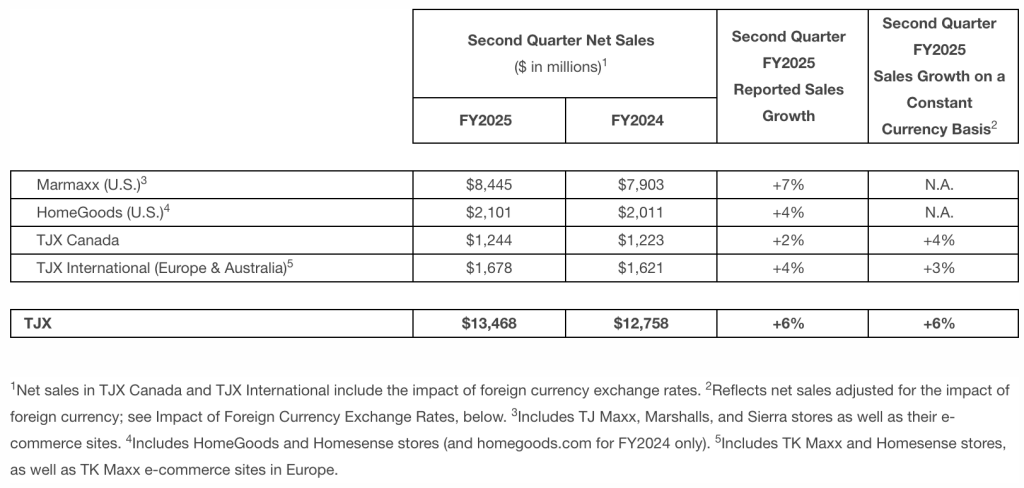

The TJX Companies, Inc., parent of the Marshall’s, TJ Maxx, and Sierra discount store nameplates, posted net sales of $13.5 billion for the Fiscal 2025 second quarter, an increase of 6 percent versus the second quarter of Fiscal 2024. Second quarter consolidated comparable store sales increased 4 percent year-over-year.

For the first half of Fiscal 2025, net sales were $25.9 billion, an increase of 6 percent versus the first half of Fiscal 2024. First half Fiscal 2025 consolidated comparable store sales increased 3 percent.

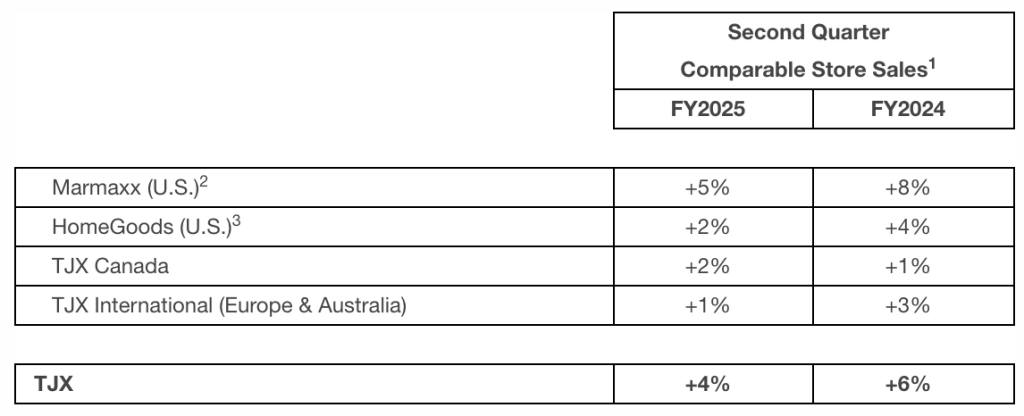

“I am extremely pleased with our second quarter performance,” commented Ernie Herrman, president and CEO, The TJX Companies, Inc. “Our comparable store sales increase of 4 percent, pretax profit margin, and earnings per share all exceeded our plans. Our teams sharply executed on our mission to deliver great value to consumers every day. Our overall comp sales growth was entirely driven by customer transactions, which increased at every division. The performance of Marmaxx, our largest division, was outstanding, with a comp sales increase of 5 percent.”

Comp Store Sales by Division

Margins

Gross profit margin for the second quarter of Fiscal 2025 was 30.4 percent, a 0.2 percentage point increase versus the second quarter of Fiscal 2024. Selling, general and administrative (SG&A) costs as a percent of sales for the second quarter of Fiscal 2025 were 19.8 percent, a 0.3 percentage point decrease versus the second quarter of Fiscal 2024.

For the second quarter of Fiscal 2025, the company’s pretax profit margin was 10.9 percent, up 0.5 percentage points versus last year’s second quarter pretax profit margin of 10.4 percent.

the company’s second quarter Fiscal 2025 pretax profit margin was above the high-end of its plan by 0.4 percentage points primarily due to a benefit from lower freight costs and stronger sales, partially offset by higher incentive compensation accruals and a contribution to the TJX Foundation.

Net Income

Net income for the second quarter of Fiscal 2025 was $1.1 billion and diluted earnings per share were 96 cents a share, up 13 percent versus 85 cents per share in the year-ago comparable quarter. Net income for the first half of Fiscal 2025 was $2.2 billion, or $1.89 per diluted share, up 17 percent versus $1.62 in the first half of Fiscal 2024.

FX Rates

The movement in foreign currency exchange rates had a neutral impact on the company’s net sales growth in the second quarter and the first half of Fiscal 2025 versus the prior year. The overall net impact of foreign currency exchange rates was neutral for the company’s second quarter and first half Fiscal 2025 diluted earnings per share.

Inventory

Total inventories as of August 3, 2024 were $6.5 billion, compared to $6.6 billion at the end of the second quarter of Fiscal 2024. Consolidated inventories on a per-store basis as of August 3, 2024, including distribution centers, but excluding inventory in transit, the company’s e-commerce sites, and Sierra stores, were down 2 percent on both a reported and constant currency basis versus last year. Inventory on a constant currency basis reflects inventory adjusted for the impact of foreign currency exchange rates, if any, as described above. the company is pleased with its inventory levels and is confident it is well-positioned to take advantage of the excellent availability of quality, branded merchandise in the marketplace and flow exciting goods to its stores and online throughout the fall and holiday season.

Cash and Shareholder Distributions

- For the second quarter of Fiscal 2025, the company generated $1.6 billion of operating cash flow and ended the quarter with $5.3 billion of cash.

- During the second quarter of Fiscal 2025, the company returned a total of $982 million to shareholders. the company repurchased $559 million of TJX stock, retiring 5.1 million shares, and paid $423 million in shareholder dividends during the quarter.

- During the first half of Fiscal 2025, the company returned a total of $1.9 billion to shareholders. the company repurchased a total of $1.1 billion of TJX stock, retiring 10.4 million shares, and paid $800 million in shareholder dividends.

- The company continues to expect to repurchase approximately $2.0 to $2.5 billion of TJX stock during the fiscal year ending February 1, 2025. the company may adjust the amount purchased under this plan up or down depending on various factors. the company remains committed to returning cash to its shareholders while continuing to invest in the business to support the near- and long-term growth of TJX.

Third Quarter and Full Year Fiscal 2025 Outlook

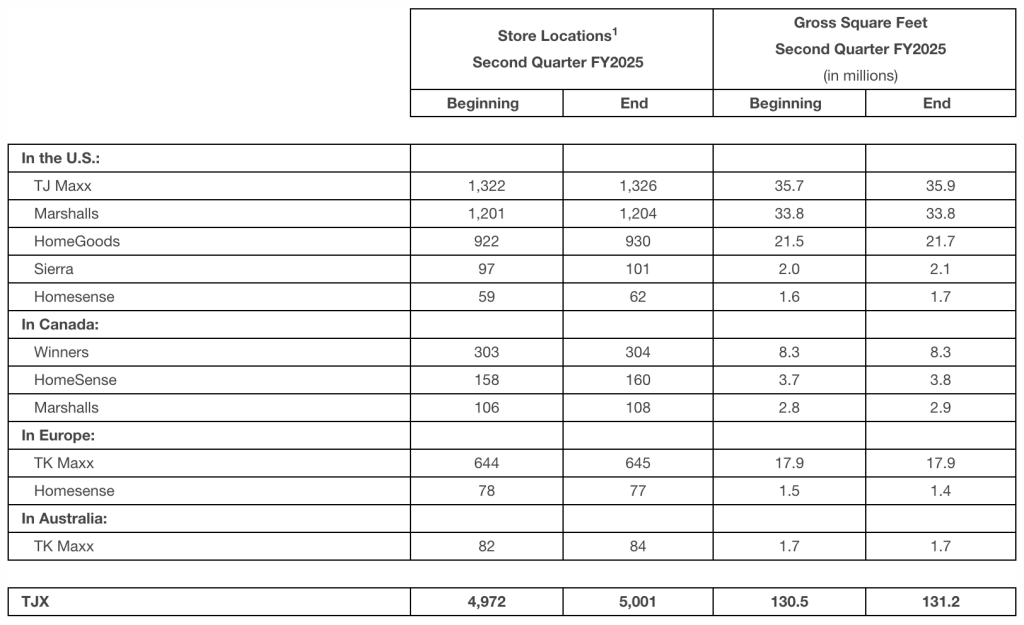

“With our strong second quarter results, we are raising our full-year guidance for both pretax profit margin and earnings per share,” Herrman added. “The third quarter is off to a strong start. We see excellent buying opportunities in the marketplace and are strongly positioned to ship fresh and compelling merchandise to our stores and online throughout the fall and holiday selling seasons. We marked a milestone for our company in the second quarter by opening our 5,000th store! Longer term, we are excited about our potential to capture additional market share in all of our geographies and to continue our global growth, while delivering great value to more consumers around the world and driving the profitability of TJX.”

Third Quarter Outlook

For the third quarter of Fiscal 2025, the company is planning consolidated comparable store sales to be up 2 percent to 3 percent, pretax profit margin to be in the range of 11.8 percent to 11.9 percent, and diluted earnings per share to be in the range of $1.06 to $1.08.

Full Year Outlook

For the full year Fiscal 2025, the company is now planning consolidated comparable store sales to be up approximately 3 percent. the company is increasing its outlook for pretax profit margin to be approximately 11.2 percent and increasing its diluted earnings per share outlook to be in the range of $4.09 to $4.13. As a reminder, last year’s full year and fourth quarter pretax profit margin and earnings per share benefited from an extra week in the company’s fiscal calendar.

Investment in Brands for Less

The company also announced that it has signed a definitive agreement to make an investment of approximately $360 million, subject to customary working capital adjustments, for a 35 percent ownership stake in privately held Brands for Less (BFL), which is currently located in the Gulf Cooperation Council (GCC) area.

BFL is based in Dubai and is the region’s only major off-price branded apparel, toys, and home fashions retailer. The transaction is expected to close later this fiscal year, and TJX’s investment represents a non-controlling, minority position in BFL. BFL currently operates over 100 stores, primarily in the UAE and Saudi Arabia, as well as an e-commerce business.

TJX said as it seeks to continue its global growth, this transaction gives the company an opportunity to invest in an established, off-price retailer with significant growth potential. the company’s ownership in BFL is expected to be slightly accretive to earnings per share beginning in Fiscal 2026. the company will record this investment using the equity method of accounting from the date of the investment. Further, TJX will report its share of BFL’s financial results on a one quarter delay. BofA Securities acted as financial advisor and Ropes & Gray LLP provided legal counsel to the company in connection with this transaction.

Stores by Concept

During the fiscal quarter ended August 3, 2024, the company increased its store count by 29 stores overall to a total of 5,001 stores and increased square footage by 0.5 percent versus the prior quarter.