Delta Apparel, Inc., which undertook a restructuring in the second quarter amid weakening demand for its Soffe shorts, T-shirt blanks and other cotton basics, reported net sales declined 6.2 percent in the fourth quarter.

Executives also said they anticipate cutting some unprofitable businesses in 2015.

We expect to take further action regarding our rationalization of certain product lines and sales channels,” said Delta Chairman Robert W. Humphreys, who took over as CEO in August to oversee a restructuring of the company. “Although we are not yet in position to provide detail regarding these initiatives under consideration, we believe these actions will provide additional positive impacts on our business in fiscal 2015 and beyond.

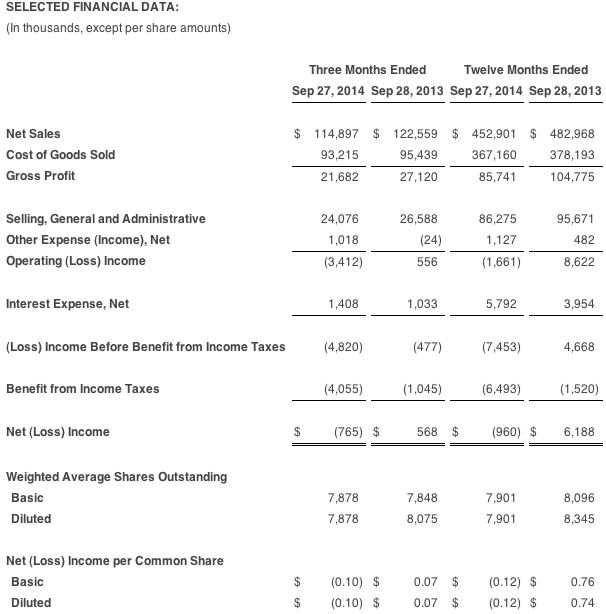

Fourth quarter sales were $114.9 million, compared with $122.6 million in the prior year September quarter. The companys adjusted net income for the fourth quarter of $1.7 million, or $0.22 per diluted share, was an improvement over its net income of $0.6 million, or $0.07 per diluted share, in the prior year period. Without adjustment for the impact of strategic initiatives, the company experienced a net loss for the fourth quarter of $0.8 million, or $0.10 per diluted share.

In the fourth quarter, Delta Apparel initiated a reorganization of its administrative structure at all levels to streamline decision-making and information flow as well as reduce duplicative and excess fixed costs. The company also began evaluating other initiatives focused on improving net profitability in response to prolonged sluggishness within the apparel markets and to better position the company as market conditions improve.

With minor exceptions, we have streamlined our administrative workforce and completed the planned reductions, effectively delayering the management structure across all business units,” said Humphreys. “We recorded $2.2 million of severance-related expenses associated with this initiative in the fourth quarter of fiscal 2014, and anticipate recognizing almost $6 million of the expected $7 million in annualized savings in fiscal year 2015.

We also began a comprehensive rationalization analysis of our manufacturing operations, product lines and sales channels intended to refocus our capital and other resources on the areas we believe are strategic to our business. We continue to maintain a sharp focus on lowering our product cost and improving our supply chain, while staying aligned with the needs of our customers. We have moved certain production into our lower cost facilities and anticipate further efforts of this nature as we progress through fiscal 2015. We are currently in the process of implementing new information systems that should further streamline our operations and better support our customer needs. During the fourth quarter, we recorded $1.8 million in expense associated with these initiatives.

Basics segment review

Fourth quarter net sales in the basics segment were $61.4 million versus $65.0 million in the prior year period, a 6 percent decrease. The company is reclassifying its Art Gun business to its basics segment to better reflect that businesss current operating characteristics and this change is included within our fiscal 2014 results.

The undecorated tee market appeared to strengthen in the September quarter and the companys undecorated tee sales were up slightly from the prior year period. That improvement was offset by declines in private label sales primarily driven from one private label customer that in the prior year had marked success at retail with a licensed product sourced from FunTees which did not repeat this year due to the license running its course and declining at retail. Sales to our core private label customers increased during the quarter, but the increase was not enough to offset the decline of this particular customer.

The company has recently gained new programs with existing customers and added programs with a major international brand, which are expected to drive sales growth in private label for fiscal year 2015. In addition, the company experienced strong growth providing customers with decorated, full-package programs on catalog blanks. These programs increased over 80 percent in fiscal 2014, adding incremental revenue and profits from the printing and packaging of blank tees. The company anticipates continued growth in these programs for fiscal year 2015. Art Gun, while up 23 percent for the year, experienced a sales decrease in the fiscal 2014 fourth quarter due to slowness of e-retailers business in advance of the holiday season, as well as temporary disruptions in production related to the installation of new equipment. Art Gun is now equipped with the latest digital printing technology, which should provide capacity to continue its growth in fiscal 2015.

Branded Segment Review

Net sales in the branded segment were $53.5 million for the fourth quarter, compared with $57.6 million in the prior year period, a 7 percent decline. Salt Life continued its strong sales growth, up 31 percent for the quarter and nearly 26 percent for the year, driven from its new product lines and an increase in retail door count. The soft retail environment and continued unsettled conditions within one of Junkfoods large retail customer groups were the primary drivers for a 16 percent sales decline in the Junkfood business for the fourth quarter compared to the prior year. Junkfood continues to grow in its other sales channels and we anticipate top-line growth and improved profitability for Junkfood in fiscal 2015. Soffe sales declined 15 percent in the 2014 fourth quarter from the prior year quarter, but Soffe has regained shelf space with important retailers and won additional military programs which should drive top-line growth in fiscal 2015.

Mr. Humphreys concluded, While we cannot be pleased with our financial results for fiscal 2014, we are already seeing benefits from the operational accomplishments completed during the year and the strategic initiatives we have implemented. Delta is now a leaner, more agile company with fewer layers of management. We have also reduced our manufacturing costs by consolidating certain domestic fabric production to a lower-cost platform offshore.

Soffe is being revitalized on several levels. During the year we were able to rebuild the Soffe leadership team with experienced apparel industry executives and we are optimistic that Soffe can begin to regain lost revenue and return to profitability as fiscal year 2015 unfolds. We are excited about our new Junkfood store in Venice, California. It is not only meeting our financial expectations but has attracted numerous key retailers who are able to witness the most effective ways to merchandise Junkfood products.

We believe our brands are gaining in consumer awareness through our branded retail outlets, in-store shops, eCommerce sites, and expanded consumer marketing initiatives. Likewise, we expect sales growth in our basics segment driven by our unique service and distribution models supported by a modern and efficient manufacturing platform. While we will continue to refrain from providing revenue and earnings guidance for the time being, we believe the initiatives we have implemented over the past months should position us well to improve our overall profitability and allow us to build market share in the current competitive environment.

Delta Apparel, Inc., along with its operating subsidiaries, M. J. Soffe, LLC, Junkfood Clothing Company, To The Game, LLC and Art Gun, LLC, is an international design, marketing, manufacturing, and sourcing company that features a diverse portfolio of lifestyle basic and branded activewear apparel and headwear. The company specializes in selling casual and athletic products across distribution tiers, including specialty stores, boutiques, department stores, mid-tier and mass chains, college bookstores and the U.S. military. The companys products are made available direct-to-consumer on its websites at www.soffe.com, www.junkfoodclothing.com, www.saltlife.com and www.deltaapparel.com. The Company’s operations are located throughout the United States, Honduras, El Salvador, and Mexico, and it employs approximately 6,800 people worldwide.