Perry Ellis International, Inc. reported a loss of $42.9 million, or

$2.90 a share, in the fourth quarter, impacted by a tax valuation

allowance against the company's U.S. deferred tax assets. As warned, the

results were impacted by the West Coast ports congestion that also

contributed to a valuation reserve.

Key Fiscal 2015 Financial and Operational Highlights:

- Adjusted diluted EPS increased 47 percent to $0.56;

- GAAP

net loss of $2.50 per share includes costs associated with strategic

initiatives and a $42.7 million or $2.88 per diluted share non-cash

income tax valuation allowance against the company's U.S. deferred tax

assets. The allowance does not restrict the company's ability to utilize

the deferred tax assets in future years; - Revenues total $890

million as compared to $912 million in the prior year period reflecting

this strategic portfolio rationalization; - International revenues increased 15 percent representing 12 percent of total revenues up from 10 percent in fiscal 2014;

- Direct-to-Consumer revenues increased 13 percent representing 10 percent of total revenues, up from 9 percent in fiscal 2014;

- Licensing revenues increased 7 percent with 27 new licenses signed in fiscal 2015;

- Gross margin expanded 80 basis points to 34 percent;

- Cost savings generated were $12 million;

- company

expanded its credit facility from $125 to $200 million with plans to

redeem $100 million of its 7 7/8 percent senior subordinated notes.

Annual interest savings will approximate $6 million or $0.25 per share.

Oscar

Feldenkreis, President and Chief Operating Officer, commented, “During

the quarter and throughout the year, we took actions to support and

advance our core global brands, grow margins and generate cost

efficiencies. In fiscal 2015, we experienced stronger demand for our

products, resulting in improved performance at retail. Our international

business also performed well underscoring the global appeal of our

brands and supporting our margin expansion. As previously discussed, the

unexpected labor disputes at the West Coast ports significantly

disrupted our supply chain and our ability to deliver products to

customers in the fourth quarter. Moving into 2016, we are confident in

our forward path. Many of the external challenges of the prior year are

behind us and we are focused on meaningfully improving results and

operations by establishing momentum through the continued execution of

our growth and profitability plan.”

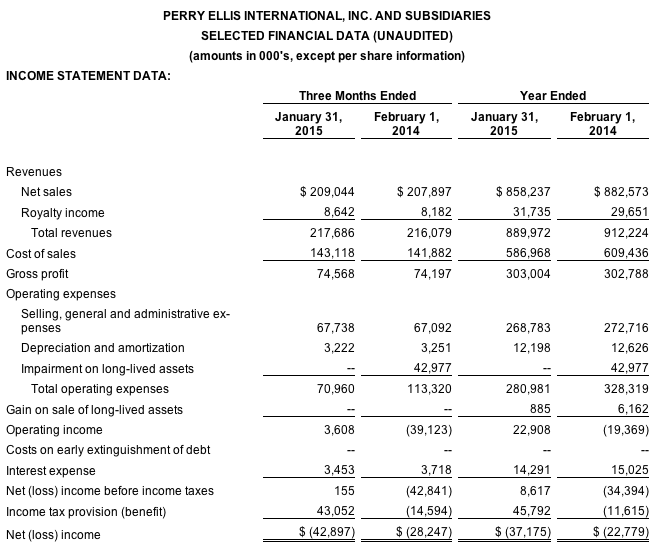

Fiscal 2015 Fourth Quarter Results

Total

revenue for the fourth quarter of fiscal 2015 was $218 million, a 1

percent increase compared to $216 million reported in the fourth quarter

of fiscal 2014. As previously disclosed, revenues were adversely

impacted by disruption at the West Coast ports. While the labor dispute

has been resolved, the company continues to anticipate an impact on

shipments throughout the first quarter due to the backlog of containers

at the port.

During the fourth quarter of fiscal 2015, overall

gross margins held at 34.3 percent. Margin expansion was generated in

our direct-to-consumer business, as well as in the Rafaella and Perry

Ellis collections businesses.

On an adjusted basis, the fiscal

2015 fourth quarter earnings per diluted share were $0.07 as compared to

adjusted earnings per diluted share of $0.06 in the fourth quarter of

fiscal 2014.

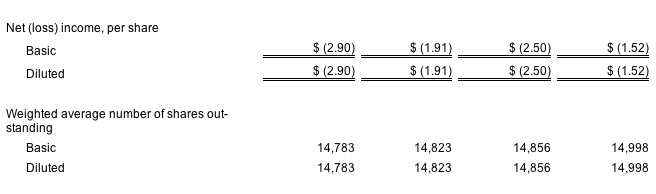

As reported under GAAP, the fiscal 2015 fourth

quarter loss was $42.9 million or $2.90 per share compared to a loss of

$28.2 million or $1.91 per share in the fourth quarter of fiscal 2014.

The company's fourth quarter 2015 results included a $42.7 million or

$2.89 per diluted share non-cash reserve associated with its deferred

tax assets. The financial results were impacted by the West Coast ports

congestion and contributed to a valuation reserve being required for the

company's domestic deferred tax assets. The position does not impact

the company's ability to use its deferred tax assets in the future. In

addition the company experienced $1.0 million or $0.05 per share in

negative foreign currency exchange, similar to many enterprises

operating a global business.

Fiscal 2015 Results

Fiscal 2015 revenues were $890 million as compared to $912 million reported in the prior year (“fiscal 2014”).

Adjusted

earnings per diluted share for fiscal 2015 were $0.56 compared to

adjusted earnings per diluted share of $.38 in fiscal 2014.

On a

GAAP basis, net loss for fiscal 2015 was $37.2 million, or $2.50 per

diluted share compared to GAAP net loss of $22.8 million, or $1.52 per

diluted share for fiscal 2014. Net loss for fiscal 2015 included $2.88

per diluted share in non-cash income tax valuation reserve as described

previously.

The gross margin for fiscal 2015 was 34.0 percent

compared to the gross margin of 33.2 percent in fiscal 2014. Gross

margin was positively impacted by a reduction in promotional activity in

the sportswear collection businesses, a more favorable revenue mix

between branded and private label revenues, as well as a stronger

contribution from the company's higher margin international and

licensing units. These margin improvements were partially offset by

liquidation of exited programs in golf and sportswear.

Selling,

general and administrative expenses totaled $268.8 million for fiscal

2015 as compared to $272.7 million in fiscal 2014. The decrease reflects

cost reductions associated with the company's infrastructure review

which were partially offset by investments in the company international

growth strategy as well as $1.8mm of unfavorable foreign exchange.

Earnings

before interest, taxes, depreciation, amortization and impairments, as

adjusted (“adjusted EBITDA”) for fiscal 2015 totaled $39.8 million, or

4.5 percent of total revenue. This compares to adjusted EBITDA of $34.8

million for fiscal 2014.

Balance Sheet

The

company's financial position continues to be very strong. Year-end cash

and investments totaled $63.5 million with no borrowings under the

credit facility. This compares to $42.4 million in the prior year and

$8.2 million drawn under the credit facility. The company has increased

its credit facility to $200 million and plans to redeem $100 million of

its senior subordinated notes. The annualized interest savings will

approximate $6 million or $.25 per diluted share.

Update on Strategic Priorities for Fiscal 2015 to Enhance Profitability

As

previously announced, the company continues to focus on specific

strategic priorities that it believes will deliver sustainable growth in

revenues and profits.

George Feldenkreis, Chairman and Chief

Executive Officer, Perry Ellis International, commented, “We have made

significant progress improving our core business and I am pleased with

our team's efforts to execute our growth and profitability plans. I am

confident that the actions we are taking combined with the global

strength of our operating brands, Perry Ellis, Original Penguin,

Rafaella and Golf lifestyle business, solidly position the company for

improved operational and financial performance.”

The company's focused strategy includes:

- Ongoing

strategic review of the company's portfolio of brands as it exits

underperforming, low growth brands and businesses. Since Fiscal 2014,

the company exited 30 brands which generated approximately $80 million

in revenues. Most recently the company announced the divestiture of its

C&C California brand. - Driving international and licensing

growth through direct investment in North America and Europe as well as

strategic partnerships with licensees and other partners. During fiscal

2015, the company signed 27 new licenses that extended eight of the

company's brands across geographies and product categories. The company

realized 15 percent revenue growth internationally, while also enhancing

the licensing division's earnings power. - Expanding the

Direct-to-Consumer channel. During fiscal 2015, the company focused on

enhancing profitability in its Direct-to-Consumer platform in order to

accelerate future growth. The company streamlined its internal team and

reporting processes to simplify the business and improve operating

performance. This initiative will continue to be a focal point for the

company in fiscal 2016. - Continuing to optimize its competitive

positioning in the menswear arena through the wholesale, retail and

licensing of its core brands. In fiscal 2015, the global reach of the

Perry Ellis and Original Penguin brands expanded both through direct and

licensed activities, which the company expects to continue in fiscal

2016. - Driving efficiencies and generating cost savings through

process enhancements, inventory management and sourcing improvements.

During fiscal 2015, the company executed $12 million in cost reductions

that reduced both the cost of goods and SG&A during the year. A

portion of these savings was reinvested into the company's international

platform to drive further growth. The company will continue executing

this review, as well as its supply chain focus in fiscal 2016.

Fiscal 2016 Guidance

The

company reiterated its guidance for fiscal 2016. It expects total

revenues to be in the range of $925 to $935 million. Gross margins for

fiscal 2016 are expected to expand 50 to 60 basis points to a range of

34.5 percent to 34.6 percent. The company expects adjusted EBITDA in the

range of $55 to $58 million and EBITDA margin of 6.0 percent to 6.25

percent. These projections translate to a range of $1.25 to $1.35 in

diluted earnings per share and do not include the impact of the

company's redemption of $100 million in senior subordinated notes.

Perry

Ellis International, Inc., through its wholly owned subsidiaries, owns a

portfolio of nationally and internationally recognized brands,

including: Perry Ellis, Jantzen, Laundry by Shelli Segal, Rafaella,

Cubavera, Ben Hogan, Savane, Original Penguin by Munsingwear, Grand

Slam, John Henry, Manhattan, Axist, and Farah. The company enhances its

roster of brands by licensing trademarks from third parties, including:

Nike and Jag for swimwear, and Callaway, PGA TOUR, and Jack Nicklaus for

golf apparel.