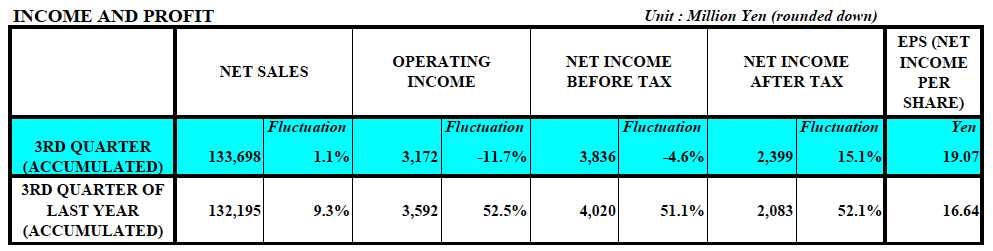

Mizuno Corp. reported net sales totaled ¥133.7 billion ($1.68 bn) in the first nine months ended Dec. 31, up 1.1 percent year-over-year. Strength in lifestyle products, centered largely on running offset “harsh conditions” in golf.

The gross margin improved by 40 basis points to 40.8 percent, but operating income declined 11.7 percent to 3.17 billion ($40 mm) due to an increase in expenses. Net income before taxes declined 4.6 percent to ¥3.8 billion ($48 mm). After-tax net income after tax was up 15.1 percent to ¥2.4 billion ($30 mm) as a result of a reduction in tax expense.

In Japan, sales were down 4.2 percent to ¥87.0 billion ($1.09 bn). Walking and running shoes “continued its solid performance” and swimming and soccer products also grew. Baseball and golf products fell in the mid- to high-priced range, particularly hurt by the impact of the consumption tax hike. Revenue fell in part due to the impact of the transfer of the agency business for the Asian region, which was conducted in Japan until last fiscal year, to two consolidated subsidiaries. Operating income in Japan was down 37.5 percent to ¥1.29 billion ($16 mm).

In Europe, sales were up 10.6 percent to ¥11.1 billion ($139 mm) and ahead 1.2 percent on a currency-neutral (c-n) basis. Operating earnings rose 149.4 percent to ¥449 million ($6 mm). Strength was seen in footwear in running and indoor sports.

In the Americas, revenues dipped 2.8 percent to ¥21.6 billion ($272 mm) and were down 9.8 percent c-n. Operating earnings declined 60.8 percent to ¥428 million ($5 mm). Running and golf “continued to face harsh conditions” while volleyball “remained solid.”

In the other Asia region, sales were up 54.4 percent to ¥13.97 billion ($175 mm) and gained 42.8 percent c-n. Operating profit reached ¥1.06 billion ($13 mm), a gain of 283.4 percent.

Mizuno didn’t change its outlook for the year. It expects revenues of ¥186.0 billion; operating income of ¥5.9 billion, and net income after tax of ¥3.4 billion. In the prior year, sales were ¥183.2 billion, operating profit was ¥5.7 billion and net income was ¥2.6 billion.