Mizuno Corp. reported revenues in the nine months ended December 31 declined 3.9 percent.

Revenues reached ¥122.7 billion ($1.12 bn).

By region, sales in Japan fell 5.0 percent to ¥83.0 billion ($756 mm) from ¥87.4 billion. Mizuno said sales decreased due to weak sales of sporting goods although outsourced facilities management business and facility materials sales keep growing.

In the Americas region, sales grew 8.6 percent to ¥15.2 billion ($138 mm) from ¥14.0 billion. Mizuno said sales in golf and running were strong in the Americas.

EMEA sales were up slightly to ¥11.4 billion ($109 mm) from ¥11.2 billion. Sales in golf and running were also strong in the EMEA.

In the Asia/Oceania region, sales slumped 12.7 percent to ¥13.1 billion ($119 mm) from ¥15.0 billion. Sales decreased as the retail business in China was turned to a licensed business.

Operating profit reached ¥4.4 billion ($41 mm), up 1.0 percent year-over-year. The performance was due to the reduction in expenses in Americas and China where business restructuring was done in previous years.

Ordinary profit was ¥4.5 billion ($41 mm), up 7.7 percent. The improvement was due to the increase in operating profits and lower interest expense resulting from the reduction of loans.

Net income reached ¥3.2 billion ($29 mm), up 11.3 percent. The gains were due to the increase of pre-tax income and extraordinary gains on the reform of the company’s retirement benefit plan.

Extrapolating six-month results from the nine months show sales in the three-month third quarter fell 8.8 percent to ¥37.2 billion ($339 mm) from ¥40.8 billion. In the Americas, sales grew slightly to ¥4.8 billion ($44 mm) from ¥4.7 billion.

Operating profits in the quarter came to ¥200 million ($1.8 mm), down from ¥900 million. Net profits came to ¥300 million ($2.7 mm) against ¥500 million.

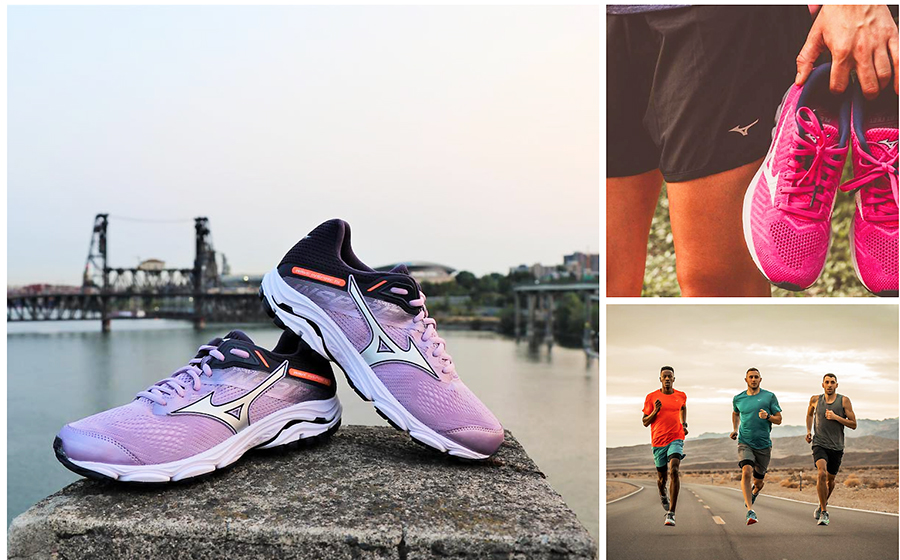

Photo courtesy Mizuno