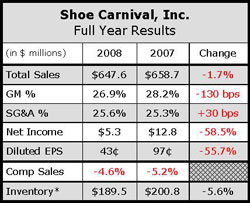

Shoe Carnival, Inc. saw declining store traffic amid the tough trading conditions that ended the retail year drive the company to report a sales decline for the fourth quarter as well as the fiscal year. That decrease combined with charges associated with closing stores and asset impairment, helped produce a net loss for the years final quarter. Overall, net sales for the fourth quarter declined 4.5% to $156.9 million from $164.3 million in the year-ago period.

Comparable store sales decreased 8.3% in the quarter on top of a 5.7% declinee reported for the year-ago quarter. For the fourth quarter, the company reported a net loss of $3.0 million, or 24 cents per diluted share, compared to net earnings of $1.1 million, or 9 cents per diluted share, in the prior-year period. Included in the fourth quarter of 2008 were store closing costs of 12 cents per diluted share compared with 8 cents per diluted share in the prior-year fourth quarter.

But business may be heading back in the right direction. On a conference call with analysts, SCVL management reported that February trended much better than the fourth quarter reversing a trend that saw January fare “much worse” than either November or December. February comp store sales increased in the high-single-digits, though management cautioned that “the retail environment continues to be promotional and the first half of February was very clearance-driven.”

Management said athletic product performed “very nicely” and pointed out that even boots and women's product continued to perform very nicely in the month of February. Still, they highlighted much of that was at clearance prices. Children's product was also highlighted as a positive in February in the lead up to Easter season.

For the fourth quarter, athletic was described as “down-trending” though management called out Converse Chucks, urban fashion styles from Nike, and performance running from several brands as strong performers. However, this was not enough to overcome other poor performing athletic categories and consequently adult athletic product in total recorded a double-digit comp store sales decline for the quarter. Elsewhere, women's non-athletic product recorded a low-single-digits decline.

Double-digit declines in the dress and casual categories were partially offset by a double-digit increase in boots, with fur-lined sport boots and cold weather boots called out as performing especially well. SCVL also saw a resurgence in juniors product led by the dress and boot categories. However, men's non-athletic product was down “almost double-digits” for the quarter. Growth in the children's dress and boot business, was offset by a decline in athletic shoes, which caused the overall kids' business to be down mid-singles for the quarter.

Management also reported a significant decline in store traffic during the quarter, which resulted in a very-low-double-digit decrease in footwear unit sales on a comparable store basis. However, average unit retail in footwear actually increased low-singles.

Gross margins for the fourth quarter declined 280 basis points to 24.7% of sales, compared to 27.5% in the fourth quarter of 2007. Merchandise margins decreased 200 basis points due to a more promotional holiday sales period and the aggressive clearance of seasonal product during the quarter. As a percentage of sales, SG&A expenses increased to 27.8% from 26.5% in the fourth quarter of 2007, due to the de-leveraging effect of lower sales.

During fiscal 2008, 24 new stores were opened and 11 were closed to end the year at 304 stores. Those 11 stores recorded a combined loss of $2.9 million in fiscal 2008. On a net basis, selling space increased 97,000 sf in 2008 bringing total retail selling space to 3.3 million sf.