Sales of Minn Kota trolling motors, Eureka! tents, Jetboil camping stoves and Old Town fishing kayaks propelled sales growth of nearly 10 percent at Johnson Outdoors Inc. in the quarter ended Oct. 3.

Sales of Minn Kota trolling motors, Eureka! tents, Jetboil camping stoves and Old Town fishing kayaks propelled sales growth of nearly 10 percent at Johnson Outdoors Inc. in the quarter ended Oct. 3.

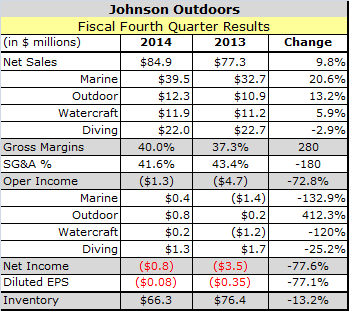

The Wisconsin company reported sales grew 9.8 percent to $84.9 million in the quarter ended Oct. 3, compared with $77.3 million in the corresponding quarter a year ago thanks primarily to double-digit growth at its Marine Electronics and Outdoor segments. All four of JOUT’s segments earned a profit in the quarter, including its long-struggling Watercraft and Diving segments.

The Marine Electronics segment continued to set the pace, posting sales growth of 20.6 percent. Minn Kota, which makes trolling motors and other boating accessories for fishermen, reported record sales for the full fiscal year. The segment turned a modest operating profit compared with a loss in fiscal 2013.

At the Outdoor segment, sales rose 13.2 percent and operating profits quadrupled thanks to strong performance by Jetboil and Eureka! and without any significant lift from military tent sales.

The Watercraft segment which makes canoes and kayaks under the Old Town, Perception and Ocean Kayaks brands as well as Carlisle paddles, turned an operating profit of $239,000 compared with a $1.2 million operating loss a year earlier. That pushed the segment into the black for fiscal 2014 a full year ahead of plan.

Chairman and CEO Helen Johnson-Leipold credited double-digit sales growth at Old Town to the continuing success of its Predator fishing kayak, which was launched in 2013 and the Minn Kota-powered Predator XL launched this year.

In the last two years, JOUT has consolidated canoe and kayak R&D, marketing, and production under one roof at its roto-molding facility in Old Town, ME in a bid to accelerate innovation and speed to market. The Watercraft segment has also exited unprofitable markets in Europe and moved to a local distributor model in Australia and New Zealand.

“We told you it would take time for our strategy to gain traction and it has,” Johnson-Leipold said of the restructuring efforts.”Rather than try and be all things to all consumers, we took a highly targeted approach directing our efforts towards the most profitable channels and fastest-growing segments, such as fishing kayaks.”

The lone laggard during the quarter was JOUT’s Dive segment, where sales dipped 2.9 percent and operating income dropped 25.2 percent against a backdrop of weak European demand and continuing turmoil in popular Mid East dive destinations. The segment owns the premium SCUBA Pro brand, but launched the Sub Gear brand at the beginning of the decade to reach a medium price point.

“With the market being as challenging as it is, we are just making sure to put the most focus and the most resources against our key brand, which is Scuba Pro,” said Johnson-Leipold. “Protecting, building, enhancing our core franchise is the number one priority that we have right now.”

JOUT lowered its quarterly operating loss to $1.3 million compared to $4.7 million in the fiscal fourth quarter of 2013. Net loss improved to $800,000, or -8 cents per diluted share, compared to a net loss of $3.5 million, or -35 cents per diluted share, in the fiscal fourth quarter of 2013.

The results marked a second consecutive quarter of strong growth, but were not enough to offset the negative impacts of the “Polar Vortex” that stifled sales of the company’s predominantly warm weather products during the first half of the fiscal year.

“We feel we almost lost a turn that we could not make up,” Johnson-Leipold said of the first two fiscal quarters of the year. “I think it had that kind of impact.”

As a result, sales for the full fiscal year came in flat at $425.4 million, while operating profit fell 34.8 percent to $16.7 million, due to one-time, non-cash charges taken in the second half and an effective tax rate of 46 percent, which is more than double the 22 percent rate for fiscal 2013. Excluding impairment charges, operating profits would have been $23.6 million.

“Bottom-line results mask the progress made to help ensure a better balance of profitability across our portfolio in the future, notably in Outdoor Gear and Watercraft,” said Johnson-Leipold, Chairman and Chief Executive Officer. “Our Marine Electronics business remains a formidable engine of profitable growth, while our work to strengthen performance in Diving continues.”

JOUT ended the fiscal year with it lowest debt in years and cash and cash equivalents of $70.8 million, an increase of $15.1 million from a year earlier. Cash, net of debt, was $63 million at year-end versus cash, net of debt, of $47.4 million on Sept. 27, 2013. Depreciation and amortization was $10.9 million year-to-date compared with $10.1 million in the prior year.

Johnson-Leipold said JOUT is now honing in on three areas as part of its strategic planning process: consumer insights, innovation process and digital commerce.

“We have to know our consumers almost better than they know themselves,” she said. “Who they really are, what makes them tick, and what will make their entire fishing, diving, camping, and watercraft recreation experience the best it can be, everything from shopping to the actual activity. More sophisticated market research capabilities will enable us to both connect with consumers in new more meaningful ways, and identify those richer, deeper insights that enable us to consistently deliver the best all-around outdoor recreational experience.”