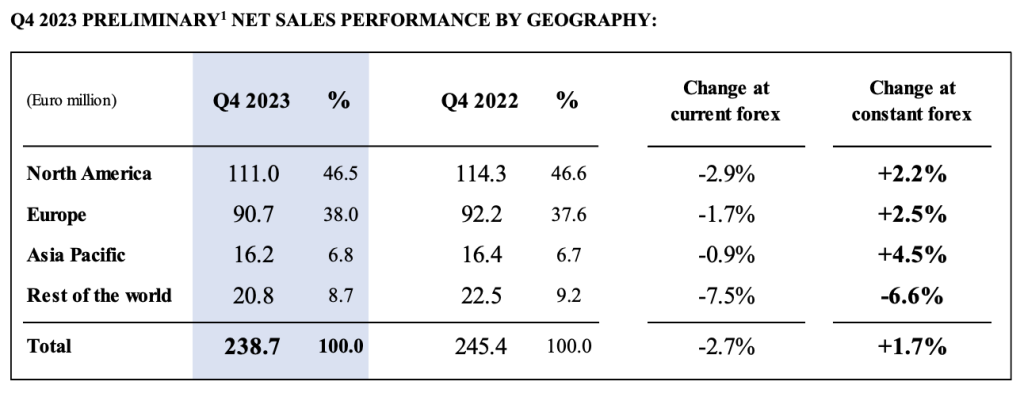

Safilo Group S.p.A., the parent of Smith and the eyewear licensee for Carrera, Havaianas, Under Armour, and Fossil, reported preliminary unaudited net sales were €238.7 million in the 2023 fourth quarter, marking the best performance of the year, equal to growth of 1.7 percent at constant FX rates but down 2.7 percent at current FX rates. Revenues were up 3.3 percent excluding sales in the former GrandVision chains.

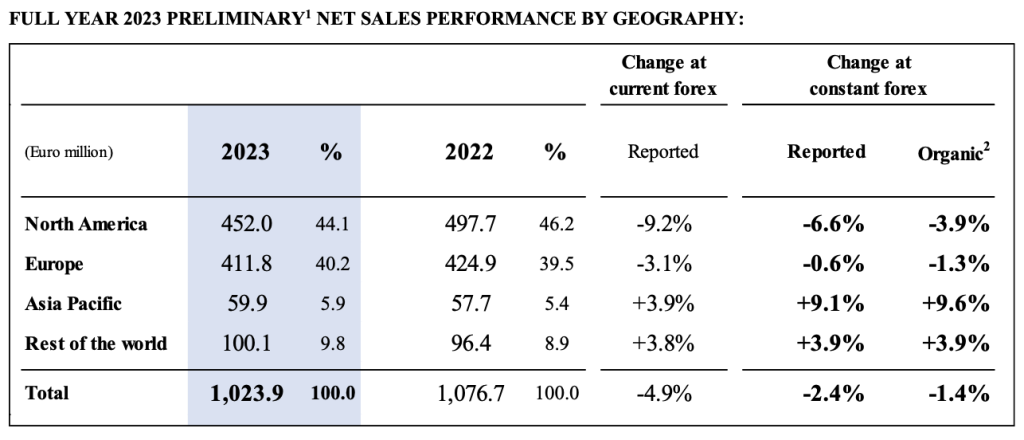

For the 2023 full year, preliminary unaudited net sales were reported at €1.02 billion, marking a decline of 2.4 percent at constant FX rates, and down 4.9 percent at current FX rates. Organic sales were down 1.4 percent year-over-year (YoY). Total revenues were €1.08 billion in 2022.

Revenues for the year were said to be “quite close to those recorded in 2022, despite the headwinds represented by the continuing weakness of the North American market, and the over 60 percent drop in revenues recorded in the former GrandVision chains,” the company said in a press release announcing results.

Net of this last effect, the Group said that organic sales increased by 1.6 percent, “thanks to the good performance of its home brands, in particular Carrera and Polaroid, which grew well for the second consecutive year, and Blenders, back in progress, after the post-pandemic normalization phase of sales in online channels.”

The Group also said that 2023 “continued to highlight Smith’s excellent development in the direct-to-consumer (DTC) channel, which allowed the brand to return to growth in the second half of a year which, for the sports sector, was influenced by a business slowdown in physical stores.”

In licensed brands, Safilo said that 2023 further confirmed the Group’s BOSS and Tommy Hilfiger’s collections as key points of reference in the eyewear landscape, while among the most recent partnerships, Carolina Herrera, which joined Safilo’s portfolio in 2022, and David Beckham, a brand launched for the very first time in eyewear in 2020 and already one of the Group’s core brands, stood out for their double-digit performances.

North America

The fourth quarter was characterized by the improvement of the North American market, where sales stood at €111.0 million, up 2.2 percent at constant FX rates but down 2.9 percent at current FX rates, thanks to greater stability of the eyewear segment in the traditional channels of independent opticians and chains, and the aforementioned growth of Blenders and Smith in the DTC channel.

For the full year, Safilo’s sales in North America amounted to €452.0 million, down 6.6 percent at constant FX rates and down 9.2 percent at current FX rates, compared to €497.7 million recorded in 2022. Organic sales were said to be down 3.9 percent YoY.

Europe

Fourth quarter sales in Europe were €90.7 million, and back to positive performance, up 2.5 percent at constant FX rates, compared to the corresponding quarter in 2022, but down 1.7 percent when measured at current FX rates. The trend line in Europe excluding the business in the former GrandVision chains, accelerated from +1 percent YoY in Q3 2023 to around +6 percent YoY in the fourth quarter.

For the year, Safilo’s sales in Europe equaled €411.8 million, almost completely recovering the sharp decline in business in the former GrandVision chains and closing the year substantially stable compared to the strong growth sales of 2022. Sales were down 0.6 percent at constant FX rates, down 3.1 percent at current FX rates, and off 1.3 percent in organic sales terms. For the year, the organic sales performance, also net of GV business, posted growth of around 7 percent.

Emerging Markets

The Group’s sales reportedly recorded progress again in Asia and Pacific, reaching €16.2 million and growth of 4.5 percent at constant FX rates (-0.9 percent at current FX rates), while revenues in the Rest of the World, equal to €20.8 million, recorded a decline of 6.6 percent at constant FX rates (-7.5 percent at current FX rates), due to a challenging comparison base.

For the full year, Safilo’s sales in the Emerging Markets regions represented approximately 16 percent of the Group’s total sales, with the business in Asia and Pacific reaching €59.9 million, up 9.1 percent at constant FX rates (+3.9 percent at current FX rates), compared to €57.7 million recorded in 2022, and the Rest of the World which closed the year at €100.1 million, recording growth of 3.9 percent at constant FX rates (+3.8 percent at current FX rates), compared to €96.4 million recorded in 2022.

On a preliminary unaudited basis, Safilo’s economic performance was said to be characterized by the strong improvement in the adjusted gross margin, significantly up also in the fourth quarter, and which reached approximately 59 percent of sales in the full year, well above the 55.5 percent margin recorded in 2022.

At the Adjusted EBITDA level, the year closed with a margin of around 9 percent of net sales, following an Adjusted gross operating margin which, in the fourth quarter, improved compared to the same quarter of 2022.

The Adjusted EBITDA performance excludes non-recurring costs expected for the year at around €29 million, mainly due to the transfer of the Longarone plant, and to the termination of activities related to exiting licensed brands.

Most of the charges do not have a cash impact, according to the company’s release.

On a preliminary unaudited basis, the Group’s net debt fell to approximately €83 million (approximately €44 million pre-IFRS 16) at year-end from €113.4 million (€69.6 million pre-IFRS 16), recorded as of December 31, 2022. In the fourth quarter, the Free Cash Flow was positive for approximately €13 million, including the expected negative impact deriving from the sale of the Longarone plant. The total cash generation for the year reached around €29 million, equal to around €35 million before the payment of €5.9 million made in the third quarter to exercise the first option on an additional 10 percent of Blenders’ non-controlling interests.

Safilo Group’s portfolio encompasses home brands: Carrera, Polaroid, Smith, Blenders, Privé Revaux, and Seventh Street. Licensed brands include Banana Republic, Boss, Carolina Herrera, Dsquared2, Etro, Eyewear by David Beckham, Fossil, Havaianas, Hugo, Isabel Marant, Juicy Couture, Kate Spade New York, Levi’s, Liz Claiborne, Love Moschino, Marc Jacobs, Missoni, M Missoni, Moschino, Pierre Cardin, Ports, rag&bone, Stuart Weitzman, Tommy Hilfiger, Tommy Jeans and Under Armour.

Image courtesy Smith Optics