Puma, which is undergoing a turnaround plan that includes reconnecting with its sports heritage, appears to have seen some stabilization on its top-line in the first quarter, with currency-neutral (c-n) sales slipping 0.5 percent versus a decline of 4.7 percent in the fourth quarter. Earnings sunk 25 percent but were in line with expectations.

Puma, which is undergoing a turnaround plan that includes reconnecting with its sports heritage, appears to have seen some stabilization on its top-line in the first quarter, with currency-neutral (c-n) sales slipping 0.5 percent versus a decline of 4.7 percent in the fourth quarter. Earnings sunk 25 percent but were in line with expectations.

Like many European businesses that rely on overseas sales in foreign currencies, Puma's net profitability is being squeezed by the relative strength of the euro. Continuing to describe 2014 as a “turnaround year” with significant investments in marketing and towards improving its turnaround-time, Puma officials reaffirmed its muted outlook for 2014. T

Those investments include its fresh signing of the NFL’s number one pick in the draft, Jadeveon Clowney, as well as its deal reached in January to become the official kit partner of Arsenal Football Club.

Revenues are expected to flat in 2014 with a modest increase in profits against a down 2013.

“During the quarter, we continued to make progress towards our mission to become the Fastest Sports Brand in the world and achieved all our key project milestones in this pursuit,” said Bjørn Gulden, CEO of Puma SE. “We know that the repositioning of Puma and the turnaround of the business will take time, but I am convinced that we are progressing well on all our key strategic priorities and that we have initiated the right projects to make 2014 the start of the turnaround.”

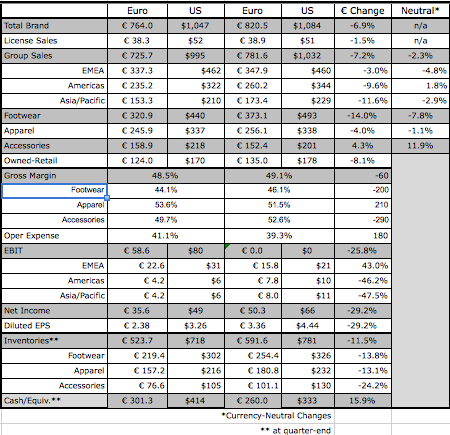

Group sales on a c-n basis declined 0.5 percent to €725.7 million ($995 mm). This represents a decrease in reported terms of 7.1 percent, as currency volatility in Russia, Turkey, North America, Latin America, India and Japan had a negative impact on sales in Euro terms.

Sales in the Americas declined 0.5 percent on a c-n basis to €235.2 million ($322 mm), which compares to a 3.5 percent drop in the fourth quarter. Sales in North America improved slightly, while mixed sales performances were seen within Latin America with improvements in Chile and Argentina and a major decline in Brazil.

Reported revenues were down 9.6 percent. EBIT in the Americas region tumbled 46.2 percent to €4.2 million ($6 mm).

In the EMEA region, sales inched up 0.3 percent on a c-n basis to €337.3 million ($462 mm), rebounding from a 7.6 percent drop in the fourth quarter. Russia, Turkey and the United Kingdom continued to deliver strong performances, which offset declines in Scandinavia and France, where wholesale revenues remained weak. Reported revenues in the EMEA region was off 7.2 percent to 725.7 million ($995 mm) EBIT jumped 43.0 percent to €22.6 million ($31 mm).

Asia/Pacific sales decreased 2.1 percent on a c-n basis to €153.3 million ($210 mm), demonstrating slight improvement over the 2.8 percent decline in the fourth quarter. Sales in China were up slightly, but business in Oceania decreased. Japan also declined, impacted by weaker sales in the Golf category.

Reported revenues in the Asia/Pacific region were off 11.6 percent to €153.3 million ($210 mm). EBIT in the region tumbled 47.5 percent to €4.2 million ($6 mm).

Among categories, Footwear sales declined 7.1 percent on a c-n basis to €320.9 million ($440 mm) as the Motorsport business continued to decline in mature markets. The Team sport category was, however, strengthened by the positive global reception of the new evoPOWER football boot during the quarter.

Apparel sales increase by 3.0 percent on a c-n basis to €245.9 million ($337 mm), boosted by the launch of Puma's football jerseys for its eight teams, including Italy, Chile and Ghana, ahead of the World Cup in June. Reported sales were down 4.0 percent.

Accessories expanded 9.5 percent on a c-n basis to €158.9 million ($218 mm) due to continued demand for Puma's socks and bodywear.

Retail sales were stable on a c-n basis at €124 million ($170.5 mm), with comps in full-price stores and outlets up while operating a slightly lower number of stores. Retails sales represented 17.1 percent of total sales compared to 17.3 percent last year.

Puma's gross profit margin declined 60 basis points from 49.1 percent due to negative currency impacts and changes in the regional and product mixes. Footwear gross margin declined from 46.1 percent to 44.1 percent, as high margin Motorsport Footwear in particular declined. Apparel increased from 51.5 percent to 53.6 percent related to strong Team sport business and Accessories decreased from 52.6 percent to 49.7 percent, impacted by negative currency effects.

Operating expenses declined 3.8 percent to €298.2 million ($409 mm) despite higher marketing investments. Due to the eroding currencies and the lower gross margins, operating profit slumped 25.3 percent to €58.6 million ($80 mm). The EBIT ratio decreased from 10.1 percent to 8.1 percent.

Consolidated net earnings declined 29.2 percent to €35.6 million ($49 mm).

Regarding its turnaround efforts, Gulden, who took over as CEO in July 2013, said Puma continues to invest in its supply chain and infrastructure to improve speed-to-market in its bid to make Puma “faster and more efficient.”

On May 2, its Puma Village development center in Vietnam officially closed. Developers have moved into the sample rooms of its suppliers' factories to speed up development process, while office employees moved into new offices in central Ho Chi Minh. The property sale of Puma Village is currently ongoing. Relocations of the Lifestyle Business Unit from London and of the Global and European Retail Organization from Oensingen, Switzerland, to its headquarters in Herzogenaurach are in process and will be finalized by the end of May and September, respectively.

Gulden said the company has “completed the definition of our brand platform and are now translating them into a marketing campaign,” with the biggest marketing campaign in its 66-year history being launched in August. The campaign will showcase Usain Bolt, Mario Balotelli, Rickie Fowler, Marta and Lexi Thompson and its other athletes “in their pursuit of our brand mantra Forever Faster.”

He added, “To improve our product engine, we have adapted our design language in accordance with our new brand platform,” added Gulden. “Torsten Hochstetter, our Global Creative Director, translated our brand mantra “Forever Faster” into a new distinctive design language for Puma, which takes its clear inspirations from our heritage and our roots in sports. With innovative products and a more commercial focus, we are convinced that we will have a strong product offering in place to excite the market in Spring/Summer 2015.”

As far as improving distribution Puma’s current focus is to reestablish the relationships with key accounts using dedicated product and marketing programs. An example is the Puma Lab at Foot Locker, with more than 100 doors in the US in place. Said Gulden, “We are satisfied with the results as our comparable sales are significantly up.

Puma is also currently adapting its direct-to-consumer channels to its new brand direction. A unified e-commerce site will be launched in the US, Europe and Russia by mid 2014 and a new retail format will launch with new full-price store opening in Dubai in the fourth quarter.

French luxury group Kering, which has gradually built up a 86 percent holding in Puma since first buying a stake in 2007, said last month that it would only return to the acquisition trail in sports and lifestyle once Puma had been turned around. Kering' Sports & Lifestyle segment includes Puma, Volcom, Electric, Tretorn and Cobra Golf. Its last acquisition was Volcom and Electric in May 2011.

“2014 will be a turnaround year for Puma, where the brand will be re-established in the market place and brought back to a path of profitable and sustainable growth in the mid-term,” concluded Gulden. “To support this turnaround, Puma will continue to invest strongly in marketing and sports assets, while maintaining tight control on other operating expenditures.”

For 2014, Puma’s expectations for the full year remain unchanged with revenues expected to be flat, gross margins expected to show a slight increase, operating expenses increasing due to marketing investments, EBIT projected to increase approximately 5 percent, and net earnings up 3 percent. Given the current currency volatility, it now expects a negative impact of around 50 basis points on the EBIT and net earnings margin for the full year.

When it announced fourth-quarter results in mid-February, it had anticipated an EBIT margin before special items of approximately 5 percent of net sales in 2014. Due to the special items booked in 2013, management expected a significant improvement in the net profit margin, which was expected to come in at approximately 3.0 of net sales, up from 0.2 percent in 2013.