Vail Resorts, Inc. reported results for the fourth quarter and fiscal year ended July 31, 2024 and reported an update on season-to-date pass product sales. Vail Resorts also provided its outlook for the fiscal year ending July 31, 2025, announced a $100 million multi-year Resource Efficiency Transformation Plan that includes significant job cuts, declared a dividend payable in October 2024, and announced share repurchases completed during the fourth quarter.

Key Highlights

- Net income attributable to Vail Resorts, Inc. was $230.4 million for fiscal 2024 compared to net income attributable to Vail Resorts, Inc. of $268.1 million for fiscal 2023.

- Resort Reported EBITDA was $825.1 million for fiscal 2024, which included an $11.1 million negative impact related to Crans-Montana, including negative $7.9 million from acquisition, closing and integration expenses and negative $3.2 million from operating results in the fourth quarter. Resort Reported EBITDA was $834.8 million for fiscal 2023.

- Pass product sales through September 20, 2024, for the upcoming 2024/25 North American ski season, decreased approximately 3 percent in units and increased approximately 3 percent in sales dollars compared to the prior year period through September 22, 2023. These figures are adjusted to eliminate the impact of changes in foreign currency exchange rates by applying current U.S. dollar exchange rates to both current period and prior period sales for Whistler Blackcomb.

- The company announced a two-year Resource Efficiency Transformation Plan, including scaled operations, global shared services and expanded workforce management to create organizational effectiveness and scale for operating leverage as the company grows globally. The company expects to achieve $100 million in annualized savings by the end of fiscal 2026 before one-time costs, with approximately $27 million realized in fiscal 2025 before $15 million of one-time expenses.

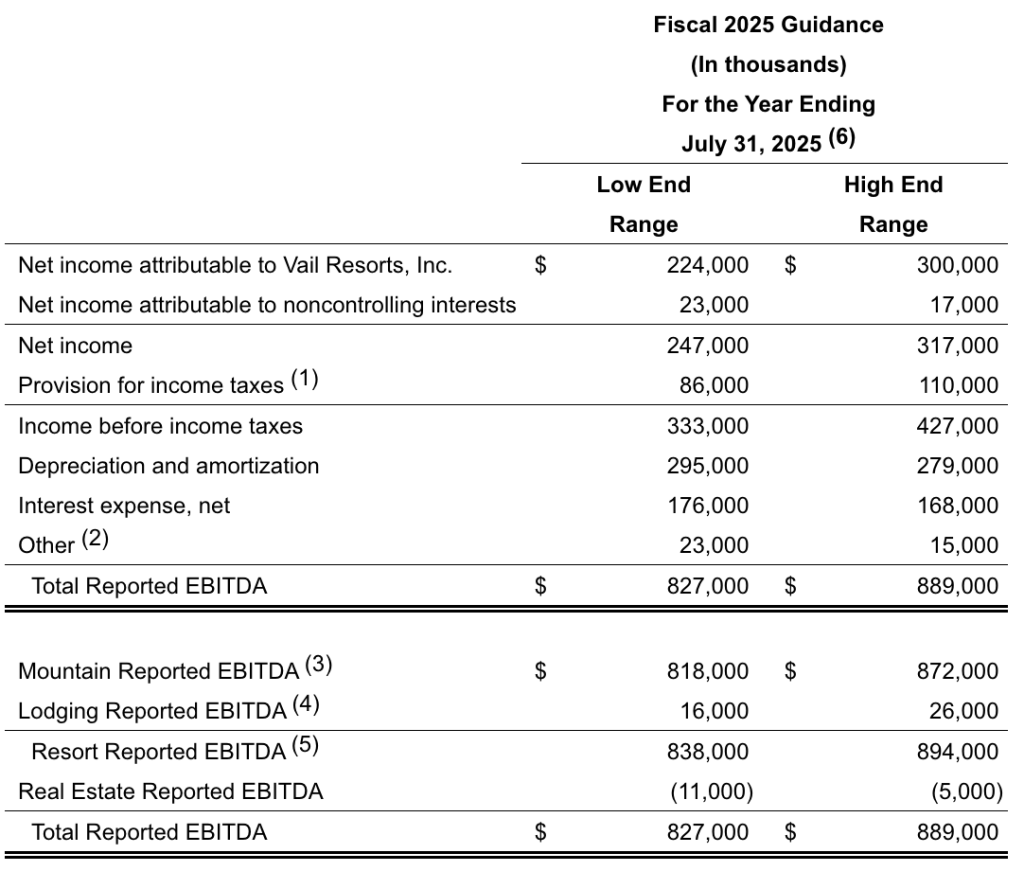

- The company provided its outlook for fiscal 2025 and expects net income attributable to Vail Resorts, Inc. to be between $224 million and $300 million and Resort Reported EBITDA between $838 million and $894 million. This outlook reflects an expected Resort Reported EBITDA decline in Australia of $10 million for the first fiscal quarter of 2025 compared to the prior year, an estimated $15 million impact related to one-time costs in support of the company’s resource efficiency transformation plan, and an estimated $1 million impact related to acquisition and integration related expenses specific to Crans-Montana.

- The company declared a quarterly cash dividend of $2.22 per share of Vail Resorts common stock that will be paid on October 24, 2024, to shareholders of record as of October 8, 2024. In addition, the company repurchased approximately 0.1 million shares during the quarter at an average price of roughly $180 per share for $25 million. For the full fiscal year, the company repurchased approximately 0.7 million shares, or 1.9 percent of shares outstanding as of the beginning of fiscal 2024, at an average price of approximately $208 per share for a total of $150 million. The company’s Board of Directors increased its authorization for share repurchases by 1.1 million shares to approximately 1.7 million shares.

Commenting on the company’s fiscal 2024 results, CEO Kirsten Lynch said, “Our overall results for the year highlight the stability and resilience of our advance commitment strategy. Skier visitation declined 9.5 percent compared to the prior year, driven by unfavorable conditions across our resorts in North America and Australia, combined with the impact of broader industry normalization post-COVID following record visitation in North America during the 2022/23 ski season.

“In North America, snowfall across our western resorts was down 28 percent from the prior year, and our Eastern U.S. resorts experienced limited natural snow and variable temperatures. Despite industry normalization and challenging conditions, Resort Reported EBITDA, excluding the impact of the Crans-Montana acquisition, remained consistent with prior year results. Performance was supported by strong growth in ancillary spending per visit across ski school, dining, and rental businesses at our resorts, and by strong delivery of the guest experience and cost discipline across our operations,” concluded Lynch.

Regarding the company’s fiscal 2024 fourth-quarter results, Lynch said, “Fourth-quarter Resort Reported EBITDA declined from the prior year and expectations, primarily driven by underperformance in our Australian winter business. During the fourth quarter, snowfall at our Australian resorts declined 28 percent from the prior year and was 44 percent below the ten-year average.

“The challenging conditions, combined with softer demand heading into the winter season, negatively impacted Australian skier visitation, which declined 18 percent in the quarter relative to the prior year period. In our North America summer mountain business, while results underperformed our expectations, we were pleased to see 15 percent revenue growth versus the prior year from fewer weather-related and construction-related disruptions,” concluded Lynch.

Operating Results

The company’s operating results below compare its results for the fiscal year ended July 31, 2024, to the fiscal year ended July 31, 2023, unless otherwise noted. Segment highlights include the following.

Mountain Segment

- Total lift revenue increased $21.9 million, or 1.5 percent, to $1,442.8 million primarily due to an increase in pass revenue of 9.4 percent, which was mainly driven by the rise in pass product sales for the 2023/24 North American ski season compared to the prior year, partially offset by a decrease in non-pass revenue of 10.7 percent, primarily driven by challenging conditions at the company’s North American resorts for a large portion of the season compared to the prior year, as well as broader industry normalization post-COVID following record visitation in North America during the 2022/23 ski season and a decrease in non-pass revenue at its Australian resorts as a result of decreased visitation from weather-related challenges that impacted terrain during the 2023/24 Australian ski seasons, compared to record visitation and favorable snow conditions in the 2022 Australian ski season. The decrease in non-pass revenue was partially offset by an increase in non-pass Effective Ticket Price (ETP) of 11.2 percent.

- Ski school revenue increased $17.3 million, or 6.0 percent, and dining revenue increased $2.9 million, or 1.3 percent, primarily due to an increase in guest spending per visit at our North American resorts. Retail/rental revenue decreased $44.3 million, or 12.3 percent, for which retail sales decreased $29.2 million, or 13.8 percent, and rental sales decreased $15.2 million, or 10.1 percent. The decrease in both retail and rental revenue was primarily driven by a decline in skier visitation, which impacted sales at its on-mountain retail outlets in North America, as well as the company’s exit of certain leased store operations which it operated in the prior year and which resulted in a revenue reduction of approximately $18.2 million.

- Operating expenses increased $24.4 million, or 1.4 percent, which was primarily attributable to an increase in general and administrative expenses, property tax expenses and repairs and maintenance expenses, partially offset by reduced labor hours at its North American resorts in the current year as a result of challenging weather conditions that existed for a large portion of the season, which impacted the company’s ability to operate at full capacity, as well as disciplined cost management.

- Mountain Reported EBITDA decreased $20.5 million, or 2.5 percent, which includes $23.2 million of stock-based compensation for fiscal 2024 compared to $21.2 million in the prior year.

Resort | Mountain and Lodging Segments Combined

- Resort’s net revenue was $2,880.5 million for fiscal 2024, a decrease of $0.8 million, compared to the resort’s net revenue of $2,881.3 million for fiscal 2023.

- Resort Reported EBITDA was $825.1 million for fiscal 2024, a decrease of $9.7 million, or 1.2%, compared to fiscal 2023.

Total Performance

- Total net revenue decreased $4.2 million, or 0.1 percent, to $2,885.2 million for fiscal 2024.

- Net income attributable to Vail Resorts, Inc. was $230.4 million, or $6.07 per diluted share, for fiscal 2024 compared to net income attributable to Vail Resorts, Inc. of $268.1 million, or $6.74 per diluted share, in fiscal 2023. The decrease in net income attributable to Vail Resorts, Inc. was primarily due (1) an increase in its provision for income taxes, primarily due to increases in net unfavorable discrete items impacting the tax provision in fiscal 2024 compared to the prior year; (2) decreased Resort Reported EBITDA; (3) an increase in interest expense due to an increase in variable interest rates associated with the unhedged portion of our term loan borrowings under our U.S. credit agreement during fiscal 2024 compared to the prior year; and (4) an increase in depreciation and amortization expense, primarily due to capital projects recently completed at its resorts and assets acquired at Crans-Montana.

Season Pass Sales

Pass product sales through September 20, 2024, for the upcoming 2024/25 North American ski season, decreased approximately 3 percent in units and increased roughly 3 percent in sales dollars compared to the period in the prior year through September 22, 2023. Pass sales dollars benefitted from an 8 percent price increase relative to the 2023/24 season, partially offset by the mixed impact from the growth of Epic Day Pass products. Pass product sales are adjusted to eliminate the effects of foreign currency by applying an exchange rate of $0.74 between the Canadian dollar and U.S. dollar in both periods for Whistler Blackcomb pass sales.

Commenting on the company’s season pass sales, Lynch said, “For the period between May 29, 2024 and September 20, 2024, pass product sales trends improved relative to spring pass product sales through May 28, 2024, with unit growth approximately flat and sales dollars growth of approximately 5 percent as compared to the period in the prior year May 31, 2023 through September 22, 2023 due to expected renewal strength following the Memorial Day deadline, which we believe reflects delayed decision-making.

“Season-to-date through September 20, 2024, the pass business achieved growth among renewing pass holders, demonstrating strong loyalty among our most tenured pass holders (those that have had a pass for three years or more) to the guest experience at our mountain resorts and the compelling value proposition of our pass products. The decline in total units versus last year was driven by a decline in new pass holders. Within new pass holders, we saw growth from guests who previously purchased passes but did not buy a pass in the previous season, offset by a decline in new pass purchases from guests in our database who purchased lift tickets in the past season, as well as a decline from guests who are completely new to our database. The decline in lift ticket visitation in the past season, driven by challenging weather and industry normalization, reduced the audience size of guests to drive conversion into pass holders, and the weather may have delayed the decision-making timing for new guests. Overall, unit performance is consistent across destination and local guest segments, and Epic Day Pass products achieved modest unit growth driven by the strength in renewing pass holders. As we enter the final period for season pass sales, we expect our December 2024 season-to-date growth rates to be relatively consistent with our September 2024 season-to-date growth rates.”

Resource Efficiency Transformation Plan

Commenting on the company’s multi-year Resource Efficiency Transformation Plan, Lynch said, “Over the past decade, Vail Resorts has expanded significantly, growing from 10 to 42 owned and operated mountain resorts, more than doubling our workforce. During that expansion, the company captured initial acquisition synergies in corporate support functions and technology integration. However, as we have shared publicly over the past two years, the company has a unique opportunity to further transform resource efficiency given the scale of our 42 owned and operated mountain resorts, a common enterprise-wide technology ecosystem, and robust data and analytics capabilities.

See more here:

Vail Resorts to Cut 14 Percent of Corporate Workforce in Transformation Plan

“The company is implementing a two-year resource efficiency transformation plan to create organizational effectiveness and scale for operating leverage as the company expands and grows globally. The transformation plan is focused on three pillars: scaled operations, a global shared services model and guest support center, and an expansion of workforce management. We expect that the transformation plan will achieve $100 million in annualized cost efficiencies by the end of fiscal 2026, with approximately $27 million to be realized in fiscal 2025 and approximately $67 million realized in fiscal 2026, all before one-time costs.

“We expect the efficiencies to be partially offset by one-time operating expenses of approximately $15 million in fiscal 2025 and approximately $14 million in fiscal 2026. In addition, we expect capital investments of approximately $6 million in calendar year 2025 and approximately $12 million in calendar year 2026. The company’s mission is to create an experience of a lifetime for our guests. The transformation plan is designed to prioritize delivering the company’s mission while also providing operating leverage for future growth.”

Guidance

The company is providing its initial guidance for the year ending July 31, 2025 and expects net income attributable to Vail Resorts, Inc. to be between $224 million and $300 million for fiscal 2025. The company expects Resort Reported EBITDA for fiscal 2025 to be between $838 million and $894 million, including an estimated $15 million in one-time costs related to the multi-year resource efficiency transformation plan and an estimated $1 million of acquisition and integration-related expenses specific to Crans-Montana.

Compared to fiscal 2024, fiscal 2025 guidance includes the assumed benefit of a return to normal weather conditions after the challenging conditions in fiscal 2024, more than offset by a return to normal operating costs and the impact of the continued industry normalization, impacting demand. Additionally, the guidance reflects the negative impact of the record low snowfall and related shortened seasons in Australia in the first quarter of fiscal 2025, which is expected to result in a $10 million decline in Resort Reported EBITDA compared to the prior year period.

After considering these items, the company expects Resort Reported EBITDA to grow from price increases and ancillary spending, the resource efficiency transformation plan and the addition of Crans-Montana for the full year. At the midpoint, the guidance implies an estimated Resort EBITDA Margin for fiscal 2025 of approximately 28.6 percent, or 29.1 percent, before one-time costs from the resource efficiency transformation plan and integration expenses.

The guidance is based on certain assumptions, including:

- A continuation of the current economic environment,

- Normal weather conditions for the 2024/25 North American and European ski season and the 2025 Australian ski season, and reflects the challenging conditions in Australia for the end of the 2024 winter ski season, and

- An exchange rate of 74 cents between the Canadian dollar and U.S. dollar related to the operations of Whistler Blackcomb in Canada, an exchange rate of 67 cents between the Australian dollar and U.S. dollar related to the operations of Perisher, Falls Creek and Hotham in Australia, and an exchange rate of $1.18 between the Swiss Franc and U.S. dollar related to the operations of Andermatt-Sedrun and Crans Montana in Switzerland.

The following table reflects the forecasted guidance range for the company’s fiscal year ending July 31, 2025, for Total Reported EBITDA (after stock-based compensation expense) and reconciles net income attributable to Vail Resorts, Inc. guidance to such Total Reported EBITDA guidance.

Liquidity and Return of Capital

As of July 31, 2024, the company’s total liquidity, as measured by total cash plus revolver availability, was approximately $946 million. Total liquidity is comprised of $323 million of cash on hand, $408 million of U.S. revolver availability under the Vail Holdings Credit Agreement and $215 million of revolver availability under the Whistler Credit Agreement.

As of July 31, 2024, the company’s Net Debt was 3.0 times its trailing twelve months Total Reported EBITDA. Regarding the return of capital to shareholders, the company declared a quarterly cash dividend of $2.22 per share of Vail Resorts’ common stock to be paid on October 24, 2024 to shareholders of record as of October 8, 2024. In addition, during the quarter, the company repurchased approximately 0.1 million shares of common stock at an average price of approximately $180 for a total of $25 million. For the full fiscal year, the company repurchased approximately 0.7 million shares of common stock during fiscal 2024 at an average price of roughly $208 for a total of $150 million. Additionally, the Board of Directors increased the company’s authorization for share repurchases by 1.1 million shares to approximately 1.7 million shares.

Commenting on the capital allocation, Lynch said, “We will continue to be disciplined stewards of our shareholders’ capital, prioritizing investments in our guest and employee experience, high-return capital projects, strategic acquisition opportunities, and returning capital to our shareholders. The company has a strong balance sheet and remains focused on returning capital to shareholders while always prioritizing the long-term value of our shares.”

Capital Investments

Commenting on the company’s investments for the 2024/25 North American ski season, Lynch said, “We remain dedicated to delivering an exceptional guest experience and will continue to prioritize reinvesting in the experience at our resorts, including consistently increasing capacity through lift, terrain and food and beverage expansion projects. As previously announced, we expect our capital plan for calendar year 2024 to be approximately $189 million to $194 million, excluding incremental capital investments in premium fleet and fulfillment infrastructure to support the official launch of My Epic Gear for the 2024/25 winter season, growth capital investments at Andermatt-Sedrun, reimbursable capital, and investments at Crans-Montana.

“At Whistler Blackcomb, the company plans to replace the four-person high-speed Jersey Cream lift with a new six-person high-speed lift. This lift is expected to provide a meaningful increase to uphill capacity and better distribute guests at a central part of the resort. At Hunter Mountain, we plan to replace the four-person fixed-grip Broadway lift with a new six-person high-speed lift and plan to relocate the existing Broadway lift to replace the two-person fixed-grip E-lift, providing a meaningful increase in uphill capacity and improved access to terrain that is key to the progressive learning experience for our guests. At Park City, we are in the planning process to support the approved replacement of the Sunrise lift with a new ten-person gondola in partnership with the Canyons Village Management Association in calendar year 2025, which will provide improved access and enhanced guest experience for existing and future developments within Canyons Village.

“At Park City and Hunter Mountain, beyond the planned lift investments, we plan to enhance snowmaking systems to improve the experience for key terrain, increase early season terrain consistency and improve the efficiency through the installation of automated and energy-efficient snowguns. We also plan to further support the company’s commitment to zero by investing in waste reduction projects across our resorts to achieve the goal of zero waste in landfills by 2030. At Afton Alps, we plan to install a 10-lane tubing experience and renovate the existing Alpine Building to create a 200-seat restaurant to further enhance the guest experience. At Seven Springs, we plan to add 390 new parking spaces to increase capacity and improve the guest experience. At Perisher, in advance of the 2025 winter season in Australia, we plan to replace the Mt Perisher Double and Triple Chairs with a new six-person high-speed lift, with capital spending commencing in calendar year 2024 and continuing into calendar year 2025.

“In addition, we are continuing to invest in innovative technology to enhance the guest experience. In the coming year, we are investing in new functionality for the My Epic App and expanding Mobile Pass and Mobile Lift Tickets to Whistler Blackcomb. At Vail Mountain, Beaver Creek, Breckenridge, and Keystone, the company plans to launch My Epic Assistant, a new technology within the My Epic app, providing mountain information at guests’ fingertips powered by advanced AI and resort experts. Across our resorts, we plan to pilot new technologies at select restaurants to make it easier and faster for guests to dine at our resorts. In addition, in order to support the launch of My Epic Gear, we plan to invest in logistics and technology infrastructure to help deliver a transformational and elevated gear access experience for our guests.

“The 2023/24 My Epic Gear pilot at Vail, Beaver Creek, Breckenridge, and Keystone delivered a strong guest experience to pilot participants and valuable learnings for the business launch. My Epic Gear provides its members with the ability to choose the gear they want, for the full season or for the day, from a selection of the most popular and latest ski and snowboard models and have it delivered to them when and where they want it, including slopeside pick-up and drop off every day. In addition to offering the latest skis and snowboards, My Epic Gear will also offer name-brand, high-quality ski and snowboard boots with personalized insoles and boot fit scanning technology. The entire My Epic Gear membership, from gear selection to boot fit to personalized recommendations to delivery, will be at the members’ fingertips in the new My Epic app.

The company is launching My Epic Gear for the 2024/25 winter season at 12 destination and regional resorts across North America, including kids gear, and will be limiting membership to 60,000 to 80,000 members in the first year as the business scales. To support the initial year of this new business, in calendar year 2024, the company plans to invest an additional $13 million beyond its typical annual capital plan in incremental gear fleet and fulfillment infrastructure investment to support the anticipated growth of this business. The company also plans to provide additional updates on My Epic Gear and the on-going capital needs of the business in December 2024.

“At Andermatt-Sedrun, we previously announced plans to invest approximately $11 million in growth capital projects as part of a multi-year strategic growth investment plan to enhance the guest experience, which will be funded by the CHF 110 million capital that was invested as part of the purchase of our majority stake in Andermatt-Sedrun. As part of the calendar year 2024 investments, we are planning to upgrade and replace snowmaking infrastructure at the Sedrun-Milez area on the eastern side of the resort to enhance the guest experience for key beginner and intermediate terrain and significantly improve energy efficiency. In addition, we plan to invest in the on-mountain dining experience with improvements to the Milez and Natschen restaurants. These investments received partial regulatory approvals and are expected to be substantially completed ahead of the 2024/25 European ski season, with the remainder of the work being completed in calendar year 2025. As a result, calendar year 2024 investment costs are now expected to be $8 million.

“Including $13 million of incremental capital investments in premium fleet and fulfillment infrastructure to support the official launch of My Epic Gear, $8 million of growth capital investments at Andermatt-Sedrun, $1 million of reimbursable capital, and investments at Crans-Montana, which include $3 million of maintenance capital expenditures and $2 million associated with integration activities, our total capital plan for calendar year 2024 is expected to be approximately $216 million to $221 million.”

Regarding calendar year 2025 expenditures, Lynch said, “In addition to this year’s significant investments, we are pleased to highlight some select projects from our calendar year 2025 capital plan, with the full capital investment announcement planned for December 2024, including a core capital plan consistent with the company’s long-term capital guidance. At Park City, we are replacing the Sunrise lift with a new 10-person gondola in partnership with the Canyons Village Management Association, which will provide improved access and enhanced guest experience for existing and future developments within Canyons Village. At Perisher, in advance of the 2025 winter season in Australia, we plan to replace the Mt Perisher Double and Triple Chairs with a new six-person high-speed lift, with capital spending commencing in calendar year 2024 and continuing into calendar year 2025. These projects are subject to approvals.”

Image courtesy Whistler Blackcomb