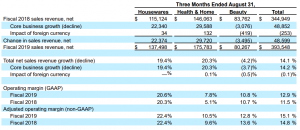

Helen of Troy reported sales in the company’s Housewares segment, which includes OXO and Hydro Flask, increased 19.4 percent in the second quarter ended August 31, to $137.5 million. The company significantly increased outlook for Houseware’s growth for the year.

The gains were due to point of sale growth with existing domestic customers, higher sales in the club channel, an increase in online sales, new product introductions and an increase in certain customer inventory levels compared to the prior year. These factors were partially offset by lower international sales.

GAAP operating margin in the Housewares segment was 20.6 percent compared to 20.3 percent. The 0.3 percentage point increase in operating margin was primarily due to the favorable comparative impact of a $1.0 million charge related to the bankruptcy of Toys R’ Us for the same period last year, a higher mix of Hydro Flask sales, improved distribution and logistics efficiency and the favorable impact of increased operating leverage from net sales growth. These factors were partially offset by less favorable channel mix, higher personnel costs and higher share-based compensation expense related to long-term incentive plans.

Housewares segment adjusted operating income increased 19.7 percent to $30.8 million, or 22.4 percent of segment net sales, compared to $25.8 million, or 22.4 percent of segment net sales.

Companywide, consolidated net sales revenue increased 14.1 percent to $393.5 million. Wall Street’s consensus estimate had been $349.19 million.

The gains were primarily due to an increase in brick and mortar sales in the company’s Housewares and Health & Home segments, growth in online sales and growth in international sales. These factors were partially offset by lower brick and mortar sales and the rationalization of certain brands and products in its Beauty segment and the unfavorable impact from foreign currency fluctuations of approximately $0.3 million, or 0.1 percent.

Net sales from Leadership Brands increased 20.5 percent to $319.0 million compared to $264.9 million. Leadership Brands consists of revenue from the OXO, Honeywell, Braun, PUR, Hydro Flask, Vicks and Hot Tools.

Income from continuing operations improved 27.2 percent to $44.0 million, or $1.66 per share, ahead of Wall Street’s consensus estimate of $1.60.

Fiscal 2019 Annual Outlook

For fiscal 2019, the company is increasing its outlook for consolidated net sales revenue to be in the range of $1.535 to $1.560 billion, which implies consolidated sales growth of 3.8 percent to 5.5 percent. Previously, the range was $1.485 to $1.510 billion which implied consolidated sales growth of 0.4 percent to 2.1 percent

The company’s updated sales outlook reflects the following expectations by segment:

- Housewares net sales growth of 9 percent to 11 percent;

- Health & Home net sales growth of 5 percent to 7 percent, including an unfavorable impact of approximately 2.3 percent from the average cough/cold/flu season assumption;

- Beauty net sales decline in the low- to mid-single digits.

The company previously expected Housewares net sales growth in the mid-single digits, Health & Home net sales growth in the low-single digits with an unfavorable impact of approximately 2.5 percent from the average cough/cold/flu season assumption and Beauty net sales decline in the low- to mid-single digits.

The company is also increasing its EPS outlook, now expecting consolidated GAAP diluted EPS from continuing operations of $6.31 to $6.46 and non-GAAP adjusted diluted EPS from continuing operations in the range of $7.65 to $7.90. Previously, consolidated GAAP diluted EPS from continuing operations was expected in the range of $6.27 to $6.42 and non-GAAP adjusted diluted EPS from continuing operations in the range of $7.45 to $7.70.

Photo courtesy Hydro Flask