Both TJX Cos. and Ross Stores missed Wall Street’s expectations in the fourth quarter due to temporary store closures tied to upticks in COVID-19 cases. Both retailers also continue to be held back by a general weakness in the broader apparel category amid the pandemic.

Burlington Stores managed to top Wall Street’s targets as store traffic picked up with colder weather’s arrival despite the pandemic.

TJX Q4 Impacted By Store Closures In Canada And Europe

TJX’s sales totaled $10.94 billion, down 10.4 percent year-over-year. Wall Street’s consensus estimate had been $11.48 billion.

“We were very pleased that our U.S. stores were generally able to stay open; however, at certain times during the quarter, we had to temporarily close all our stores in Europe and a majority of our Canadian stores,” said Ernie Herrman, president and CEO, TJX, on an investor call with analysts. Europe was closed for almost two-thirds of the quarter and Canada for about one-third of the quarter.

Companywide, open-only comp sales were down 3 percent and exceeded plans. By concept, same-store sales at Marmaxx, including the U.S. operations of T.J. Maxx, Marshalls and Sierra Trading, were down 7 percent in the quarter. HomeGoods, also based in the U.S., grew same-store sales by 12 percent. Same-store sales at TJX Canada were down 4 percent, while TJX International (Europe & Australia) rose 2 percent.

“During the fourth quarter, we saw a continuation of strong sales trends in our home and beauty departments and great customer response to our holiday gift assortments and values,” said Herrman. “I am particularly pleased with the terrific assortment of brands we offered shoppers across all categories, which we believe was an important driver of our above plan sales. These comp sales also exceeded our plans across each of our divisions, including at HomeGoods which, once again, saw a double-digit increase.”

“While overall sales were down significantly due to the temporary closing of our stores for approximately 13 percent of the quarter, I want to emphasize that we are very encouraged by our fourth quarter overall open-only comp sales, which improved each month of the quarter and were positive in January,” added Herrman. “Despite operating during COVID-19 surges with the headwinds of uncertain consumer behavior, occupancy constraints and social distancing protocols, we only had a small decline in sales at our stores that were permitted to be open. It was great to see many of our best customers enthusiastically returned to our stores. We believe this speaks to the business’s resilience in the enduring appeal of our value proposition across all retail banners, regardless of the environment. All of this gives us great competence in our business over the long-term.”

Earnings in the fourth quarter fell 66.9 percent to $325.5 million, or 27 cents. Excluding debt extinguishment and tax adjustment charges, EPS came in at 50 cents per share, missing Wall Street’s consensus target of 61 cents.

Fourth-quarter merchandise margin was up year-over-year, driven by a strong mark on, and a benefit from, the timing of a shrink accrual. Higher freight costs and higher markdowns partially offset these benefits due to the store closures in Europe and Canada.

TJX estimated that the temporary store closures in Europe and Canada during the fourth quarter negatively impacted sales by approximately $950 million to $1.05 billion, resulting in a significant loss of profit dollars and about 18 cents to 21 cents. The earnings decline also reflects approximately $300 million of incremental expense related to COVID-19, including extra payroll to clean the store and monitor occupancy levels, payroll for some store associates kept on despite temporary store closures, and additional payroll for stores that were open longer hours. Supply chain costs increased due to a lower average ticket and processing more units as its merchandise mix continued to shift to non-apparel categories. Expenses also increased related to additional distribution capacity and wage increases at its distribution facilities.

Scott Goldenberg, CFO, stated, “As for inventory, our teams are doing a great job, procuring merchandise and adjusting logistics to get it to distribution facilities and stores. As a result, our store inventory position is close to where we want it to be. To reiterate, availability of merchandise in the marketplace is excellent.”

Ross Stores Hurt By Virus Surge In California

Ross Stores reported fourth-quarter results that missed Wall Street expectations as an upsurge of the virus resulted in lower-traffic, especially in California, its largest state. Earnings fell 47.8 percent to $238 million or 67 cents per share, down from $456.1 million, or $1.28, a year ago. Earnings were short of Wall Street’s consensus estimate of $1.00.

Sales were $4.2 billion, down 4.8 percent year-over-year. Sales were just below Wall Street’s consensus estimate of $4.27 billion.

Gross margins declined 125 basis points in the quarter. A merchandise margin gain of 70 basis points was more than offset by higher costs, including freight, which increased 100 basis points due to ongoing industrywide supply chain congestion. Buying costs were higher by 50 basis points. Occupancy delevered 30 basis points on the lower sales line. Lastly, distribution costs grew 15 basis points, primarily due to higher wages mostly offset by the favorable timing of packaway expenses.

On a conference call with analysts, Barbara Rentler, CEO, said results exceeded internal expectations, but the spike in COVID-19 cases led to more stringent occupancy and operating hour restrictions.

For the holiday selling season, the best-performing major merchandise area was home, while the Southeast and Midwest were the strongest regions. For the quarter, its largest states of California, Texas and Florida significantly underperformed the chain average.

At the close of the year, total consolidated inventories were down 18 percent versus the prior year, with packaway levels at 38 percent of the total compared to last year’s 46 percent. Average store inventories at year-end were down 16 percent from 2019 levels.

For the first quarter, Ross Stores projected comparable-store sales would decline 1 percent to 5 percent compared to the 13 weeks ended May 4, 2019. The sales guidance reflects the potential impact of lower demand during this year’s Easter selling season and ongoing supply chain congestion. EPS was projected to be in the range of 74 cents to 86 cents.

“Over the longer-term, we believe both Ross and dd’s are well-positioned in the off-price sector as consumers continue to favor retailers focused on delivering both value and convenience,” said Rentler. “This is especially true given the number of retail closures and bankruptcies over the past several years.”

In the Q&A session, Rentler said the home category strength in the quarter was “very broad-based” and benefited from its gift-giving appeal. In apparel, Ross saw “the continuation of casuals being very strong, whether it’s activewear or more casual just type products, whether it’s denim shirts.”

Rentler added that the second quarter is traditionally a better apparel quarter, and the company’s merchants can quickly adjust should the trend return in apparel’s favor. She said, “A lot of those classifications of business have availability. And so, we’re watching every week to see where the customer is going, and we’ll make the shift, just the way we made the shift the last time into more money as a Home and Casual and all of the businesses on the way into the fourth quarter.”

Burlington Stores Top Wall Street’s Targets

Burlington Stores reported earnings fell 24.2 percent in the fourth quarter to $155.9 million, or $2.33 a share, topping Wall Street’s consensus target of $2.12.

Revenue climbed 3.3 percent to $2.28 billion, ahead of Wall Street’s consensus target of $2.06 billion. Same-store sales were flat. Comps were down 10 percent in November, flat in December, and up positive 17 percent in January.

On a conference call, Michael O’Sullivan, CEO, said the weak trend in November was driven by unseasonably warm weather. He said, ‘Given the legacy of our brand and our particular strength in outerwear, our usually warm weather in the fall tends to hurt our traffic and sales more than most other retailers. This was the primary driver of the 10 percent comp-store sales decline for the month.”

Traffic improved in December as weather normalized, and O’Sullivan said Burlington was able to chase over $100 million of sales above its internal plan in December.

“We were particularly pleased with this improvement in the sales trend in December, given the external environment,” he said. “The resurgence in COVID-19 cases across the country meant that we faced lower occupancy limits in many stores and reduced operating hours in some of our major markets. We improved to a flat comp in December despite these limitations.”

The acceleration of gains in January was attributed to stimulus payouts.

Gross margin in Q4 was up approximately 40 basis points, despite a 70 basis point increase in freight expense. The 110 basis point increase in merchandise margin reflected lower markdowns. Said O’Sullivan, “Our receipts are fresher. We are turning faster, and we are capturing the margin benefits of these faster inventory terms. The buying environment in the fourth quarter was very favorable, and we were able to finance great merchandise values to flow to stores and to fuel our ahead-of-plan sales trend.”

At year-end, in-store inventory levels were down 16 percent on a comp-store basis, which reflects efforts to operate with leaner inventory levels as part of its Burlington 2.0 improvement plan. He said, “This is deliberate and consistent with our stated strategy of running our business with much leaner in-store inventory levels. Our in-store inventory turns increased 27 percent on a comparable basis for Q4, evidence that our strategy is working.”

Reserve inventory increased to 38 percent of total inventory at the end of the fourth quarter versus 33 percent last year.

Looking ahead, Burlington forecast a flat comp for 2021 compared to 2019. O’Sullivan added, “We intend to manage our business very flexibly. If our comp during 2021 is stronger than flat, then, as demonstrated in Q4, we can chase a stronger sales trend. And conversely, of course, we can pull back if that turns out to be necessary.”

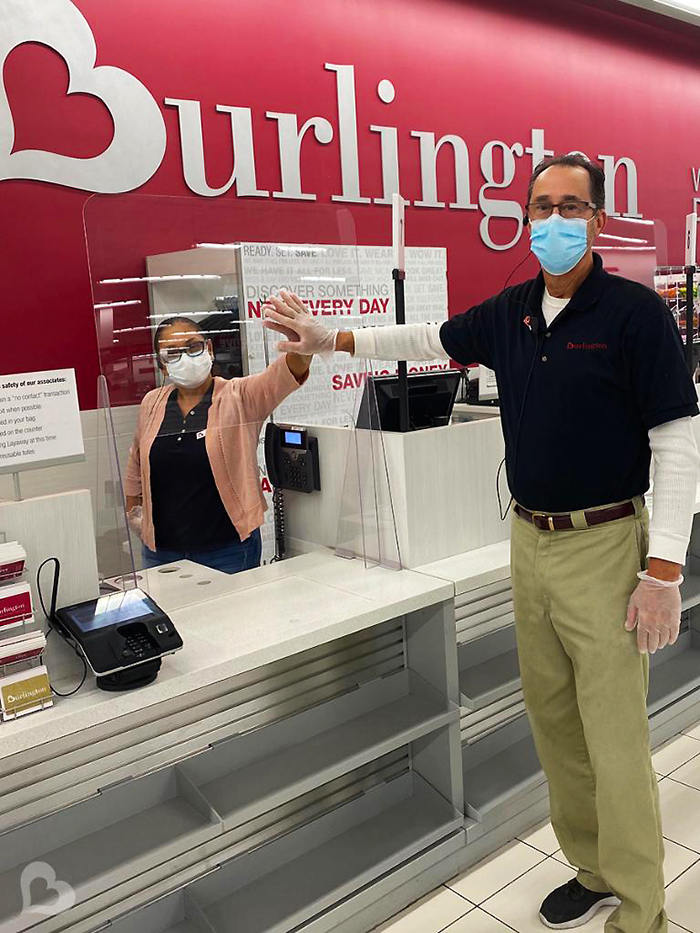

Photo courtesy TJX, Ross Stores, Burlington