Nike Inc. reported sales and earnings that topped Wall Street targets, driven by double-digit currency neutral growth in Western Europe, Greater China and the Emerging Markets. Sales in the North America region were up 3 percent.

Global consumer demand drove revenue growth across the Nike Brand portfolio. Diluted earnings per share were up 11 percent and grew faster than revenue, primarily due to selling and administrative expense leverage and a lower average share count.

“Nike’s ability to attack the opportunities that consistently drive growth over the near and long term is what sets us apart,” said Mark Parker, chairman, president and CEO, Nike Inc. “With industry-defining innovation platforms, highly anticipated signature basketball styles and more personalized retail experiences on the horizon, we are well-positioned to carry our momentum into the back half of the fiscal year and beyond.”

Second Quarter Income Statement Review

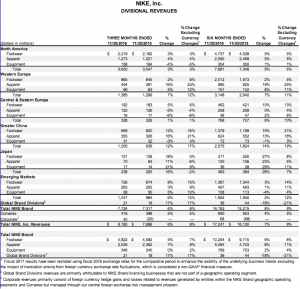

• Revenues for Nike Inc. increased 6 percent to $8.2 billion, up 8 percent on a currency neutral basis. Wall Street was forecasting $8.09 billion in revenue on average.

• Revenues for the Nike Brand were $7.7 billion, up 8 percent on a constant currency basis, driven by double-digit currency neutral growth in Western Europe, Greater China and the Emerging Markets as well as the Sportswear and Running categories.

• Revenues for Converse were $416 million, up 5 percent on a currency neutral basis, driven by strong growth in North America.

• Revenues for the Nike Brand were $7.7 billion, up 8 percent on a constant currency basis, driven by double-digit currency neutral growth in Western Europe, Greater China and the Emerging Markets as well as the Sportswear and Running categories.

• Revenues for Converse were $416 million, up 5 percent on a currency neutral basis, driven by strong growth in North America.

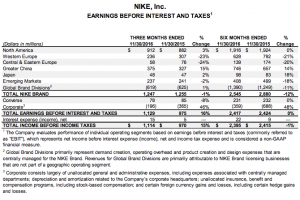

• Gross margin contracted 140 basis points to 44.2 percent, as higher average selling prices were more than offset by higher product costs, unfavorable changes in foreign exchange rates and the impact of higher off-price sales.

• Selling and administrative expense declined 2 percent to $2.5 billion. Demand creation expense was $762 million, relatively unchanged from the prior year. Operating overhead expense decreased 3 percent to $1.7 billion, as continued investments in Direct-to-Consumer (DTC) were offset by productivity gains compared to the prior year.

• Other income, net was $18 million, comprised primarily of non-operating items and, to a lesser extent, net foreign exchange gains. For the quarter, the company estimates the year-over-year change in foreign currency-related gains and losses included in other income, net, combined with the impact of changes in currency exchange rates on the translation of foreign currency-denominated profits, decreased pretax income by approximately $29 million.

• The effective tax rate was 24.4 percent, compared to 19.1 percent for the same period last year, primarily due to an increased mix of U.S. earnings, which are generally subject to a higher tax rate.

• Net income increased 7 percent to $842 million, while diluted earnings per share increased 11 percent to 50 cents, reflecting revenue growth, selling and administrative expense leverage and a 3 percent decline in the weighted average diluted common shares outstanding, partially offset by lower gross margin. Wall Street’s consensus estimate had been 43 cents.

November 30, 2016 Balance Sheet Review

• Inventories for Nike, Inc. were $5.0 billion, up 9 percent from November 30, 2015, due to a 1 percent increase in Nike Brand wholesale unit inventories and increases in average product costs per unit primarily due to product mix, as well as higher inventories associated with growth in DTC.

• Cash and short-term investments were $5.9 billion, $173 million lower than November 30, 2015, as growth in net income and proceeds from the issuance of debt in the second quarter of fiscal 2017 were more than offset by share repurchases, higher dividends, investments in infrastructure and a reduction in collateral received from counter-parties to foreign currency hedging instruments.

Share Repurchases

During the second quarter, Nike Inc. repurchased a total of 17 million shares for approximately $900 million as part of the four-year, $12 billion program approved by the Board of Directors in November 2015. As of November 30, 2016, a total of 56 million shares had been repurchased under this program for approximately $3.1 billion.

Lead photo and tables courtesy Nike