RYU Apparel Inc., the maker of urban athletic apparel, reported revenues for the year ended December 31, 2017 were $3.0 million, 121 percent higher than revenue of $1.37 million during the year ended December 31, 2016.

After completing its second year of operations, the RYU team is encouraged with its sales record to date and a 46 percent gross profit for the year.

Fourth quarter 2017 results included additional revenue from the company’s new retail store locations in Park Royal South in West Vancouver, Queen St. West in Toronto and Metrotown in Burnaby. The Metrotown location in Burnaby was only open for one month within the quarter.

The fourth quarter of 2017 is RYU’s ninth consecutive quarter of increasing gross profit.

“We are pleased with this quarter and yearly results and the steady progress we are making in our strategic plan,” said Marcello Leone, CEO. “Moving forward, RYU remains focused, and we have a solid road map in place to position the brand for success. As creators of Urban Athletic Apparel, we are the leader in this new category that evolved from Athleisure.”

During the year ended December 31, 2017, the company achieved the following milestones:

RYU met the company’s retail store expansion target of five open stores by the end of 2017. The company currently has five stores in operation and three under construction. In addition to the opening of Park Royal South on March 28, 2017 and Queen St. West in Toronto on September 19, 2017, management opened the company’s first enclosed mall location at Metrotown in Burnaby on November 28, 2017.

RYU partnered with netamorphosis, an award winning digital and creative agency from New York City, to facilitate and maximize RYU’s digital and e-commerce business across the United States and globally. Work has begun to further accelerate and expand e-commerce revenue and performance. High-priority tasks were deployed in the fourth quarter of 2017 and will continue into the third quarter of 2018.

E-commerce revenue grew 125 percent against 2016. RYU achieved 17 percent of total revenue from e-commerce in 2017 and it is focused on a clear roadmap to achieve a 65:35 “bricks (65 percent) and clicks (35 percent)” business model by the year 2021.

The fourth quarter of 2017 marked the first full quarter that ryu.com offered international shipping since partnering with Global-E to provide the service. With a target go-live in the third quarter of 2018, a new ryu.com will launch with improved performance, speed and integration as RYU continues to progress towards an omni-channel experience for customers.

RYU secured the company’s first USA retail store location in Williamsburg, in the New York City borough of Brooklyn. The 2,800-square-foot store in the newly renovated Lewis Steel Building on 76 North 4th St. will perfectly connect RYU’s urban aesthetic and appeal with Williamsburg’s style and community. The store is scheduled to open during the third quarter of 2018.

The company is also pleased to provide the following 2018 updates:

- RYU’s expansion plan is on target to have eight stores by the end of 2018 and to achieve +100 percent year over year growth in retail revenue. Subsequent to year-end, the company secured the leases to its second and third USA store locations in the state of California. This expansion gives RYU exposure in New York City and Los Angeles, the most important urban centers of both coasts of the USA. The three stores have targeted openings in the second and third quarters of 2018.

- RYU continues to enhance the company’s capital structure in 2018;

- On January 19, 2018 the company closed a non-brokered private placement financing of $5,651,945;

- On February 19, 2018, the company closed a non-brokered private placement financing of $3,997,808 and

- Year-to-date, a total of 52,560,615 warrants have been exercised for proceeds of $10,156,352. The company is pleased to report that 84 percent of the $0.20 warrants subject to the acceleration of their expiry dates, as announced on February 20, 2018, were exercised by March 29, 2018.

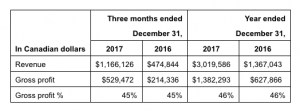

Fourth Quarter Summary

Fourth quarter revenue of $1,166,126 compared with $474,844 in the same period in fiscal 2016. Revenue increased by 146 percent, as it included sales from five versus two retail stores and growth in e-commerce sales. RYU’s fifth retail store location at Metrotown in Burnaby was only open for one month within the quarter.

The fourth quarter of 2017 marks RYU’s ninth consecutive quarter of increasing gross profit. Fourth quarter gross profits were $529,472 compared with $214,336 in the same period in fiscal 2016, an increase of 147 percent. Gross profit percentage was 45 percent was achieved in the fourth quarter of 2017, in line with 2016.

Fourth quarter expenses were $3,082,668 compared with $2,008,768 in the same period in fiscal 2016. The increase of 53 percent is primarily due to the expansion of retail operations from two to five stores.

Fourth quarter comprehensive loss was $2,553,196 compared with $1,781,197 in the same period in fiscal 2016. The $771,999 (43 percent) increase is due to variances in gross profit net of higher occupancy costs and depreciation from running five retail stores versus two, as well as additional manpower needs.

The company closed non-brokered private placements on December 4 and December 22, raising gross proceeds of $1,784,810 and $563,227 respectively.

Annual Summary

Revenue of $3,019,586 compared with $1,367,043 in fiscal 2016. Revenue increased by 121 percent, as it included sales from five stores versus two retail stores and growth in e-commerce sales. The Park Royal location in West Vancouver opened March 2017, the Queen St. West location in Toronto opened September 2017 and the Metrotown location in Burnaby opened November 2017.

Revenue in 2017 was adversely affected following a challenging period of approximately six months during which we experienced shortages in styles and sizes and sold out of bags due to popular demand. In 2017, we dedicated significant resources to produce innovative new products, place inventory deposits to fill gaps and restock core items. Deliveries of the 2017 buy plan began at the end of the second quarter of 2017 and are scheduled to continue into the second quarter of 2018.

Gross profit of $1,382,293 compared with $627,866 in fiscal 2016, an increase of 120 percent. Gross profit percentage of 46 percent in the year ended December 31, 2017 was in line with the comparative 2016 year.

Expenses of $10,590,853 compared with $7,976,992 in fiscal 2016. The increase of 33 percent is due to the increase in retail operations from two to five stores, investment in additional manpower and the development of our 2017 marketing strategy.

Comprehensive loss was $9,200,856 compared with $5,621,662 in fiscal 2016. The loss was 64 percent higher due to the 2016 recovery of the warrant derivative of $1,518,541, a non-cash item and the $208,923 gain on settlement of debt for two transactions that took place in 2016. Without these outliers, comprehensive loss during the year ended December 31, 2017 and 2016 would have been $9,208,560 and $7,349,126 respectively. The $1,859,434 (25 percent) increase is mostly due to the higher manpower and occupancy costs attached to running five versus two retail stores, net of the additional gross profit generated.

The company closed a short-form prospectus offering, raising gross proceeds of $3,734,441 on February 2, 2017; a non-brokered private placement, raising gross proceeds of $2,252,841 on June 22, 2017; a short form prospectus offering, raising gross proceeds of $3,737,500 on July 25, 2017; a non-brokered private placement, raising gross proceeds of $1,784,810 on December 4, 2017 and a non-brokered private placement, raising gross proceeds of $563,227 on December 22, 2017.

Photo courtesy RYU Apparel