VF Corp. Data Breach Impacting Ability to Ship Orders

The company detected a cybersecurity breach in its systems on December 13 that is “reasonably likely to continue to have a material impact on the company’s business operations,” including its ability to fulfill online orders.

Boxto Adds Seven Indie Golf Sales Reps Across U.S.

The manufacturer of leather golf shoes and belts in Leon, Mexico, said in a release “that all of the new reps have decades of industry experience and deep connections with buyers ranging from green grass shops to big box retailers.”

Jordan Brand President Joins Albertsons Board

Albertsons Companies, Inc. reported that Sarah Mensah, president of the Jordan Brand for Nike, Inc., had joined the supermarket chain’s Board of Directors.

Shoe Carnival Sets $50 Million Share Buyback Program

Shoe Carnival, Inc.’s Board of Directors authorized a new share repurchase program for up to $50 million of its outstanding common stock, effective January 1, 2024.

Coliseum Capital Co-Founder Joins Gildan Board; Firm Plans Further Investment

After a week of turmoil at Gildan Activewear Inc. with the ouster of company Founder and CEO Tom Chamandy, and pushback from at least two large investors, Gildan found support elsewhere on Monday, announcing a support agreement with Coliseum Capital Management, LLC.

Alpha Silencer Appoints New VP of Sales

Cody Bennion is expected to aggressively grow market share, revenue, distribution channels, and dealer satisfaction for the company’s titanium suppressors

Savage Arms Appoints New CEO as Al Kaspar Retires

Al Kasper, who has led the company for over a decade, will retire December 31, 2023. Chris Bezzina will take over as president and CEO effective December 31, 2023. Bezzina joined Savage in 2007.

Wolverine Transforming Saucony and Merrell Model in China; Sells Asia Leathers Business

Wolverine World Wide, Inc. said it plans to shift its Merrell and Saucony businesses in China from a joint venture model with with Xtep to a license and distribution rights model. It also agreed it sell its Asia-based Wolverine Leathers business. Both actions are expected to simplify Wolvderine’s business model and generate $70 million in proceeds.

Report: Sycamore Partners Exploring Bid For Macy’s

Private equity firm Sycamore Partners is reportedly eyeing making a bid for Macy’s, Inc., according WWD. The speculation comes after the Wall Street Journal, on December 12, reported that Arkhouse Management and Brigade Capital Management made a $21 a share, or $5.8 billion, offer for the department store chain.

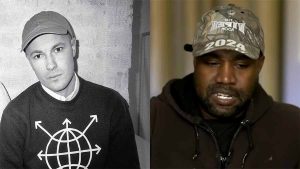

Yeezy Hires Head of Design

Kanye West’s fashion brand Yeezy hired Russian designer and former Adidas collaborator Gosha Rubchinskiy as head of design.

GT Golf Acquires ProActive Sports Group

GT Golf Supplies, Inc., a wholesale golf distributor, reported acquiring the ProActive Sports Group, based in Canby, OR.

Paris Saint-Germain, Lids and Fanatics Open New Store in Toronto

The Paris Saint-Germain (PSG) opened a new club store in partnership with Lids and Fanatics at 399 Queen Street West in Toronto.

Adidas AG Appoints HR Chief to Supervisory Board

The Supervisory Board of Adidas AG has appointed Michelle Robertson as an Executive Board member, responsible for global human resources, people and culture, effective January 1, 2024.

StockX Outlines Cold Weather Footwear Favorites for Winter

According to the latest analysis from StockX, top picks at the culture marketplace include cold weather favorites from Ugg and performance styles from Salomon, New Balance and Hoka with Gore-Tex.

Costco’s Q1 Profits Top Targets

Costco reported earnings rose 16.5 percent in its fiscal first quarter ended November 26 as same-store sales rose 3.8 percent, including a 2.0 percent gain in the U.S. Earnings topped analyst expectations.