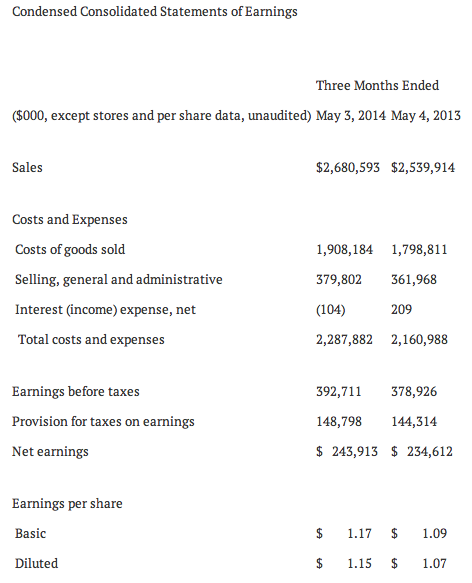

Ross Stores, Inc. reported earnings per share for the 13 weeks ended May 3, 2014 of $1.15, up from $1.07 for the 13 weeks ended May 4, 2013. These results represent a 7 percent increase on top of 15 percent and 26 percent gains in the first quarters of 2013 and 2012, respectively. Net earnings for the 2014 first quarter were $243.9 million, up from $234.6 million in the prior year.

First quarter 2014 sales increased 6 percent to $2.681 billion, up from $2.540 billion in the first quarter of 2013. Comparable store sales for the 13 weeks ended May 3, 2014 rose 1 percent on top of 3 percent and 9 percent gains in the first quarters of 2013 and 2012, respectively.

Michael Balmuth, Vice Chairman and Chief Executive Officer, commented, “First quarter earnings per share performed at the high end of our guidance as strict inventory and expense controls offset the impact from unfavorable weather and a more challenging retail environment. Sales trends improved in April with more seasonal Spring weather that coincided with the later Easter shopping period. Operating margin for the quarter was better than forecasted, declining 25 basis points to 14.6 percent. A 35 basis point increase in cost of goods sold was partially offset by a 10 basis point improvement in selling, general and administrative costs.”

Balmuth continued, “During the first three months of fiscal 2014, we repurchased 2.0 million shares of common stock for an aggregate price of $139 million. We expect to buy back a total of $550 million in common stock during fiscal 2014, which will complete the two-year $1.1 billion authorization approved by our Board of Directors in January 2013.”