Iconix Brand Group reported fourth-quarter revenues rose 6.8 percent to $112.4 million and rose 7 percent in the year.

Full Year 2014 Results for Iconix Brand Group, Inc.:

Total revenue for the full year 2014 was approximately $461.2 million, a 7 percent increase as compared to approximately $432.6 million for the prior year. Licensing revenue for 2014 was approximately $406.9 million, a 2 percent increase as compared to approximately $398.0 million in the prior year. Other revenue for 2014 was approximately $54.3 million, a 57 percent increase as compared to approximately $34.6 million in the prior year.

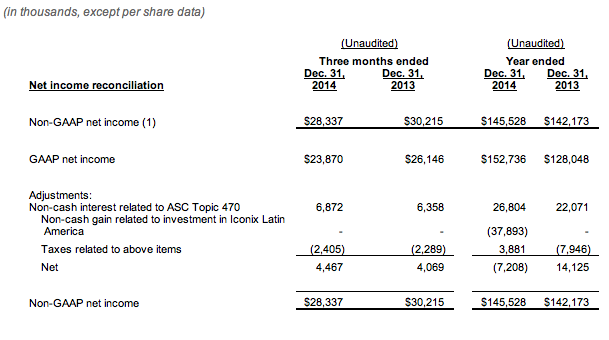

On a non-GAAP basis, as defined in the tables below, net income attributable to Iconix for 2014 was approximately $145.5 million, a 2 percent increase as compared to approximately $142.2 million in the prior year, and non-GAAP diluted earnings per share was approximately $2.78 for 2014, a 16 percent increase versus $2.39 for the prior year. GAAP net income attributable to Iconix for 2014 was approximately $152.7 million, a 19 percent increase as compared to $128.0 million in the prior year, and GAAP diluted EPS for 2014 increased 26 percent to $2.66 as compared to $2.11 in the prior year. EBITDA attributable to Iconix for 2014 was approximately $263.8 million, as compared to approximately $262.9 million in the prior year. Free cash flow attributable to Iconix, as redefined in the tables below, was approximately $174.3 million for 2014, a 26 percent decrease as compared to approximately $235.5 million in the prior year. In connection with the formation of joint ventures and sale of certain trademarks the Company generated approximately $51.2 million of notes receivable in 2014 as compared to approximately $15.8 million in 2013.

Q4 2014 Results for Iconix Brand Group, Inc.:

Total revenue for the fourth quarter of 2014 was approximately $112.4 million, a 7 percent increase as compared to approximately $105.3 million in the fourth quarter of 2013. Licensing revenue increased 16 percent to approximately $102.2 million as compared to approximately $88.3 million in the prior year quarter. Other revenue was $10.3 million in the fourth quarter compared to $17.0 million in the prior year quarter.

On a non-GAAP basis, as described in the tables below, net income attributable to Iconix was $28.3 million, a 6 percent decrease as compared to the prior year quarter of approximately $30.2 million. Non-GAAP diluted EPS for the fourth quarter of 2014 increased 4 percent to $0.56 as compared to $0.54 in the prior year quarter.

GAAP net income attributable to Iconix for the fourth quarter of 2014 was approximately $23.9 million, a 9 percent decrease as compared to $26.1 million in the prior year quarter, and GAAP diluted EPS for the fourth quarter of 2014 was 44 cents a share, as compared to 44 cents in the prior year quarter. EBITDA attributable to Iconix for the fourth quarter was approximately $50.4 million, a 16 percent decrease as compared to approximately $60.1 million in the prior year quarter. Free cash flow attributable to Iconix, as redefined in the tables below, for the fourth quarter was approximately $46.3 million, a 19 percent decrease as compared to the prior year quarter of approximately $57.4 million.

EBITDA, free cash flow, non-GAAP net income and non-GAAP diluted EPS are all non-GAAP metrics. Definitions along with reconciliation tables for, each are attached to this press release.

Neil Cole, Chairman and CEO of Iconix Brand Group, Inc. commented, “We are pleased with our performance in 2014 and are enthusiastic about our growing global brand management platform, which today includes a diversified portfolio of over 35 brands across women's, men's, home and entertainment. In 2015, we expect to achieve strong top and bottom line growth driven by steady expansion in our domestic licensing business, rapid growth in our international business both inside our joint ventures and across the territories that we control, the excitement surrounding our upcoming Peanuts movie and the benefits of our recently announced Strawberry Shortcake and PONY transactions.”

2015 Guidance for Iconix Brand Group, Inc.:

- Raising 2015 revenue guidance to $490-$510 million from $485-$500 million

- Raising 2015 non-GAAP diluted EPS guidance to $3.00-$3.15 from $2.90-$3.10

- Raising 2015 GAAP diluted EPS guidance to $3.06-$3.20 from $2.82-$3.00

- Establishing new 2015 free cash flow calculation and guidance of $208-$218 million

- This guidance relates to the Company's existing portfolio of brands, and includes the Company's recently announced PONY and Strawberry Shortcake transactions, but does not include any additional acquisitions.

See reconciliation tables below for non-GAAP metrics. Please note that, for comparative purposes, the definition of free cash flow has been updated. Please see the free cash flow reconciliation table and accompanying discussion below regarding this change. These non-GAAP metrics may be inconsistent with similar measures presented by other companies and should only be used in conjunction with our results reported according to U.S. GAAP. Any financial measure other than those prepared in accordance with U.S. GAAP should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP.

Iconix Brand Group, Inc. owns, licenses and markets a growing portfolio of consumer brands including: Candie's, Bongo, Badgley Mischka, Joe Boxer, Rampage, Mudd, Mossimo, London Fog, Ocean Pacific, Danskin, Rocawear, Cannon, Royal Velvet, Fieldcrest, Charisma, Starter, Waverly, Zoo York, Sharper Image, Umbro, Lee Cooper, Ecko Unltd. and Marc Ecko . In addition, Iconix owns interests in the Artful Dodger, Material Girl, Peanuts, Ed Hardy, Truth Or Dare, Billionaire Boys Club, Ice Cream, Modern Amusement, Buffalo, Nick Graham and Pony brands.

![]()