Urban Outfitters, Inc. reported sales for the fourth quarter of fiscal 2015 increased

12 percent over the same quarter last year to a record $1.01 billion.

Comparable retail segment net sales, which include its comparable

direct-to-consumer channel, increased 6 percent.

Net income reached $80 million and $232 million for the three months and year ended Jan. 31, 2015, respectively. Earnings per diluted share were $0.60 and $1.68 for the three months and year ended January 31, 2015, respectively.

Total company net sales for the fourth quarter of fiscal 2015 increased 12 percent over the same quarter last year to a record $1.01 billion. Comparable Retail segment net sales, which include our comparable direct-to-consumer channel, increased 6 percent. Comparable Retail segment net sales increased 18 percent at Free People, 6 percent at the Anthropologie Group and 4 percent at Urban Outfitters. Wholesale segment net sales rose 21 percent.

For the year ended January 31, 2015, total company net sales increased 8 percent over the prior year to a record $3.3 billion. Comparable Retail segment net sales increased 2 percent. Wholesale segment net sales increased 27 percent.

“We are pleased to report our first billion dollar quarter, fueled by positive retail segment `comps` at all of our brands, “said Richard A. Hayne, Chief Executive Officer. “It is encouraging to see this sales trend continue into Q1,” finished Mr. Hayne.

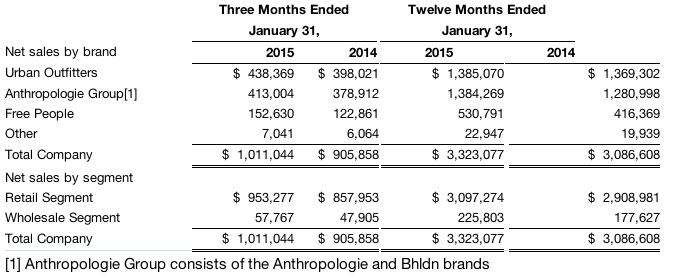

Net sales by brand and segment for the three and twelve month periods were as follows:

For the three months ended January 31, 2015, the gross profit rate decreased by 207 basis points versus the prior year`s comparable period. The deleverage occurred primarily due to lower initial merchandise markups followed by higher markdowns, which were primarily driven by the underperformance at the Urban Outfitters brand. For the year ended January 31, 2015, the gross profit rate decreased by 227 basis points versus the prior year`s comparable period. The deleverage occurred primarily due to lower initial merchandise markups, store occupancy deleverage due to negative store comparable net sales and higher markdowns, which were primarily driven by the underperformance at the Urban Outfitters brand.

As of January 31, 2015, total inventories increased by $47 million, or 15 percent, on a year-over-year basis. The growth in total inventories is primarily related to the acquisition of inventory to stock new and non-comparable stores as well as an increase in comparable Retail segment inventories. Comparable Retail segment inventories increased 7 percent at cost while decreasing 7 percent in units.

For the three months ended January 31, 2015, selling, general and administrative expenses, expressed as a percentage of net sales, leveraged by 8 basis points when compared to the prior year period. For the year ended January 31, 2015, selling, general and administrative expenses, expressed as a percentage of net sales, deleveraged by 56 basis points compared to the prior year period primarily due to increased marketing and technology expenses which were used to drive higher direct-to-consumer traffic.

The company`s effective tax rate for the fourth quarter of fiscal 2015 was 35.0 percent compared to 31.7 percent in the prior year period. The tax rate variance is due to prior year favorable one-time benefits pertaining to a federal rehabilitation credit received related to the expansion of the company`s home office and the release of foreign valuation allowances.

On August 27, 2013, the Board of Directors authorized the repurchase of 10.0 million common shares under a share repurchase program. During the first quarter of fiscal 2015, the company repurchased and retired 9.7 million common shares for approximately $353 million completing the share repurchase authorization. On May 27, 2014, the Board of Directors authorized the repurchase of an additional 10.0 million common shares under a share repurchase program. During the year ended January 31, 2015, the company repurchased and retired 7.7 million common shares for approximately $258 million, leaving 2.3 million shares available for repurchase under the authorization. On February 23, 2015, the Board of Directors authorized the repurchase of an additional 20.0 million shares under a share repurchase program.

During the year ended January 31, 2015, the company opened a total of 38 new stores including: 15 Anthropologie Group stores, 12 Free People stores, and 11 Urban Outfitters stores. The company closed 3 Urban Outfitters stores due to lease expirations.

Urban Outfitters, Inc. is an innovative specialty retail company which offers a variety of lifestyle merchandise to highly defined customer niches through 238 Urban Outfitters stores in the United States, Canada, and Europe, catalogs and websites; 204 Anthropologie Group stores in the United States, Canada and Europe, catalogs and websites; 102 Free People stores in the United States and Canada, catalogs and websites; Free People wholesale, which sells its product to approximately 1,600 specialty stores and select department stores worldwide; and 2 Terrain garden centers and a website, as of Jan. 31, 2015.