Genesco Inc. reported fourth-quarter revenues slightly exceeded guidance with a healthy 10 percent companywide comp gain. But earnings came in well below expectations, largely due to a disappointing performance by Lids.

Genesco Inc. reported fourth-quarter revenues slightly exceeded guidance with a healthy 10 percent companywide comp gain. But earnings came in well below expectations, largely due to a disappointing performance by Lids.

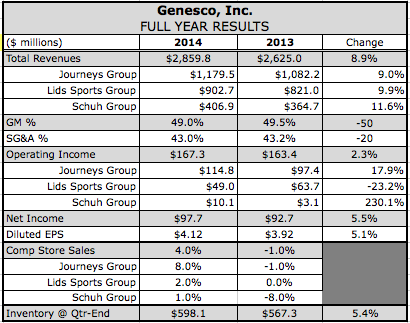

Earnings adjusted to exclude special items rose 7.3 percent in the period ended Jan. 31 to $54.7 million, or $2.30 a share. In the third quarter, the company had lowered its outlook for the year and that put fourth-quarter’s guidance between $2.32 and $2.42.

“This performance marked a disappointing end to a disappointing year for the company,” said Bob Dennis, chairman, president and CEO, on a conference call with analysts.

Dennis attributed the shortfall to three factors. First, Genesco felt “substantial gross margin pressure” at Lids due to higher promotional activity to clear inventories in a “an increasingly promotional competitive environment.” Second, lower than planned profit contribution came from new stores and acquisitions, primarily at Locker Room by Lids and Locker Room by Lids at Macy's. Finally, the strengthening of the U.S. dollar negatively impacted the reported results of its non-US businesses.

On the bright side, the above-plan 10 percent comp gain in the quarter was fueled by a double-digit increase at Journeys, which led to a record sales and record profit for the division. Its direct business overall had another strong quarter with comps ahead 25 percent.

The first quarter is also off solid start with companywide comps ahead 5 percent through Mar. 7 although the snow that hit many parts of the U.S. in recent weeks has negatively affected sales.

Looking ahead, however, Dennis said given the challenges turning around Lids as well as external factors, such as disruptions from the West Coast port slowdown, ongoing currency-fluctuations and wage pressures due tied to the minimum-wage, Genesco has adopted “a considerably more conservative outlook for earnings growth” in the current year.

Breaking out its segments, Journey’s revenues grew 17.2 percent in the quarter, to $376.7 million. Comps ran up 16 percent against flat same-store sales a year ago. Operating earnings rose 29.3 percent to $53.2 million.

Dennis said Journeys benefited from a favorable fashion cycle with the combination of casual footwear, and in particular, boots, plus newness on the fashion athletic side. Said Dennis, “The Journeys merchant team was squarely on the trends and we bought a focused selection in sufficient depth to meet the strong demand. We also believe lower gas prices at the pump contributed to some of this demand.”

Journeys also benefited from moves to drive traffic and increase conversion. These included adjusting store staffing to better capitalize on peak shopping hours. The chain also increased investment in catalogs and digital marketing, an area delivering high ROI from driving traffic to both the website and the stores. A new order management system also helped fuel a 40 percent direct comp.

“Looking ahead,” Dennis added, “we expect that Journeys product advantages as well as improvements in operations, marketing and omni-channel will continue to have a positive effect throughout the current year.”

On the downside, minimum wage pressures well as a Journeys-specific initiative to increase co-manager pay are expected to put pressure on SG&A expense this year. The West Coast port situation didn’t hurt Journeys in the fourth quarter but the first has seen some receipt disruptions.

“As a branded retailer, Journeys is relying on its vendors, and as such, lacks the complete supply chain visibility that we have in our vertical businesses,” said Dennis. “Thus, we see the possibility for more potential disruption in the first half that we can't see as of yet. Of course, this same situation could affect Lids as well.”

to $23.8 million.

At Lids Sports Group, sales grew 16.9 percent to $294.0 million. Comps added 3 percent versus a 7 percent decline in the year-ago quarter. Operating income slumped 15.9 percent to $23.8 million.

Dennis said Lids was expected to be promotional but was worse than plan.

In the hats category, including the Lids chain, comps were ahead of plan but operating income fell short due to accelerated promotions. Said Dennis, “While a few minor silhouettes have gained interest from customers, there are, unfortunately, no dominant trends driving the hat business at this time.”

Lids direct saw double-digit comp gains, but gross margins were lower since the channel was used to clear inventory.

Locker Room by Lids likewise saw better-than-expected comps, up high single-digits with particularly strength in its Ohio region stores due to Ohio State winning the college football championship. But the bulk of the business was “highly promotional” and new store performance fell short of expectations.

“Locker Room by Lids is still a work in progress, however, our long-term vision for this business has not changed,” said Dennis.

At Locker Room by Lids at Macy's, the few stores in its Q4 comp base performed well but the overall business lagged. Lids identified some operational challenges, including where many of the departments are situated inside Macy’s doors, that addressing. Its staffing model is also being adjusted. Added Dennis, “While it's in its early days, we still believe that Locker Room by Lids at Macy's represents a valuable growth opportunity for the future.”

Finally, Lids Team Sports, its dealer business, grew sales ahead of plan but gross margins were below last year. The division is “taking a hard look at expenses.”

Dennis noted that one of Lids' founders is leading the efforts to improve day-to-day operations and performance. Lids is also working on bringing freshness to its inventory while recognizing that the “intensified promotion cadence” begun in the fourth quarter will likely continue through the first half of the year to right-size overall inventories across the channel.

The focus at Lids will remain on “execution rather than growth” to help shore up profitability. A new CFO for Lids is expected to particularly help the effort to find efficiencies, as well as new technologies, including a new inventory locator system, a new robotics system that facilitates single-order picking, and a new front-end system for e-commerce.

At Schuh Group, a U.K. chain similar to Journeys, revenues in the quarter inched up 1.8 percent to $123.9 million. Operating earnings tripled to $10.1 million from $3.1 million. Comps increased 3 percent against a decline of 7 percent last year.

Companywide, gross margins for the quarter decreased 120 basis points over last year to 47.5 percent due to markdowns and promotional activity primarily at Lids, but also at Schuh and Johnston & Murphy. Journeys gross margin improved on the strength of full-priced selling. Total adjusted SG&A expense decreased 70 basis points to 37.6 percent. Adjusted operating income for the quarter increased 8 percent to $89 million.

For 2015, it expects earnings of $5.10 to $5.20, which represents an 8 percent to 10 percent increase over adjusted earnings of $4.74 in 2014. Total sales for the year are projected to increase 4 percent to 6 percent with consolidated comps, including direct, increasing 3 percent to 4 percent. It’s planning to open 116 new stores, concentrated in concepts other than Lids.

Gross margins are expected to be down slightly for the year overall. For at least the first half, overall margins are expected to particularly be weighed down by efforts to right-size inventory at Lids but then will improve somewhat later in the year.