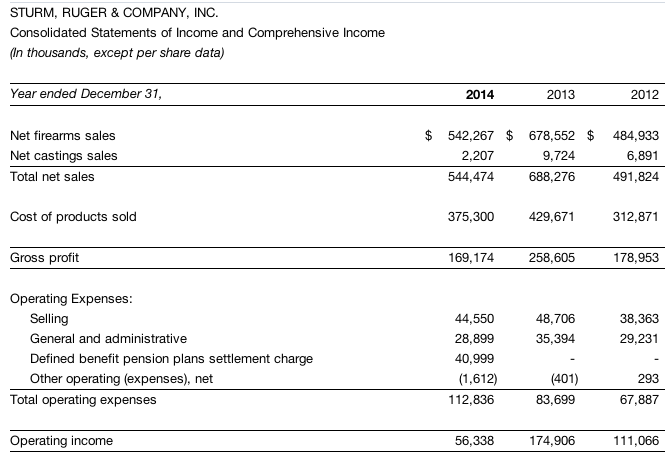

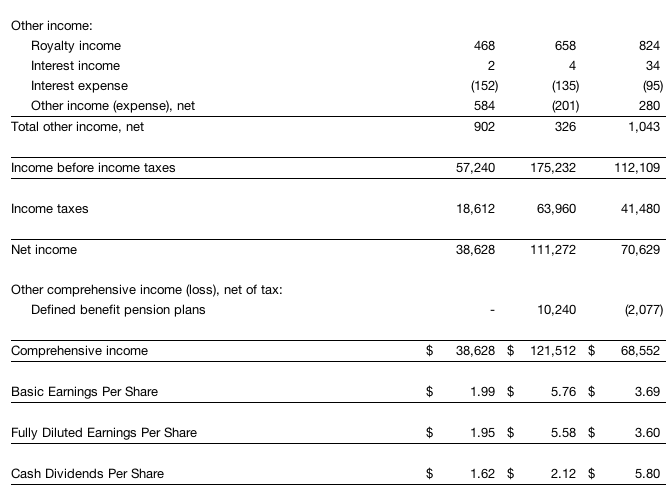

Sturm, Ruger & Company, Inc. reported a steep loss in the fourth quarter due to a charge related to its previously-disclosed plan to terminate its frozen defined benefit pension plans. Revenues declined 32.6 percent.

For the fourth quarter 2014, net sales were $122.6 million and the

company realized a fully diluted loss of 77 cents a share. For the

corresponding period in 2013, net sales were $181.9 million and fully

diluted earnings were $1.33 per share.

In the fourth quarter of

2014, the company recorded an expense of $41.0 million related to the

termination and settlement of its defined benefit pension plans.

Excluding this expense, 2014 net income was $64.0 million or $3.22 per

share, and fourth quarter 2014 net income was $10.5 million or 53 cents per

share. The cash requirement for the termination and settlement of the

defined benefit pension plans was $7.5 million.

For 2014, net sales of $544.5 million and fully diluted earnings of $1.95 per share, compared with net sales of $688.3 million and fully diluted earnings of $5.58 per share in 2013.

The company also announced that its Board of Directors declared a dividend of 17¢ per share for the fourth quarter for shareholders of record as of March 13, 2015, payable on March 27, 2015. This dividend varies every quarter because the company pays a percent of earnings rather than a fixed amount per share. This dividend is approximately 40 percent of net income. The pension plan termination expense was excluded when calculating this dividend.

Chief Executive Officer Michael O. Fifer made the following observations related to the company’s 2014 performance:

The strong demand experienced in 2013 remained through the first quarter of 2014 and much of the second quarter of 2014. However, during the latter half of 2014 demand for our products declined significantly, as a result of the following:

- the reduction in overall consumer demand,

- high inventory levels at retail, which encouraged retailers to buy fewer firearms than they were selling, in an effort to reduce their inventories and generate cash,

- aggressive price discounting by many of our competitors, and

- the lack of significant new product introductions from the company.

In 2014, sales to the independent distributors and the estimated sell-through of the company’s products from the independent distributors to retailers decreased 21 percent and 20 percent, respectively, from 2013. The National Instant Criminal Background Check System (“NICS”) background checks (as adjusted by the National Shooting Sports Foundation) decreased 12 percent in 2014 from 2013.

Demand for higher-margin firearms accessories, especially magazines, which was very strong in 2013, softened in the first half of 2014 and then decreased significantly in the latter half of 2014.

Excluding the expense related to the termination of our defined benefit pension plans, in 2014 earnings decreased 42 percent and EBITDA decreased 36 percent from 2013. The main drivers of the reduced operating margins were:

reduced sales of firearms and firearms accessories, the de-leveraging of fixed costs, including depreciation, indirect labor, engineering, and product development costs, approximately $7 million of increased depreciation expense due to the reduction in the estimated useful lives of the company’s capital assets, and approximately $8 million of increased depreciation expense due to the $151 million of capital equipment purchases as the company increased firearm sales from $144 million in 2007 to $679 million in 2013.

New product introductions in 2014 included the AR-556 modern sporting rifle and the LC9s pistol. New products represented $89.4 million or 16 percent of firearm sales in 2014, compared to $195.8 million or 29 percent of firearms sales in 2013. New product sales include only major new products that were introduced in the past two years.

Cash generated from operations during 2014 was $55.6 million. At December 31, 2014, our cash totaled $9 million. Our current ratio is 2.0 to 1 and we have no debt.

In 2014, capital expenditures totaled $45.6 million, a decrease from $54.6 million in 2013. We expect our 2015 capital expenditures to total approximately $30 million.

In 2014, the company returned $55.4 million to its shareholders through:

- the payment of $31.4 million of dividends, and

- the repurchase of 680,813 shares of our common stock in the open market at an average price of $35.22 per share, for a total of $24.0 million.

At December 31, 2014, stockholders’ equity was $185.5 million, which equates to a book value of $9.90 per share.