<span style="color: #a1a1a1;">Smith & Wesson Brands Inc. reported its last quarter as a combined entity this week after completing the spin-off of its Outdoor Products & Accessories segment on August 24. The spin-off will not have much of an impact on Smith & Wesson’s business as the company reported a blow-out quarter that saw the sales increase alone for the Firearms segment at more than double the total size of the spun-off Outdoor Products & Accessories segment in the period.

Firearms segment gross sales increased 140.9 percent to $229.9 million in the fiscal first quarter ended July 31, which included $1.0 million of intersegment revenue, representing an increase of $134.4 million over the comparable quarter last year. Company President & CEO Mark Smith said that the sales volume equates to 584,000 units shipped in the period. The Outdoor Products & Accessories segment was no laggard in the quarter as gross sales grew 52.3 percent to $50.6 million, which included $1.5 million of intersegment revenue.

The company has three main consumer sales channels: distributor, strategic retailer (SRA) and buying groups.

Smith said that overall NICS (firearms) background checks increased 111 percent during the company’s fiscal first-quarter but also pointed out that while adjusted NICS background checks are generally considered to be the best available proxy for consumer firearm demand at retail, they are not necessarily a proxy for Smith & Wesson shipments. “Since NICS is a measure of consumer activity and since we transfer firearms only to law enforcement agencies and federally licensed distributors and retailers, not directly to end consumers, NICS does not directly correlate to our shipments or market share in any given time period. We believe mostly due to inventory levels in the channel,” he explained.

<span style="color: #a1a1a1;">For Smith & Wesson, total units shipped into the sporting goods channel during this time increased 114 percent to 549,000 units, while, simultaneously, the SRA and distributor combined inventory declined by over 112,000 units. Smith said NICS checks for handguns increased 141 percent during the quarter while S&W handgun unit shipments increased 122 percent to 441,000 units, while simultaneously, their handgun channel inventory dropped by 103,000 units. NICS checks for long guns increased 96 percent in the quarter and S&W’s long gun unit shipments increased 89 percent to 108,000 units, while simultaneously, their long gun channel inventory dropped by nearly 9,000 units. “This all translates to a 58 percent decline in channel inventory for our products in spite of a record quarter in unit shipments from our facilities, which we believe indicates very strong market share growth,” he detailed.

<span style="color: #a1a1a1;">For Smith & Wesson, total units shipped into the sporting goods channel during this time increased 114 percent to 549,000 units, while, simultaneously, the SRA and distributor combined inventory declined by over 112,000 units. Smith said NICS checks for handguns increased 141 percent during the quarter while S&W handgun unit shipments increased 122 percent to 441,000 units, while simultaneously, their handgun channel inventory dropped by 103,000 units. NICS checks for long guns increased 96 percent in the quarter and S&W’s long gun unit shipments increased 89 percent to 108,000 units, while simultaneously, their long gun channel inventory dropped by nearly 9,000 units. “This all translates to a 58 percent decline in channel inventory for our products in spite of a record quarter in unit shipments from our facilities, which we believe indicates very strong market share growth,” he detailed.

“If you remember last quarter, we were actually talking about the SRAs that really drove that difference in the mix to our inventory,’ explained Smith in response to a question on inventory. “The major driver, we believe, of the difference between our results and NICS results is what’s happening with inventory in the channel,” Smith said that during the last quarter they had a significant decrease in inventory at one of their SRA accounts. Smith went on, “They were not replenishing from us, whereas this time, we’ve had significant decreases in inventory across the board internally in all the channels. And we are still, obviously, as you can see from the results, pretty heavy on shipments.”

Smith & Wesson’s internal finished goods inventory declined by almost 48 percent, or $28 million, during the fiscal first quarter.

“As we’ve seen before during these surge periods, these results reflect that despite our record numbers in market share growth, consumer demand for our products during the quarter still exceeded our internal manufacturing capacity levels,” Smith said.

Smith went on to say that they have fully reengaged their third-party component manufacturing partners and are aggressively ramping production to meet incoming orders. He said they were able to utilize their state-of-the-art distribution center to “deliver products more efficiently and rapidly than ever before.”

The CEO also detailed out a trend in expanded diversity in gun ownership.

“A recent poll of firearms retailers conducted by NSSF estimates that between 40 percent to 60 percent of the consumers purchasing firearms are first-time gun owners who are looking to exercise their Second Amendment rights to protect themselves and their families,” Smith reported. “Since March, the NSSF estimates that nearly 5 million Americans have purchased their first firearm. Not only are we seeing record new consumer entrants in the market, but those new entrants are serving to broaden and diversify the core base of firearms consumers. With the two fastest-growing segments of new gun owners being women and African Americans.”

To help train and educate this sharp rise in new gun owners, Smith said they have launched a nationwide outreach campaign called Gun Smarts. “We have three goals with this program,” he explained. “First, welcome these new gun owners to our industry. Second, make sure they know how to safely use and store their firearms. And finally, provide instructional resources from Smith & Wesson on increasing shooting proficiency, help them understand the basics of firearms function, and help them locate welcoming, hands-on training, ranges, and other resources. Everything a first-time gun owner would want to know but may not want to ask. Gun smart is the only program of its kind in the market today. Using the very top professional shooters and instructors in the industry, we have produced over 60 instructional online videos and tips to help convey best practices, all regardless of the brand of firearm purchased.”

Smith & Wesson is providing free of charge a welcome kit to new gun owners — regardless of the brand of firearm purchased — that includes Smith & Wesson branded safety glasses, hearing protection, instructional booklets, and a link to S&W’s online platform containing the video library. Smith said the program launched in mid-August and by mid-September, they will have donated over 40,000 Gun Smarts boxes to new gun owners.

<span style="color: #a1a1a1;">Overall company gross margin was 42.0 percent of sales compared with 38.7 percent in the comparable quarter last year. The S&W Firearms segment generated margins of 40.2 percent of sales in the first quarter. Increased unit shipments, combined with a reduction in promotional activity and only slightly offset by pandemic related costs, resulted in a 3.1 percent increase in gross margin over the prior year.

Total company operating expenses were $4.6 million higher in fiscal Q1 compared to the prior-year quarter due to $3.6 million of spin-off costs and $2.8 million of increased profit-sharing expense. Increased volume-related customer allowances were said to be more than offset by reduced travel, lower advertising costs, and lower employee medical costs, likely due to the deferral of elective procedures resulting from the pandemic.

Quarterly GAAP net income was $48.4 million, or 86 cents per diluted share, compared with a GAAP net loss of $2.1 million, or 4 cents per diluted share, for the comparable quarter last year. Quarterly non-GAAP net income was $54.9 million, or 97 cents per diluted share, compared with $1.7 million, or 3 cents per diluted share, for the comparable quarter last year. GAAP to non-GAAP adjustments for net income exclude costs related to the spin-off of the Outdoor Products & Accessories segment, COVID-19-related expenses, and other costs.

Smith & Wesson generated $83.5 million in cash from operations in the quarter and spent $7.6 million on capital equipment, leaving $75.8 million in free cash at quarter-end. The company also repaid $135 million on a revolving line of credit, leaving $25 million outstanding on the revolver, and had zero net debt. After the end of the first quarter, as part of the spin-off process, the company restructured its credit facility for a new five-year term that enables them to maintain an unsecured $100 million line of credit for the “foreseeable future.”

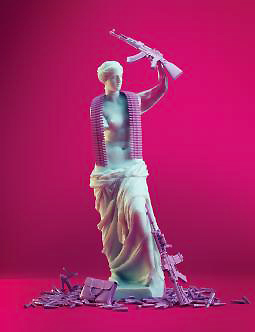

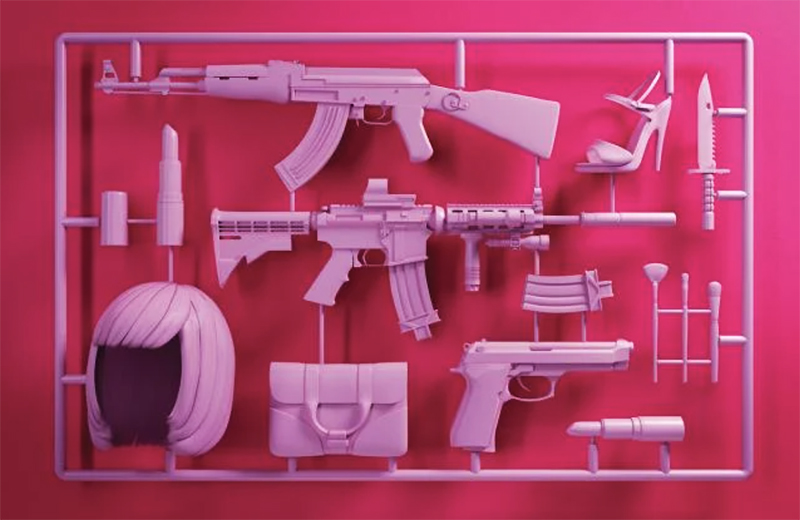

Photos courtesy Ad Age