By Thomas J. Ryan

Representing its first official outfitting deal with a major American pro sports league, Under Armour has reportedly secured a deal to replace Majestic Athletic as the manufacturer of on-the-field jerseys for Major League Baseball come 2020.

Under Armour would also replace Nike as the provider of under-layer or baselayer for MLB’s players. Like Majestic Athletic’s deal, Nike’s contract is due to expire in 2019.

Meanwhile, Fanatics will gain “broad apparel rights across MLB” as part of the new arrangement, according to Sports Business Journal, which first reported the news. New Era will continue to control the headwear license.

Sources told Sports Business Journal that MLB President of Business and Media Bob Bowman recently presented the new apparel deal to MLB ownership, which approved it during a conference call last week. An official announcement is expected to come following the World Series.

The deal may lead to Under Armour becoming a bigger player in league deals in the future. Last summer, Under Armour was in the mix to replace Adidas as the NBA’s uniform provider starting next year, but was beat out by Nike.

Under Armour is the uniform and gear provider for various colleges, including the Maryland Terrapins, Notre Dame Fighting Irish and Auburn Tigers. It also makes workout apparel for the NFL Scouting Combine. Nike holds the NFL on-the-field license.

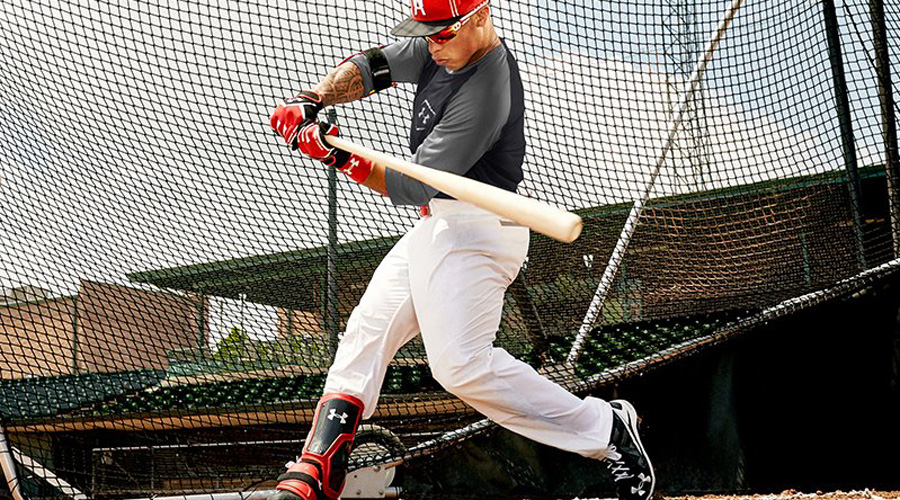

In baseball, Under Armour has gained attention in the sport by signing individual star players to use and market its products. Among its signature players are Washington Nationals right fielder Bryce Harper and Los Angeles Dodgers starting pitcher Clayton Kershaw. Being featured on the uniforms of all players across 162 games would clearly represent a jump in brand exposure.

A Hotter Brand

Beyond the financial bids for the contract, which have yet to be released, MLB may have also wanted to shift to a hotter brand in the marketplace for its own branding reasons. In shifting from Adidas to Nike, the NBA implied that it expected to benefit from an affiliation with a brand better known for basketball and more popular overall.

Nike is still top dog in the pros, however, with the on-the-field rights to the NFL, by far the most popular sport in America, and soon the NBA. It’s become debatable whether MLB or NBA is America’s second most-popular sport. Baseball has more heritage than any sport but basketball, earns better TV ratings and has stars that are better known to the public.

For Majestic, the news certainly complicates its ongoing sale process. VF Corp., Majestic’s parent, indicated in March it was exploring strategic options for its licensed sports group, largely made up of Majestic. The MLB on-field rights, which Majestic had owned since 2005, were seen as the crown jewel of the business and were expected to drive the bidding for the brand. With the new Under Armour deal, any buyer would only hold those rights through 2019.

The Fanatics deal could also hold major implications for the future of licensing deals. Currently, “hot market” opportunities, or the next-day sales spurred by a big win or other events, are handled by a number of brands across the industry across leagues. But Fanatics has been aggressively investing in domestic turnaround capabilities and may consolidate much of the business.

Retailing MLB

Fanatics currently has the rights to make fan apparel, mostly designing apparel with team logos on it. It wasn’t clear, however, how Under Armour and Fanatics will allot the fanwear part of the MLB business that will reach the retail marketplace. It also wasn’t clear whether Fanatics would just be selling the gear through its own channels or to retailers as well.

For fans, uniform changes could come as Under Armour seeks to make its mark, spurring some sales as well as controversy. Both Nike and Under Armour have garnered attention for reimagining college uniforms as they’ve taken over various schools. When it replaced Reebok as the NFL’s apparel provider in 2012, however, Nike declined to make significant alterations to most uniforms, the Seattle Seahawks being the exception.

The Sports Business Daily report also noted that the licensed youth business is up for review. Outerstuff controls much of the youth business across leagues.

Photo courtesy Under Armour