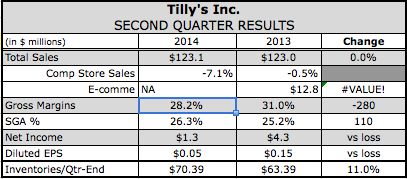

Tilly's didn’t offer any surprises in reporting a sharp drop in second-quarter earnings but did when it offered a profit outlook for the current quarter that missed Wall Street's expectations. In the quarter, profits tumbled 70.3 percent to $1.27 million, or 5 cents a share. Same-store sales, which include e-commerce sales, decreased 7.1 percent. Tilly’s had previously said it expected EPS in the period in the range of 3 to 7 cents a share with a comp decline in the high single digits.

Tilly's didn’t offer any surprises in reporting a sharp drop in second-quarter earnings but did when it offered a profit outlook for the current quarter that missed Wall Street's expectations. In the quarter, profits tumbled 70.3 percent to $1.27 million, or 5 cents a share. Same-store sales, which include e-commerce sales, decreased 7.1 percent. Tilly’s had previously said it expected EPS in the period in the range of 3 to 7 cents a share with a comp decline in the high single digits.

Gross margins eroded to 28.2 percent compared to 30.8 percent, primarily due to the deleverage of occupancy costs and a 40 basis point decrease in product margins.

Looking to the third quarter, Tilly’s said it expects comps to decline in the mid single digits. EPS is expected to be in the range of 9 to 13 cents a share, down from 22 cents a year ago. Analysts polled by Thomson Reuters had predicted a 19-cent profit.

On a conference call with analysts, Daniel Griesemer, Tilly’s president and CEO, said the declines in the second quarter “reflect the continuation of challenging market conditions combined with the planned reduction in our clearance inventory. Despite continuing traffic headwinds, we successfully managed our inventory in season.”

Griesemer said Tilly’s ended the quarter “with healthy product margins,” significantly less summer goods than last year, and inventory about flat on a per-square-foot basis.

“Although traffic headwinds continue, I am encouraged by improvements in sales trends so far in the third quarter, including strength in our regular price business,” said Griesemer.

The comp performance in the second quarter reflected relative strength in juniors, kids and footwear and continued softness in men's and accessories. As seen at other chains, denim was weak. Decreases in traffic and conversion was only partially offset by increased average transaction value.

Griesemer said Tilly’s continued to make progress in adding product innovation as part of its 2014 growth initiatives. Several new brands including Asphalt Yacht Club, Baker, Spitfire and ICNY were added in the quarter. Also added to the mix were more exclusive products including styles from Volcom, Rugova, Vans and LRG as well as new or exclusive collaborations, including offerings from Neff, Nike, Vans and most recently the Asphalt Yacht Club Nyjah Houston collection.

Tilly’s expanded its offerings of Full Tilt sport and Patrons of Peace in juniors, and Ethica boxers and accessories, and further expanded its assortment of men's joggers and junior fashion tops. Its back-to-school footwear initiative was rolled out late in the second quarter to help drive improved footwear comps.

Griesemer said the active influence “has made the jogger relevant” on the guys’ side and is also supporting the Full Tilt offering on the junior side.

“The junior trends that are important to us right now, we call it Vintage Romance and the 90's Muse, which kind of captured kind of the whole look and feel of things that are going on there,” said Griesemer.

Regarding its digital growth initiatives, Griesemer noted that its e-commerce and mobile platforms are continuing to be upgraded with a rollout set for this fall. Its Tilly's Hookup loyalty program continued to see significant growth. A new state-of-the-art e-commerce fulfillment center is fully functional.

On the retail front, new markets such as Minneapolis, Sacramento and Chicago are seeing a good response.

In the Q&A session, Griesemer said he expects the market to remain “relatively promotional” for the balance of the year.

Said Griesemer, “We remain intently focused on the things that we can control, and that's the product offering, the experience in any channel the customer chooses to access us, and controlling the overall cost and execution.”