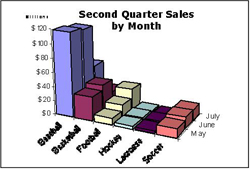

The macroeconomic trends that the majority of public companies discussed on conference calls for the second quarter were also felt in the team sports market as overall sales improved less than one percentage point over the year-ago quarter. This near-flat result masks two different trends at work.

According to retail point-of-sale data compiled by SportScanINFO, retail fiscal second quarter sales of team sports equipment in the discount/mass sector were down in the high-single-digits in units and mid-single-digits in dollars, while sales in the sports retailer sector increased in the mid-singles in both units and dollars.  As gas prices have risen, along with the general cost of living, and talk of the downfall of the housing market has reached a crescendo, discount/mass retailers are taking the hardest hit as their typical consumer has less disposable income than those shopping in the specialty and full-line sporting goods stores. Second, the slight average selling price decrease seen in the sports retailer channel suggests that, while May is typically the time for clearance sales to take place, there was more off-price shopping going on than in the past as this consumer looks to become more fiscally-minded and goes for the best deal rather than the best product on the wall.

As gas prices have risen, along with the general cost of living, and talk of the downfall of the housing market has reached a crescendo, discount/mass retailers are taking the hardest hit as their typical consumer has less disposable income than those shopping in the specialty and full-line sporting goods stores. Second, the slight average selling price decrease seen in the sports retailer channel suggests that, while May is typically the time for clearance sales to take place, there was more off-price shopping going on than in the past as this consumer looks to become more fiscally-minded and goes for the best deal rather than the best product on the wall.

As gas prices pinch the wallets in the discount/mass checkout lines, the housing market tumble is beginning to slow spending in the up market channels as these consumers worry about home equity loans no longer being plentiful. However, despite these economic signs of distress, sports continue to be played and the Team Sports market heads into the bulk of football season with sales trending ahead in the second quarter.

Sales were up in the mid-singles with units slightly outpacing dollars in the sports retailer sector. While both cleated footwear and team Sports equipment sales increased in the mid-singles in dollars, footwear actually saw unit sales decrease in the low-singles. Equipment saw a high-singles units increase that led to a low-singles overall average selling price decline.

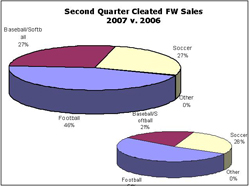

In the cleated category, comping against last years Under Armour launch in football was made difficult without a similar major event this year. Though the overall cleated footwear category saw an increased average selling price in the second quarter, that improvement came at the expense of high-end, higher-margin product as sales over $99 were down in the strong double-digits, matched nearly percentage point for percentage point as growth in the $75 to $99 range. Nikes Team-Code D came out on top for the quarter, surging forward with the second quarters end and the start of football two-a-days. Under Armour took three of the top ten best seller spots. Cleated sales actually showed a bit of the classic bell curve pattern in the quarter as unit sales of shoes selling for less than $50 decreased in the mid-singles. In fact, sales within the price range moved toward the $50 point. A shift in the price range dynamic like this could signal either that the general worries in the marketplace are having an impact on cleated sales, or that an increase in clearance and markdown product is encouraging consumers to spend a little more to get a lot more. Baseball shoes sold well in the quarter, up in the strong double-digits with a mid-teens jump in average selling price. Football however, was affected by the same force as the overall cleated category.

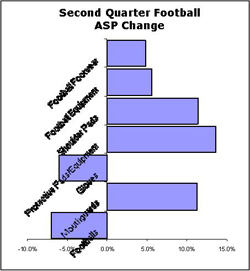

Football sales as a whole came out just below flat for the quarter in both units and dollars. The high-singles increase in equipment, was not quite enough to offset the mid-singles decrease in football shoes sales.

Within equipment, mouthguards continue to see strong sales growth accompanied by ASP increases as the consumer opts for the safer, more technologically advanced, and higher priced product. This mindset seems to penetrate much of the football category as shoulder pads and protective pads both showed similarly strong sales and ASP growth.

equipment, mouthguards continue to see strong sales growth accompanied by ASP increases as the consumer opts for the safer, more technologically advanced, and higher priced product. This mindset seems to penetrate much of the football category as shoulder pads and protective pads both showed similarly strong sales and ASP growth.

These two categories along with mouthpieces, all of which are typically supplied by the school or league, suggest by starting the season so strong that elite players are opting to step up to higher price points and safer product. Footballs themselves were actually down in the mid-singles for the quarter; perhaps those sales will move somewhat closer to the start of the season when tailgates start once again filling parking lots.

Baseball/softball finished the second quarter with a dollar sales total representing a high-teens sales increase over the same quarter in 2006. Footwear was particularly strong with average selling price increasing in the mid-teens for the quarter to $40.12, even though not a single shoe in the top 10 sold for more than $50 per pair on average. Equipment in the category posted strong sales gains for the quarter, but saw average selling price lowered on increased sales of lower margin categories like baseballs and softballs as the season came to a close and players shopped mainly for the games smaller necessities or for bargains on the clearance table.

Soccer had a tough time comparing against the FIFA World Cup held during last years second quarter. Soccer footwear managed a low-singles dollar sales improvement, aided by strong sales of indoor shoes, probably benefiting from the low profile trend.

However, the boost to footwear by fashion was not  enough to offset last years equipment sales with no World Cup soccer balls sitting on shelves to commemorate the event. In fact, Ball sales were down in the mid-teens for the quarter, the root cause of the categorys downturn for the quarter, as both protective equipment and gloves both had strong sales.

enough to offset last years equipment sales with no World Cup soccer balls sitting on shelves to commemorate the event. In fact, Ball sales were down in the mid-teens for the quarter, the root cause of the categorys downturn for the quarter, as both protective equipment and gloves both had strong sales.

With the all important third quarter coming up for both football and soccer, eyes will begin looking inside the gym towards the basketball hoops and the next round of equipment sales. Football will look to post strong comp results on the hope that sales that moved forward during the year-ago quarters cleated excitement will shift back to the third once again. Soccer faces a similar question on whether the World Cup caused sales to push forward into the second quarter, which would theoretically cause an easier comp in Q3, or just a general spike in sales last year, with the third quarter a more nominal result to compare against.

For a review of Q2 team sports retail sales, look for the next issue of Sporting Goods Dealer magazine…