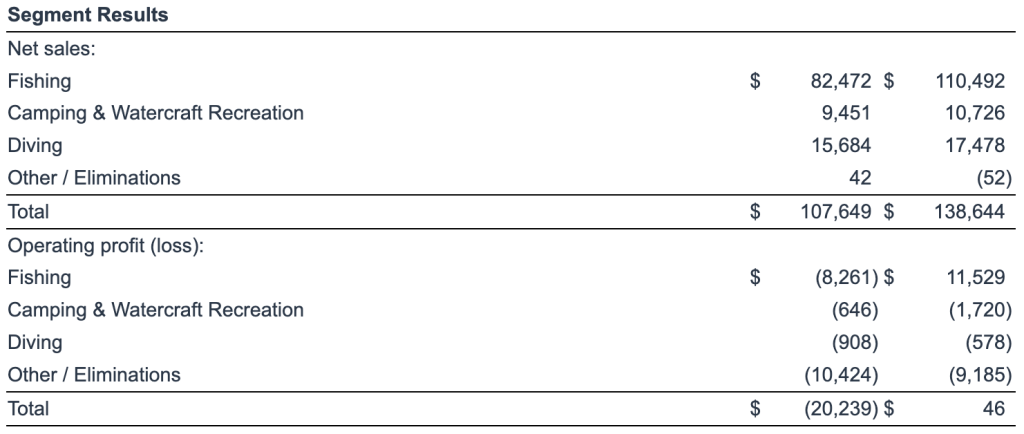

Johnson Outdoors Inc., parent of the Jetboil, Minn Kota, Humminbird, Old Town, and ScubaPro brands, among others, reported total company net sales in the first quarter declined 22 percent to $107.6 million in the first fiscal quarter ending December 27, 2024, compared to $138.6 million in the prior-year first Q1 period.

The company’s first fiscal quarter typically generates the lowest sales and profits due to the lead-up to the primary selling season.

- Fishing revenue decreased 25 percent to $82.5 million, reportedly due to a continued challenging market and competitive dynamics as well as a strong sell-in of new products in the prior year quarter.

- Camping & Watercraft Recreation sales were down 12 percent to $9.5 million, primarily due to general declines in consumer demand.

- Diving sales decreased 10 percent to $15.7 million, driven by softening market demand across all geographic regions.

First Quarter Segment Results

(in thousands)

“Ongoing market challenges, a cautious retail and trade channel environment, and competitive pressures resulted in lower first-quarter sales and profitability. We remain focused on our key strategic priorities and the changes necessary for future growth—investing in strong consumer-driven innovation, enhancing our go-to-market strategy, and improving operational efficiencies,” said Helen Johnson-Leipold, chairman and CEO of Johnson Outdoors, Inc.

Income Statement Summary

Gross margin was 29.9 percent of net sales in fiscal Q1, compared to 38.1 percent in the prior-year Q1 period. The 820 basis-point decline was due primarily to unfavorable overhead absorption and product mix, as well as increased promotional pricing.

Operating expenses of $52.4 million decreased $0.4 million from the prior-year Q1 period, reportedly due primarily to lower sales volumes between quarters and decreased expenses on the company’s deferred compensation plan, nearly offset by increases in consulting expenses and warranty expenses.

Total company operating loss was $20.2 million for the first fiscal quarter compared to operating profit of $0.05 million in the prior-year first quarter.

Loss before income taxes was $18.9 million in the first quarter, compared to profit before income taxes of $5.9 million in the prior-year first quarter. In addition to the decline in operating profit noted above, Other income also declined by approximately $4.4 million due primarily to a decline in earnings on the company’s deferred compensation plan, as well as a gain in the prior-year quarter of approximately $1.9 million related to the sale of a building.

The effective tax rate was 19.2 percent compared to 33.0 percent in the prior year first quarter.

Net loss was $15.3 million, or a loss of $1.49 per diluted share, compared to net income of $4.0 million, or 38 cents per diluted share in the prior-year first quarter.

Other Financial Information

- The company reported cash and short-term investments of $101.6 million as of December 27, 2024.

- Depreciation and amortization were $4.8 million in the three months ending December 27, 2024, compared to $5.0 million in the prior-year three-month period.

- Capital spending totaled $4.1 million in the current quarter compared with $5.0 million in the prior-year period.

In December 2024, the company’s Board of Directors approved a quarterly cash dividend to shareholders of record as of January 9, 2025, payable on January 23, 2025.

“Although we were disappointed in our operating results in what is historically our slowest quarter of the year, we were able to mitigate some of the profit losses through our cost savings initiatives, which we’ll expand this fiscal year, and we continued to make progress on managing our inventory levels,” said David W. Johnson, VP and CEO of Johnson Outdoors, Inc. “Our debt-free balance sheet provides a competitive advantage in today’s marketplace and we remain confident in our ability to create long-term value and pay dividends to shareholders.”

Image courtesy Jetboil/Johnson Outdoors Inc.