Lands’ End, Inc. reported fiscal 2024 fourth-quarter net revenue declined 14.2 percent to $441.7 million, compared to $514.9 million in the fourth quarter of fiscal 2023. The decrease in net revenue was reportedly driven by the transition of the kids’ and footwear product lines to licensing arrangements and optimizing promotional activity as the company focused on higher quality sales, resulting in higher gross margins and increased gross profit for the fourth quarter and full year of fiscal 2024 ended January 31, 2025.

Gross Merchandise Value (GMV) in Q4 decreased low-single digits compared to the fourth quarter of 2023. Excluding the 53rd week of fiscal 2023, GMV increased low-single digits. GMV is the total order value of all Lands’ End branded merchandise sold to customers through business-to-consumer and business-to-business channels and the retail value of the merchandise sold through third-party distribution channels.

“Lands’ End had a strong finish to a year defined by continued positive momentum across the business,” CEO Andrew McLean offered. “We increased gross profit dollars, expanded gross margins and grew GMV each quarter of fiscal 2024, excluding the 53rd week, resulting in a return to profitability for the full year. Through our amazing products, robust product franchises and our evolved marketing approach, it’s clear that our strategic evolution, including considerable growth from licensing, is driving strong progress and expanding the reach of our brand. Looking ahead, we are focused on further enhancing our digital business and operations, continuing to leverage our compelling asset-light licensing business, and growing our market-leading Outfitters business, all while delivering solutions that are ready for life’s every journey.”

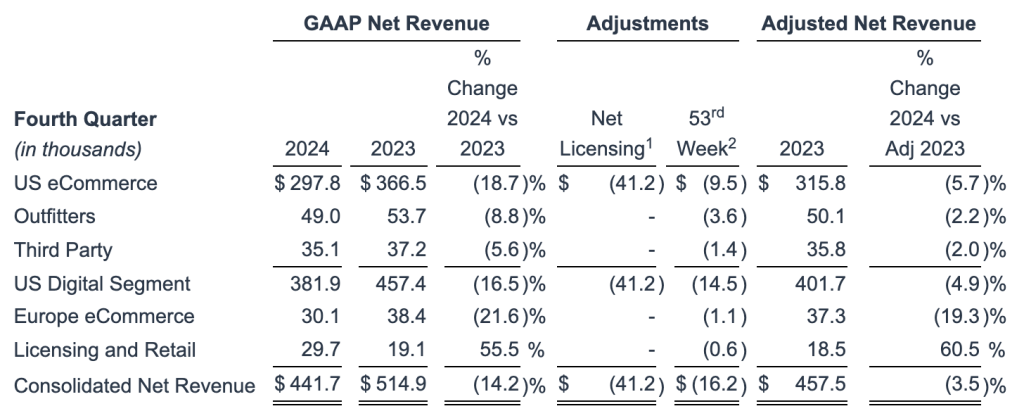

Net revenue by operating segment for the periods shown and the prior-year period as adjusted for the extra week in fiscal 2023 and the impact of the product line transition:

(1) Net impact of transitioning kids and footwear product lines to licensing arrangements. (2) Additional week of sales in fiscal 2023.

- Gross profit was $201.3 million in 2024, an increase of $5.9 million, or 3.0 percent, from $195.4 million in the fourth quarter of fiscal 2023. Gross margin increased approximately 760 basis points to 45.6 percent of net revenue, compared to 38.0 percent in fourth quarter of fiscal 2023. The gross margin improvement was primarily driven by lower promotional activity, leveraging the strength in product solutions and newness across the channels and improved inventory management.

- Selling and administrative expenses decreased $14.6 million to $158.0 million or 35.8 percent of net revenue, compared to $172.6 million or 33.5 percent of net revenue in fourth quarter of fiscal 2023. The approximately 230 basis-point increase was reportedly driven primarily by deleveraging from lower revenues.

- Net income was $18.5 million, or 59 cents per diluted share, in 2024, compared to a net loss of $8.6 million, or a 27 cents loss per diluted share, in the fourth quarter of fiscal 2023.

- Adjusted net income was $17.7 million, or 57 cents earnings per diluted share, in Q4, compared to Adjusted net income of $8.0 million, or 25 cents earnings per diluted share in the fourth quarter of fiscal 2023, representing a $9.7 million increase, or 32 cents per diluted share, in Q4 2023.

- Adjusted EBITDA was $43.7 million in the fourth quarter of fiscal 2024, compared to $31.7 million in the fourth quarter of fiscal 2023.

Full Year Financial Highlights

- For fiscal 2024, GMV increased low-single-digits compared to fiscal 2023. Excluding the 53rd week of fiscal 2023, GMV increased mid-single digits.

- For fiscal 2024, net revenue was $1.36 billion, a decrease of $109.6 million or 7.4 percent from $1.47 billion in fiscal 2023. The decrease in net revenue was driven by the transition of kids’ and footwear product lines to a licensing arrangement and the optimization of promotional activity as the company focused on sales, resulting in higher gross margins and increased gross profit.

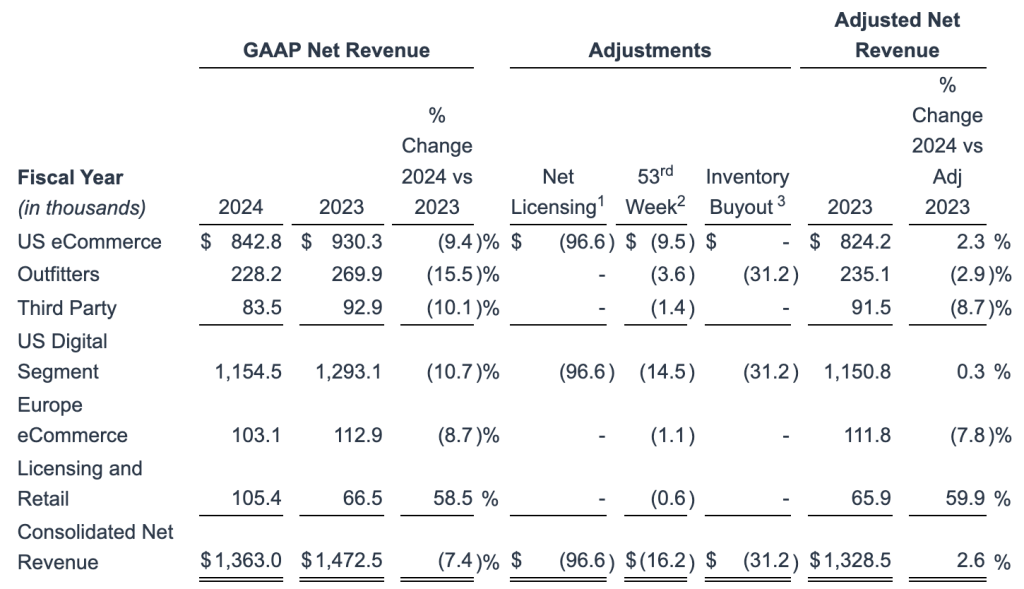

Net revenue by operating segment for the periods shown and the prior year as adjusted for the extra week in fiscal 2023, the impact of the product line transition and the effect of an inventory buyout by a corporate client at the end of its contract.

(1) Net impact of transitioning kids and footwear product lines to licensing arrangements. (2) Additional week of sales in fiscal 2023. (3) Inventory buyout by corporate client at the end of the contract in fiscal 2023.

- Gross profit was $653.3 million, an increase of $27.8 million, or 4.4 percent, from $625.5 million in fiscal 2023. Gross margin increased approximately 550 basis points to 47.9 percent of net revenue, compared to 42.5 percent in fiscal 2023, primarily driven by leveraging the strength in the swimwear, outerwear and newness in adjacent product categories across the channels, lower promotional activity, and improvements in both inventory management and supply chain costs for fiscal 2024 compared to fiscal 2023.

- Selling and administrative expenses increased $11.6 million to $561.8 million, or 41.2 percent of net revenue in 2024, compared to $550.2 million, or 37.4 percent of net revenue in 2023. The approximately 380 basis-point increase was reportedly driven by deleveraging from lower revenues, higher digital marketing spend focused on new customer acquisition and third party professional services.

- Net income was $6.2 million, or 20 cents per diluted share, compared to a net loss of $130.7 million, or a $4.09 loss per diluted share in fiscal 2023.

- Adjusted net income was $12.6 million, or 40 cents per diluted share, compared to an Adjusted net loss of $4.8 million, or 15 cents loss per diluted share, in fiscal 2023, representing an increase of $17.4 million, or 55 cents per diluted share.

- Adjusted EBITDA was $92.6 million in fiscal 2024 compared to $84.3 million in fiscal 2023.

Fiscal 2024 Business Highlights

- Delivered mid-single-digit growth in GMV, excluding the 53rd week in Fiscal 2023, primarily driven by the execution of the licensing strategy.

- Delivered an increase of 4.4 percent in gross profit and an approximately 550 basis point gross margin improvement with year-over-year increases in each quarter throughout Fiscal 2024.

- Achieved the eighth consecutive quarter of improvement in inventory with a year-over-year 12 percent reduction through improved flow and productivity.

- Global new customer acquisition increased by 5 percent, driven by enhanced digital marketing strategies.

Balance Sheet and Cash Flow Highlights

Cash and cash equivalents were $18.8 million at year-end, compared to $27.3 million as of February 2, 2024.

Net inventory was $265.1 million as of January 31, 2025, and $301.7 million as of February 2, 2024. The 12 percent decrease in inventory was driven by the company’s actions to improve inventory efficiency and capitalize on speed-to-market initiatives.

Net cash provided by operating activities was $53.1 million and $130.6 million for fiscal 2024 and fiscal 2023, respectively. The increase in net cash used was due to changes in working capital, primarily the reduction of cash used for inventories during fiscal 2023.

As of January 31, 2025, the company had no borrowings outstanding and $129.3 million of availability under its ABL Facility, compared to no borrowings and $167.2 million of availability as of February 2, 2024. Additionally, as of January 31, 2025, the company had $247.0 million of term loan debt outstanding compared to $260.0 million outstanding as of February 2, 2024.

During the fourth quarter of fiscal 2024, the company repurchased $2.7 million of its common stock under its share repurchase program announced on March 15, 2024. As of January 31, 2025. The company could purchase up to $13.5 million under the program through March 31, 2026.

“For the full year 2024, we delivered mid-single-digit growth in GMV excluding the 53rd week and Adjusted EBITDA growth of 10 percent year-over-year,” stated CFO Bernie McCracken. “We also achieved gross margin improvement of 550 basis points to 48 percent. Looking at 2025 and beyond, we are continuing to focus on generating improved cash flows, particularly from the prioritization of our licensing strategy and ongoing emphasis on more high-quality sales, which we expect will drive additional gross profit dollars and gross margin expansion over the long term.”

Outlook

For the first quarter of fiscal 2025, the company expects:

- Net revenue between $260.0 million and $290.0 million.

- Gross Merchandise Value to deliver flat-to-low single-digit percentage growth.

- Net loss between $9.0 million and $6.0 million and diluted loss per share between 29 cents and 19 cents.

- Adjusted net loss to be between $7.0 million and $4.0 million and Adjusted diluted loss per share to be between 22 cents and 13 cents.

- Adjusted EBITDA in the range of $9.0 million to $12.0 million.

For fiscal 2025 the company expects:

- Net revenue between $1.33 billion and $1.45 billion.

- Gross Merchandise Value to deliver mid-to-high single-digits percentage growth.

- Net income between $8.0 million and $20.0 million and diluted earnings per share between 25 cents and 64 cents.

- Adjusted net income to be between $15.0 million and $27.0 million, and Adjusted diluted earnings per share to be between 48 cents and 86 cents.

- Adjusted EBITDA in the range of $95.0 million to $107.0 million.

- Capital expenditures of approximately $30.0 million.

The company said its outlook incorporates the impact of already implemented global tariffs.

Image courtesy Lands’ End, Inc.