Smith & Wesson Brands Inc. fell far short of Wall Street expectations in their fiscal second quarter as sales decreased versus the year-ago quarter amid reduced consumer demand and fuller inventories at distributors and retail. Still, the firearms manufacturer posted improved margins that more than offset the sales decline and resulted in increased net income.

The company reported sales declined 7.3 percent to $230.5 million in the second quarter ended October 31 against tough year-ago comparisons. Two-year compounded sales growth was over 140 percent.

Gross margin was 44.3 percent, compared with 40.6 percent for the comparable quarter last year.

—•—

Net Sales and Gross Profit for the Three Months Ended October 31, 2021

(the table includes net sales and gross profit for the three months ended October 31, 2021 and 2020 (dollars in thousands))

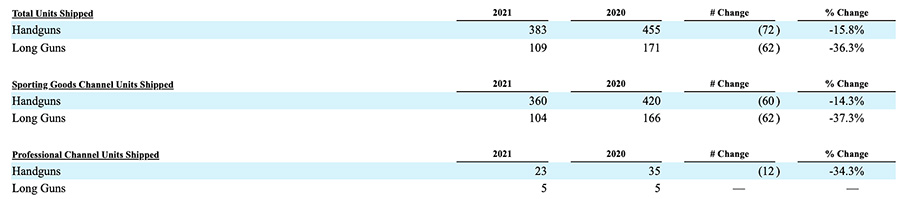

Firearm units shipped by trade channel for the three months ended October 31, 2021 and 2020

(units in thousands)

—•—

Handguns sales decreased 2.2 percent from the comparable quarter last year and were said to be due primarily to decreased shipments of “M&P branded polymer pistols, partially offset by increased shipments of revolvers and two price increases, one in November 2020 and one in June 2021.”

Handgun unit shipments into the sporting goods channel decreased by 14.3 percent from the comparable quarter last year, while overall consumer demand decreased 24.2 percent (as indicated by adjusted background checks reported in the National Instant Criminal Background Check System, or NICS). However, based on data S&W tracks internally on distributor and strategic retailer inventory levels in the channel in certain handgun products, they said they believe that a significant portion of their unit shipments was used to replenish inventory in distribution and retail channels. After adjusting for this, management said in their 10-Q for the quarter that they believe their market share likely declined in the quarter as compared to NICS.

“We believe this is due to the significant market share gains we achieved as a result of the historical demand levels during the pandemic, and with demand levels now easing, competitor offerings are more available at retail, which likely resulted in a market share decline for us from our peak levels, although we believe we still maintain our leadership position, the company noted in the 10-Q.”

Second-quarter sales of long guns decreased 20.6 percent from the comparable quarter last year. The decrease in sales was said to be primarily due to decreased shipments of hunting rifles due to the planned divestiture of that product line combined with lower shipments of M&P modern sporting rifles, partially offset by increased shipments of a newly introduced product in the quarter and two price increases.

Long gun unit shipments into the sporting goods channel decreased 37.3 percent from the comp quarter last year. Excluding shipments of Thompson/Center branded products, long gun units decreased 12.7 percent as compared with a 16.2 percent decrease in reported NICS checks. However, the company noted that based on data tracked internally on distributor and strategic retailer inventory levels in the channel in certain of long gun products, they believe that a significant portion of their unit shipments was used to replenish inventories in the distribution and retail channels. After adjusting for this, they said they think Smith & Wesson’s market share likely declined in the quarter as compared to NICS.

“We believe this is due to the significant market share gains we achieved as a result of the historical demand levels during the pandemic, and with demand levels now easing, competitor offerings are more available at retail, which likely resulted in a market share decline for us from our peak levels, although we believe we still maintain our leadership position, the company noted in the 10-Q for the period.

Other products and services revenue increased 7.9 percent versus the comparable quarter last year, primarily because of “increased business-to-business services, increased sales of component parts, and increased sales of handcuffs.”

New products, which the company defines as any new SKU not shipped in the comparable quarter last year, represented 12.8 percent of sales for the three months ended October 31, 2021 and included a new M&P branded long gun and “many” new M&P product line extensions.

GAAP net income was $50.9 million, or $1.05 per diluted share, in the fiscal second quarter, compared with $49.1 million, or 87 cents per diluted share, for the comparable quarter last year. Fiscal Q2 non-GAAP net income was $55.3 million, or $1.13 per diluted share, compared with $52.8 million, or 93 cents per diluted share, for the comparable quarter last year.

GAAP to non-GAAP adjustments for income exclude costs related to the planned relocation of the company’s headquarters and certain manufacturing and distribution operations to Tennessee, the spin-off of the outdoor products and accessories business in fiscal 2021, COVID-19 related expenses, and other costs.

Wall Street anticipated sales of $264.98 million and adjusted earnings of $1.29 per share in the fiscal second quarter.

Photo courtesy Smith & Wesson