAAP basis)

- Full year gross margin up 160 basis points to 48.1 percent

- Full year revenues up 5 percent; fourth quarter revenues up 8 percent

- 2014 revenues expected to increase 7 to 8 percent

- 2014 gross margin expected to reach 49 percent; operating margin should reach 15 percent

- 2014 EPS expected to grow 11 to 13 percent to $3.00 to $3.05

- 2014 cash flow from operations expected to approach $1.65 billion

- Expect to return more than $1 billion to shareholders in 2014 through share repurchases and dividends.

“2013

was a terrific year for VF with record gross margin and earnings per

share,” said Eric Wiseman, VF Chairman and Chief Executive Officer. “The

combined power of our brands and platforms remains our greatest

competitive advantage enabling us to push the envelope on product

innovation to connect even more intensely with consumers and providing

stellar returns to our shareholders.

“Among many noteworthy brand

performances, two significant milestones included The North Face brand

passing $2 billion in global revenues and the Vans brand surpassing the

$1.7 billion revenue mark, becoming VF’s second largest brand,” Wiseman

continued. “And with strong results from our direct-to-consumer and

international businesses, supported by outstanding execution from our

global supply chain, we’ve established excellent momentum that we expect

to contribute to a strong year for VF in 2014.”

In the fourth quarter ended Dec. 28, gross margin improved 80 basis points to 48.2 percent, compared with 47.4 percent in the same period of 2012, with improvements in nearly every coalition. The higher gross margin reflects the continuing shift of our revenue mix toward higher margin businesses as well as lower year-over-year product costs.

SG&A as a percent of revenues rose 10 basis points to 32.7 percent in the fourth quarter. This increase includes the impact of an incremental investment of nearly $30 million in marketing to support growth in VF’s largest and fastest growing businesses.

Operating income on an adjusted basis grew 11 percent to $509 million in the fourth quarter, compared with $457 million in the same period of 2012. On a GAAP basis, fourth quarter operating income increased 13 percent to $508 million, compared with $450 million during last year’s same period. There were no material Timberland acquisition-related expenses in the fourth quarter of 2013 while the fourth quarter of 2012 included $7 million of such expenses. Adjusted operating margin was 15.5 percent, compared with 15.1 percent in the fourth quarter of 2012. On a GAAP basis, operating margin rose to 15.5 percent from 14.8 percent in last year’s period.

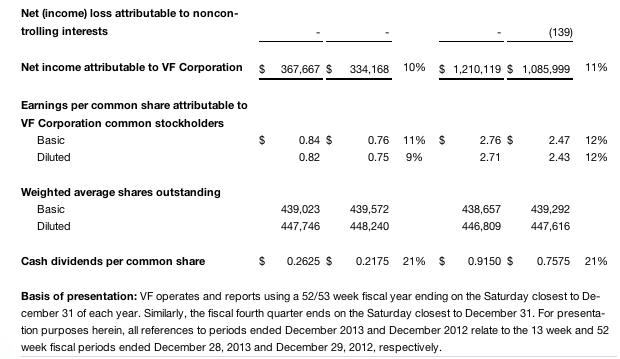

Net income on an adjusted basis grew 7 percent to $368 million in the fourth quarter, compared with $344 million in the same period of 2012. Adjusted earnings per share increased 6 percent to $0.82 per share compared with $0.77 per share during the same period last year. Fourth quarter 2012 adjusted earnings per share of $0.77 excluded $0.02 per share in Timberland acquisition-related expenses. On a GAAP basis, fourth quarter 2013 net income was up 10 percent to $368 million or $0.82 per share.

Full Year 2013 Review

Revenues increased 5 percent to a record $11.4 billion compared with $10.9 billion in 2012. International revenues were up 8 percent driven by 7 percent growth in Europe and Asia Pacific, and a 9 percent increase in the Americas (non-U.S.) region.

Gross margin rose by 160 basis points to a record 48.1 percent, compared with 46.5 percent in 2012, with improvements in nearly every business. For the full year, the improvement in gross margin reflects the continued shift in our revenue mix toward higher margin businesses as well as lower product costs.

SG&A as a percent of full year revenue rose 50 basis points to 33.6 percent. This increase includes the impact of higher marketing expense that increased the SG&A ratio by 60 basis points, including the nearly $40 million in incremental marketing investments in the second half of 2013 that increased the SG&A ratio by 40 basis points.

Operating income on an adjusted basis increased 11 percent to $1.7 billion in 2013. On a GAAP basis, full year operating income rose 12 percent to $1.6 billion from $1.5 billion in 2012. Acquisition-related expenses for Timberland in 2013 and 2012 were $11 million and $31 million, respectively. Adjusted operating margin was 14.5 percent compared with 13.8 percent in 2012. On a GAAP basis, operating margin was 14.4 percent versus 13.5 percent in 2012.

Net income on an adjusted basis rose 13 percent to $1.2 billion compared to $1.1 billion in 2012. Adjusted earnings per share, which excludes $0.02 in Timberland acquisition-related expenses in 2013 increased 13 percent, to $2.73 from $2.41 in the same period last year. Adjusted earnings per share of $2.41 in 2012 exclude a combined $0.02 in Timberland acquisition-related expenses and the gain from the sale of John Varvatos. On a GAAP basis, full year net income was $1.2 billion while earnings per share grew 12 percent to $2.71 per share.

Coalition Review

Revenues for the Outdoor & Action Sports coalition increased 12 percent in the quarter to $1.9 billion with balanced growth across the U.S. and international markets as well as in wholesale and direct-to-consumer channels. Full year Outdoor & Action Sports revenues were up 9 percent in 2013.

Fourth quarter revenues for The North Face brand rose 12 percent globally driven by more than 30 percent growth in direct-to-consumer sales and a mid single-digit increase in the brand’s wholesale business. By region, The North Face brand’s revenues were up 10 percent in the Americas and increased at a high-teen percentage rate in both Europe and Asia Pacific. For the full year, revenues for The North Face brand grew 7 percent, establishing VF’s first $2 billion brand.

Revenues for the Vans brand in the fourth quarter were up 14 percent with strong, double-digit growth across all geographies, as well as in the brand’s wholesale and direct-to-consumer platforms. Revenues in the Americas region were up at a low double-digit rate in the quarter, which contributed to the brand surpassing the $1 billion mark in annual revenues in its largest region. In Europe, the Vans brand grew 20 percent and was up nearly 20 percent in the Asia Pacific region. Revenues for the Vans brand globally for the full year were up 17 percent.

Revenues for the Timberland brand were up 13 percent in the fourth quarter. In the Americas region, revenues increased at a high-teen rate driven by strong direct-to-consumer and wholesale growth rates. In Europe, the Timberland brand posted its strongest quarter of the year with a low-teen rate percentage increase in revenues. And in Asia Pacific, where the brand’s largest market is Japan, fourth quarter revenues were down modestly, but up at a high single-digit rate on a constant-dollar basis. Globally, the Timberland brand’s growth was balanced between its direct-to-consumer and wholesale businesses in the quarter. Full year Timberland brand revenues were up 5 percent.

Fourth quarter operating income for Outdoor & Action Sports rose 11 percent to $358 million. Operating margin decreased 10 basis points to 18.7 percent, compared with 18.8 percent in the 2012 period, including the impact of incremental marketing investments in The North Face, Vans and Timberland brands in 2013.

Jeanswear fourth quarter revenues were flat at $734 million. Revenues in the Americas business were flat, including flat results in the U.S. offset by declines in Central and Latin America. In Europe, revenues were up at a mid single-digit percentage rate and sales in our Asia Pacific region were down slightly. In 2013, global Jeanswear revenues were up 1 percent.

Fourth quarter revenues for the Wrangler brand were up 5 percent driven by strength in the Americas region, with mid single-digit growth in western specialty and slight growth in its U.S. mass channel business, offset by a 10 percent decline (up 8 percent in constant dollars) in Latin America. Wrangler brand revenues in Europe were up 4 percent (flat on a constant dollar basis). Fourth quarter revenues for the Lee brand were down 6 percent driven by a mid single-digit percentage increase (up low single-digit percentage in constant dollars) in Europe and Asia, offset by a 10 percent decline in the Americas region, where the business is being negatively impacted by ongoing challenges in the U.S. mid-tier channel.

Operating income for Jeanswear in the fourth quarter rose 2 percent to $134 million. Operating margin grew 40 basis points to 18.3 percent in the quarter, with improvements primarily attributable to strong performances from both the Wrangler and Lee brands outside the U.S.

Imagewear revenues were up 9 percent in the fourth quarter to $287 million. This increase is largely due to a contract that was renewed later than expected. For the full year, revenues for the Imagewear coalition were down 1 percent. Fourth quarter operating income for Imagewear was up 31 percent to $45 million, with a 250 basis point improvement in operating margin to 15.6 percent, reflecting meaningful gross margin expansion.

Sportswear had a strong quarter with revenues increasing 14 percent to $208 million. The Nautica brand grew 11 percent with solid increases in both its wholesale and direct-to-consumer businesses. The Kipling brand’s U.S. business achieved a 33 percent increase in revenues compared with the same period last year. Globally, the Kipling brand grew 28 percent. For the year, Sportswear coalition revenues were up 8 percent. In the fourth quarter, operating income increased 11 percent to $36 million, while operating margin declined 50 basis points to 17.2 percent.

In a business environment that continues to be challenging for premium denim, fourth quarter revenues for the Contemporary Brands coalition were up 1 percent to $108 million. Full year revenues for the coalition were down 7 percent, or down 2 percent excluding the impact of the sale of the John Varvatos brand in April 2012. Contemporary Brands’ fourth quarter operating income was flat compared with last year’s fourth quarter at $9 million. Operating margin was also comparable at 8.3 percent.

International Review

International revenues in the fourth quarter increased 11 percent, up 10 percent on a constant currency basis. Revenues in Europe rose 15 percent, up 10 percent in constant currency, with positive results from nearly every brand in VF’s portfolio. In Asia Pacific, revenues were up 7 percent (up 11 percent in constant currency) driven by 14 percent growth in China, which included strong results from nearly every brand. As anticipated, the Lee brand returned to growth during the quarter in China. Americas (non-U.S.) revenues increased 5 percent (up 11 percent in constant currency) driven by particular strengths in the Vans, Timberland and The North Face brands. International revenues were 38 percent of total VF revenues in 2013 compared to 37 percent in 2012.

Direct-to-Consumer Review

Direct-to-consumer revenues grew 14 percent in the fourth quarter driven by a 32 percent increase in The North Face brand, a 12 percent increase in the Vans brand, 8 percent increases from both the Timberland and Nautica brands, and a 44 percent increase in the Kipling brand. Fifty-three stores were opened across our brands during the quarter bringing the total number of VF owned retail stores to 1,246. For the full year 2013, direct-to-consumer revenues grew 13 percent and accounted for 22 percent of total VF revenues compared with 21 percent in 2012.

Balance Sheet Review

Inventories were up 3 percent compared with December 2012 levels reflecting VF’s continued focus on operational efficiency. For the full year, VF’s cash generation from operations exceeded $1.5 billion. The company returned nearly $700 million to shareholders through dividends and share repurchases despite contributing $100 million to its pension plan and repaying $400 million of debt.

2014 Guidance

“As we look to 2014, we are confident in the continued global success of VF’s portfolio of powerful brands and platforms,” Wiseman said. “Our proven execution and financial discipline makes us the best positioned company in our industry to consistently deliver products and experiences that consumers want and returns that shareholders have come to expect.”

Key points related to VF’s full year 2014 outlook include:

- Revenue expected to increase by 7 to 8 percent including growth in every coalition. Outdoor & Action Sports coalition revenues should increase at a low double-digit rate including a mid-teen percentage growth rate from the Vans brand, approximately 12 percent growth for The North Face brand and 10 percent growth for the Timberland brand. Jeanswear and Imagewear are expected to grow at a low single-digit rate. Sportswear is expected to grow at a high single-digit rate and Contemporary Brands should see mid single-digit percentage growth.

- International revenue should grow 10 percent, driven by high-teen growth in Asia and high single-digit growth in both Europe and the Americas (non-U.S.) regions. International revenues should approximate 38 percent of total revenues in 2014.

- In 2014, to better represent the operations of its direct-to-consumer business, VF will begin to include its concession locations in its direct-to-consumer revenues. Concessions are retail locations (outside the U.S.) where the company is responsible for all aspects of operations without ownership of the retail space. After adjusting 2013 direct-to-consumer revenues for this change, direct-to-consumer is expected to grow at a high-teen percentage rate in 2014 and should represent 26 percent of total VF revenues. Direct-to-consumer growth in 2014 will be driven by approximately 150 store openings, comp store growth and an expected increase of more than 30 percent in e-commerce revenues.

- Expect continued margin expansion, including a 90 basis point improvement in gross margin to 49 percent, and about 60 basis point increase in operating margin to 15 percent.

- Earnings per share should increase 11 to 13 percent to $3.00 to 3.05.

- Expect record cash flow from operations, approaching $1.65 billion.

- Expect to spend approximately $700 million under the company’s share repurchase program; when combined with annual dividend, should return more than $1 billion to shareholders in 2014.

- Other full year assumptions include a 23.5 to 24 percent effective tax rate, a negligible impact from changes in foreign currency and capital expenditures of approximately $270 million.

- In terms of quarterly revenue comparisons in 2014, the cadence should be similar to that of 2013 although at a higher percentage increase per quarter. Accordingly, we expect mid single-digit growth in the first half of 2014 followed by high single-digit growth in the second half of the year. First quarter earnings will face a tougher comparison against last year’s first quarter earnings per share due to the inclusion of $0.03 per share from discrete tax benefits primarily related to the impact of U.S. tax law changes (American Taxpayer Relief Act of 2012) enacted in January 2013. In the second half of 2014, revenue growth and profitability should be the strongest comparison, reflecting the growing contribution of the more seasonally driven Outdoor & Action Sports coalition and expansion of our direct-to-consumer business.

Share Repurchase Authorization

In December 2013, VF’s Board of Directors authorized an additional 50 million shares of common stock for its repurchase program. The company’s previous program, approved in February 2010, authorized 10 million shares of common stock, of which approximately 3 million shares are still available for execution. This brings the total current authorization of VF’s new program to 53 million shares.

Repurchases under VF’s new program will be made in open market or privately negotiated transactions in compliance with Securities and Exchange Commission Rule 10b-18, subject to market conditions, applicable legal requirements and other relevant factors. This share repurchase plan does not obligate VF to acquire any particular amount of common stock, and it may be suspended at any time at the company's discretion. VF had approximately 440 million shares of common stock outstanding as of Jan. 31, 2014.

Dividend Declared

VF’s Board of Directors declared a quarterly dividend of $0.2625 per share, payable on March 20, 2014 to shareholders of record on March 10, 2014. As a reminder, prior to VF’s four-for-one stock split, the quarterly dividend was $1.05 per share.

Adjusted Amounts

This release refers to adjusted amounts that exclude restructuring and other items related to the acquisition of Timberland, which approximated $11 million ($0.02 per share) for the full year 2013. Adjusted amounts for 2012 exclude Timberland acquisition related expenses of $31 million ($0.06 per share) and the gain on the sale of John Varvatos of approximately $42 million ($0.08 per share). Reconciliations of certain GAAP measures to adjusted amounts are presented in the supplemental financial information included with this release, which identify and quantify all excluded items.

VF's five largest brands are The North Face, Vans, Wrangler, Timberland, and Lee. Other brands include 7 For All Mankind, Bulwark, Eagle Creek, Eastpak, Ella Moss, JanSport, Kipling, lucy, Majestic, Napapijri, Nautica, Red Kap, Reef, Riders, Splendid and SmartWool.