The Finish Line, Inc., while embroiled in a dispute  with Genesco, Inc. over its planned acquisition of the GCO business, may have hinted at some non-financial reasons why the deal may not make as much sense as it first did when announced this past spring. While comparable store sales and net income both declined for the second quarter ended September 1, the retailer pointed to a number of internal and macro trends that may improve the short- and long-term prospects of the business.

with Genesco, Inc. over its planned acquisition of the GCO business, may have hinted at some non-financial reasons why the deal may not make as much sense as it first did when announced this past spring. While comparable store sales and net income both declined for the second quarter ended September 1, the retailer pointed to a number of internal and macro trends that may improve the short- and long-term prospects of the business.

During a quarterly conference call with analysts on Friday, Alan Cohen, chairman and CEO of The Finish Line, Inc., suggested that they are starting to see a change in the attitude of the consumer in the mall that may favor the Finish Line format. That consumer shift may reflect a move back to performance athletic footwear and away from the strength of the low-profile business that has haunted the mall specialty retailers for the last year or two, depending on region. If that assessment is correct, then there may be one other reason why the jewel in the Genesco crown, Journeys, may not be as attractive as it once was.

When the Genesco deal was first announced, FINL looked at the acquisition as an opportunity to diversify its footprint and broaden its appeal in the mall. Many analysts saw the move as an avenue to tap into the stronger consumer trends that favor retailers capable of capitalizing on the trend to lifestyle fashion athletic footwear, including the sharp gains seen in low-profile silhouettes, as well as the trends to Crocs, sandals, and Heelys. Journeys has been the focal point in the mall for all of those trends.

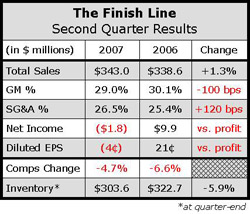

While FINL posted a net loss of $1.8 million, or 4 cents per diluted share, for the second quarter, the loss includes a pre-tax charge of $13.0 million, or 17 cents per diluted share, related to the closure of 15 Paiva stores. Gross profit margins were down for the period, but much of the decrease was due to inventory write-downs at Man Alive and Paiva.

Overall product margins were down 10 basis points in Q2, but product margins at Finish Line stores were up 60 basis points for the period.

On a per square foot basis, consolidated inventories decreased 11%, and Finish Line store merchandise inventories decreased 8% compared to the same time last year.

Total company comparable store net sales decreased 4.7%, with comps at the namesake concept, Finish Line, decreasing 4.8% and Man Alive comps decreasing 2.4% versus Q2 last year. As seen with other retailers, July sales were negatively affected by a shift in sales tax holidays from July to August, as well as some states going to back to school later.

Finish Line comp store footwear sales decreased  2.8% on top of a 5.1% comp decrease in the year-ago period. Softgoods comps decreased 15.5% for the quarter on top of a 13.9% decline last year. Finish Line posted a double-digit decline in the women's footwear category, a low-single-digit decline in the men's business, and a mid-single-digit increase in the kids business. They said they continued to see strong demand for premium products, such as Jordan and Shox running in men's, and also posted growth in the men's and women's technical running category and the men's sport casual category.

2.8% on top of a 5.1% comp decrease in the year-ago period. Softgoods comps decreased 15.5% for the quarter on top of a 13.9% decline last year. Finish Line posted a double-digit decline in the women's footwear category, a low-single-digit decline in the men's business, and a mid-single-digit increase in the kids business. They said they continued to see strong demand for premium products, such as Jordan and Shox running in men's, and also posted growth in the men's and women's technical running category and the men's sport casual category.

Contributing to the overall weakness in footwear was a decline in the average selling price of 5.1% for the quarter. Excluding the effect of sandal sales, average selling prices declined 1.2% for the quarter.

Finish Line did see positive momentum in a new Under Armour program and in NCAA licensed product. UA will be in over 400 doors by Holiday. They also tested the cleated footwear this summer and said they saw a “tremendous amount of success” with the program. Mr. Cohen said they will “certainly” participate in the Under Armour cross-training launch next spring.

Mr. Cohen said they are starting to see a “drift away” from the low-profile silhouette in the mens business and back to a “traditional athletic profile.” He indicated that the womens business may be seeing a similar trend, with a particular focus on running, but it is not as pronounced as the mens shift.

The direct-to-consumer sales through the FinishLine.com website and catalog saw double-digit growth for the quarter and year-to-date. Management said they continue to invest in the direct business to support additional growth.

Looking ahead to the third quarter, comps for the month-to-date period in September are up in the low-single-digits as they move “aggressively” to move slower moving product.