Moody’s Investors Service downgraded The Topps Company, Inc.’s Corporate Family Rating (CFR) to B2 from B1, its Probability of Default Rating (PDR) to B2-PD from B1-PD, its Speculative Grade Liquidity rating to SGL-4 from SGL-1, and the rating on its senior secured first-lien credit facilities to B2 from B1, consisting of a $30 million first-lien revolver due April 2022 and a $197 million first-lien term loan due October 2022. The outlook is negative.

The downgrades and negative outlook reflects that the termination of Topps’ planned merger agreement with Mudrick Capital Acquisition Corporation II (MUDS) and cancellation of a proposed debt offering increases near term refinancing risks, and that the prospective loss of the company’s flagship baseball license agreements will significantly and negatively affect revenue and earnings. In addition, the company’s liquidity is meaningfully constrained by the upcoming maturity of its $197 million term loan on October 2022.

On August 20, 2021, Topps terminated its planned merger with MUDS by mutual agreement and said that it would remain a private company. The merger termination came after Major League Baseball (MLB) and the Major League Baseball Players Association (MLBPA) notified Topps that they would not renew their respective license agreements with Topps after they expire at the end of 2025 for MLB and 2022 for MLBPA. The company expects that it will be able to produce substantially all its current licensed baseball products through 2025, pursuant to its existing agreements. However, Moody’s anticipates that the company’s current leading market share in the Major League Baseball card market will erode after the MLBPA license expires at the end of 2022.

Moody’s said the prospective loss of the baseball licensing contracts represents a significant weakening of the company’s market position amid increased competition in a shifting trading card business. Moody’s believes the abrupt contract losses will weaken the Topps brand and create challenges to overcoming the lost revenue and restoring the market position. The contract losses create uncertainty regarding the company’s strategic direction and plan to overcome the lost earnings.

Topps’ operating performance has been strong over the past year, resulting in low debt/EBITDA leverage at 1.2x for the last twelve months period (LTM) ending July 3, 2021. The company reported year-over-year revenue growth of 77.7 percent and management-adjusted EBITDA growth of 144 percent for the second quarter period that ended July 3, 2021, following very strong results in fiscal 2020 with consolidated revenue growing 23 percent and EBITDA rising 98 percent over 2019 levels. Topps’ low financial leverage helps to somewhat mitigate near-term refinancing risks. However, Moody’s expects that prospective leverage will weaken because of the loss of earnings related to baseball cards and will make it more challenging and costly to refinance maturities beyond the MLB/MLBPA/player license cessation dates.

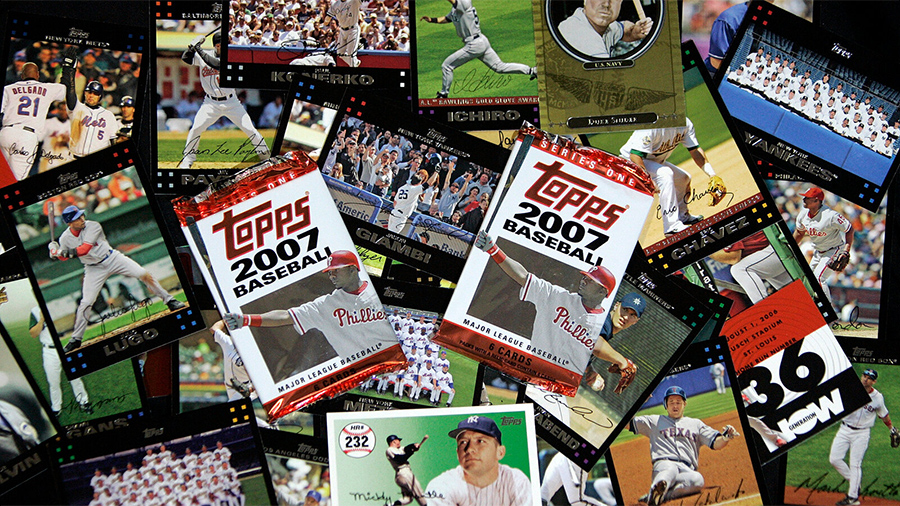

Photo courtesy Topps