Hibbett Sports Inc. reported fourth-quarter earnings increased 18.1 percent to $19.9 million, or 79 cents a share, handily exceeding Wall Street's consensus estimate of 68 cents a share.

Hibbett Sports Inc. reported fourth-quarter earnings increased 18.1 percent to $19.9 million, or 79 cents a share, handily exceeding Wall Street's consensus estimate of 68 cents a share.

Sales increased 9.9 percent, to $239.3 million. Comparable store sales increased 5.4 percent on top of a 1.7 percent gain last year. Traffic was slightly positive in the quarter with higher average selling prices the bigger contributor to the comp gain. Comps grew 8.9 percent in November, 1.4 percent in December and 11.3 percent in January.

“We experienced good comps during the holiday period on top of good comps last year and our product assortment resonated well with our customers for January and February,” said Jeff Rosenthal, president and CEO, on a conference call with analysts. “We experienced a shift compared to last year in terms of weather impacts and tax refunds. The weather impact shifted to February this year and the tax refunds were issued earlier this year which favored January.”

Quarter-to-date comps are down mid-single-digits due to the shift in tax refunds, West Coast port delays and store closings due to weather. He added, “However, we are very excited about the rest of the year.”

Jared Briskin, SVP of merchandising, said Hibbett’s branded apparel achieved a low-single-digit increase for the quarter. Men's apparel was up mid-single-digits, boosted by athletic fleece bottoms. Women's saw flat comps as strong gains in tights and fitness apparel were offset by declines in outerwear. Kids apparel was up low-single-digits, also driven by the strong athletic bottom trend.

Accessories was up mid-single-digits, helped by investments in cold-weather items.

Footwear was up high-single-digits. Men’s was up high-single-digits, women's down mid-single-digits, and kids up low teens.

“Our traditional running business continued to be outperformed by the lifestyle category and basketball offerings as both of those categories drove double-digit growth,” said Briskin. “Running across all categories grew high-single-digits. Under Armour, Nike Signature and the continued strength of our Jordan business drove the basketball category. Running inspired silhouettes as well as iconic models drove the lifestyle category.”

Licensed apparel was flat for the quarter as a low-single-digit gain in licensed apparel was offset by a mid-single-digit decline in headwear. Positive comps in its college business, NFL business and MLB lines were offset by declines in its NBA business primarily related to the headwear business.

Equipment grew mid-single-digits for the quarter as strong gains in soccer, football and basketball offset a challenging fitness business.

“Although the quarter is off to a slow start, weather and shipment patterns should normalize and we are confident when that happens our assortment and flow of product will continue to resonate with our customer and yield our expected results,” said Briskin.

Gross margins eased 28 basis points to 35.5 percent. Product margin decreased 45 basis points mainly due to markdowns associated with some inventory management, according to Scott Bowman, SVP and CFO. Warehouse and store occupancy decreased 17 basis points due to sales leverage.

SG&A expenses were reduced 129 basis points to 20.4 percent of sales due to sales leverage, tight expense controls and lower cost for employee benefits, new store costs and the annual recognition of gift card breakage.

For 2014, Hibbett opened 80 new stores, expanded 9, and closed 19, bringing its store base to 988 stores in 31 states at year-end. For 2015, it plans to open 80 to 85 stores, expand 10 to 15 more-profitable ones, and close 15 to 20 underperforming stores.

Rosenthal noted that there are still over 400 additional markets the chain can expand into in its 31 states. In April, it will open its 1,000th store. He added, ”We are very positive on our store growth as ever.”

Regarding initiatives, Rosenthal said Hibbett is beginning to benefit from its new wholesale and logistics facility. Said Rosenthal, “As we progress throughout this year we will plan on seeing more and more benefits from our facility and our new allocation system and our marketing optimization systems which should help us to continue to get the right product assortment in the right stores at the right time and also see an improvement in product.”

Its new labor management tool also provided some benefits in the fourth quarter, “which gives us confidence in seeing improvements for this year,” said Rosenthal.

Hibbett is also in the first phase of developing e-commerce. He added, “We are as excited as ever in getting this done as soon as possible.”

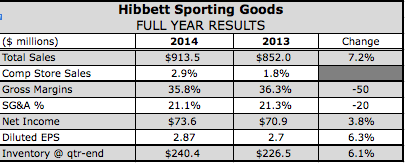

For 2015, Hibbett expects comps to increase in the low- to mid-single-digit range. EPS is expected to come in the range of $2.95 to $3.09, which compares to $2.87 in 2014. The projections include approximately 5 cents per share for the implementation of a new point-of-sale system, approximately 4 cents for increased healthcare and IT costs, and approximately 3 cents for increased depreciation.

Gross margins are expected to be slightly positive with some ongoing benefits expected from its markdown optimization system and initial benefits from its wholesale and logistics facility.

Asked about the port situation in the Q&A session, Rosenthal noted that some brands are shifting shipments to the East Coast but those ports have quickly become overburdened. Rosenthal added, “The shipments just kind of got backed up even when we try to get a little bit more proactive on it.” The impact is broad-based across categories although the larger brands have typically had shorter delays than smaller ones.

On the plus side, Briskin noted that deliveries have started to “normalize a little bit,” adding, “I think it will still take a little bit of time to clean up.”

Asked about the competitive disadvantage of not having e-commerce given Foot Locker’s robust gains in direct, Rosenthal admitted that not having online sales has had some impact. But he added that “we are holding our own” at its brick & mortar stores and adding an online component should provide a quick lift to Hibbett. Rosenthal noted that Foot Locker has said it gains between a 1 to 2 percent comp bonus at its stores from having an omnichannel presence. He added, “When we have that extra feature, I think that will even drive our sales even that much faster.”

Asked about challenging categories, Briskin said Hibbett’s performance-running category was down mid-single digits in the quarter with the high-single overall run gain carried by lifestyle offerings such as Nike Roshe.

Briskin said upcoming running launches from Nike around its Air technology as well as some launches from others could spark the performance side. He adds, “I don't see necessarily a dramatic change in that business. But there is some newness coming that I think can give it some life, but I still see the strength in the footwear business coming from the basketball and the lifestyle categories.”

On women’s, Briskin said footwear has been a challenge “for a period of time” but Hibbett still sees a “significant opportunity” in the area. In women’s apparel, some hot items quickly ran out early in the quarter and the chain is in a “much better position” inventory-wise for spring. Headwear has likewise been “challenged for a little while” and is suffering from the lack of “a trendy silhouette in that category today.”

Asked about the soft quarter-to-date performance, Rosenthal noted that major categories like baseball and soccer have been seeing “some pretty good results” in areas like Florida largely unaffected by the inclement weather. He adds, “But when you talk like an Alabama, Mississippi, even some parts of Texas and some other states, the fields are too wet, people can't get out, and that is where we are seeing it. Even locally in some other areas like in Atlanta and some other areas the fields are just soaking wet and they are not letting the kids get on the fields.”

He said stronger performances in areas such as Florida “gives us some confidence that when the weather gets a little bit more normalized that we will see positive results.”

He also is hopeful Hibbett can still deliver a positive comp for the first quarter. Although February is a “huge volume month for us,” an earlier Easter and some key launches hold promise to make up for the shortfall.

“The first quarter will be a little tougher, but we still feel good about the year and where we sit from product assortments and the way we sit in the stores and definitely getting some benefits from our new logistics facility,” said Rosenthal. “We think a combination of those type things should be able to help us at least get through it. Obviously February miss definitely makes it a little tougher.”