<span style="color: #808080;">Unifi Inc. for the third quarter in a row lowered its outlook for the year due to competitive pressures in the polyester space, especially from low-cost imports heading into the U.S.

In its third fiscal quarter ended March 31, sales improved 8.4 percent to $180.0 million. On a currency-neutral basis, sales increased 11.7 percent.

International revenue growth was led by PVA product sales, partially offset by unfavorable foreign currency headwinds and softness in Brazil. Domestically, revenue increased primarily as a result of one more shipping week due to the timing of the holiday shutdown occurring within the prior year’s quarter, partially offset by competitive pressure from polyester yarn imports into the U.S.

Gross margins eroded to 7.7 percent from 10.0 percent a year ago. The decline was primarily attributable to competitive pressures, which were contributed to weaker fixed cost absorption, a less favorable sales mix and lower conversion margin (selling price less raw material cost).

Operating income slumped 51.0 percent to $775,000 from $1.58 million a year ago. The decrease in operating income was primarily due to a $2.8 million decrease in gross profit, partially offset by bonus and equity compensation forfeitures triggered by recently-announced executive departures.

<span style="color: #808080;">On March 18, Unifi announced that Kevin Hall, its CEO, had resigned. Thomas Caudle, Jr., president and COO, assumed the role of principal executive officer. Albert Carey, formerly the company’s non-executive chairman, was appointed executive chairman.

Adjusted EBITDA for the quarter slid 6.8 percent to $6.8 million from $7.3 million, resulting primarily from lower gross profit, partially offset by lower compensation expenses.

The net loss came to $1.5 million, or 8 cents a share, compared to net income of $176,000, or 1 cent, a year ago. The loss reflected a significantly higher effective tax rate that offset higher earnings from Parkdale America, LLC as a result of higher conversion margin and better operating leverage.

<span style="color: #808080;">Caudle said Unifi continues to see positive demand for its sustainable and innovative PVA product portfolios but near-term profitability is being challenged by foreign currency headwinds, a surge in imports of polyester textured yarn from China following the filing of its October 2018 trade petitions, and softness in certain markets.

“Amid these pressures, we were pleased to see the Commerce Department’s preliminary countervailing duty and critical circumstances determinations,” said Caudle. “These announcements are critical steps in advancing our efforts to better compete against the subsidized imported yarns that have flooded our market in recent years, and we will continue in our efforts to pursue these important trade actions in the coming months.”

On April 29, the U.S. Department of Commerce announced affirmative preliminary countervailing duty determinations on unfairly subsidized imports of polyester textured yarn from China at rates of 32 percent or more and India at rates of 7 percent or more. In addition, due to the “critical circumstances” resulting from a spike in Chinese imports in the months immediately following the filing of the company’s October 2018 trade petitions, the Commerce Department preliminarily determined that these duties will be applied retroactively for Chinese imports, beginning 90 days prior to the date that the duties go into effect.

Preliminary antidumping determinations are expected on June 26 and final determinations of dumping, subsidization and injury are expected by the end of calendar 2019. The antidumping duties will also be applied retroactively for Chinese imports.

Unifi noted that imports of polyester textured yarn from China and India increased approximately 79 percent from 2013 to 2017 and have continued to increase this year.

Operationally, Caudle said the company has transitioned the leadership team “to a leaner and more agile structure with deep roots in operational excellence and a balanced focus on profitability.” A cost reduction plan has been further launched with the aim of a “considerable step-down” in operating costs.

Said Caudle, “Our global strategy to Partner, Innovate and Build is creating opportunities for future growth while we take appropriate action to restore profitability in the Americas businesses. This includes increasing the utilization of our assets, supporting and expanding our sustainable and innovative portfolios, and optimizing the supply chain and cost structure to better deliver efficient and effective solutions to meet the demands of our customers. We remain confident in our path forward and have made calculated changes to our organization that empower our teams and strengthen our ability to remain the leader in synthetic and recycled textile solutions.”

Said Caudle, “Our global strategy to Partner, Innovate and Build is creating opportunities for future growth while we take appropriate action to restore profitability in the Americas businesses. This includes increasing the utilization of our assets, supporting and expanding our sustainable and innovative portfolios, and optimizing the supply chain and cost structure to better deliver efficient and effective solutions to meet the demands of our customers. We remain confident in our path forward and have made calculated changes to our organization that empower our teams and strengthen our ability to remain the leader in synthetic and recycled textile solutions.”

For the fiscal year, Unifi now expects:

- Mid-single-digit percentage growth in net sales, the same as under its previous guidance;

- Operating income between $10.0 million and $12.0 million, down from $19.0 million and $23.0 million under its previous guidance;

- Adjusted EBITDA between $33.0 million and $35.0 million, down from $42.0 million and $46.0 million previously;

- Capital expenditures of approximately $25.0 million, the same as before; and

- An effective tax rate and a cash-based tax rate each between 70 percent and 80 percent. Previously, Unifi expected an effective tax rate in the mid-40 percent range, with a cash-based tax rate in the high-30 percent range.

Unifi said fourth-quarter adjusted EBITDA performance above $10.0 million is attainable given current demand levels and recent stabilization of the raw material cost environment.

“As we look beyond fiscal 2019, we remain optimistic,” added Caudle. “In combination with our ongoing growth efforts that drive our innovative and recycled portfolios, the considerable reduction in our overhead costs should provide meaningful improvement in our profitability, while further momentum on recent trade activity is expected to provide an additional lift to our domestic operations. By growing U.S. earnings, we would also expect to see a significant improvement in our effective tax rate.”

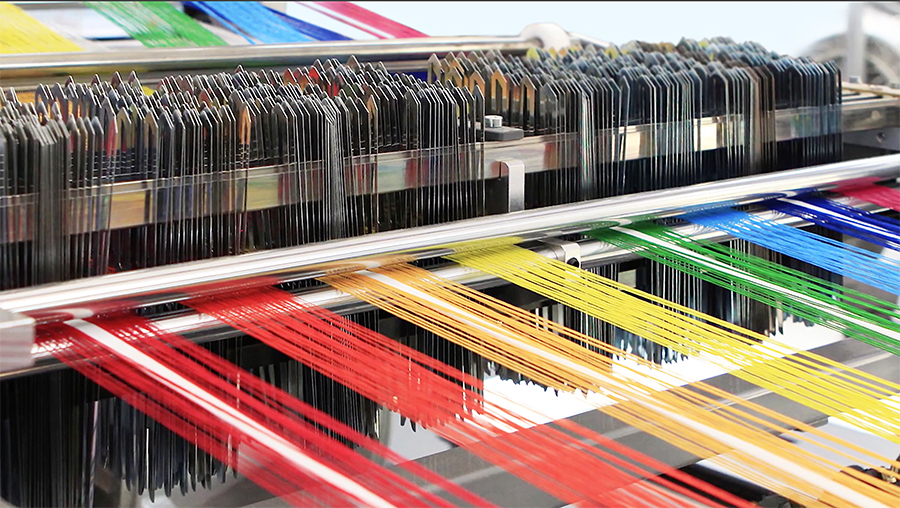

Photos courtesy Unifi