HanesBrands, the parent of Champion and Hanes, reported that acquisition benefits, strong Activewear performance, and increased operating efficiencies drove record second-quarter financial results. Despite a restrained consumer-spending environment, the company again raised its full-year adjusted EPS guidance.

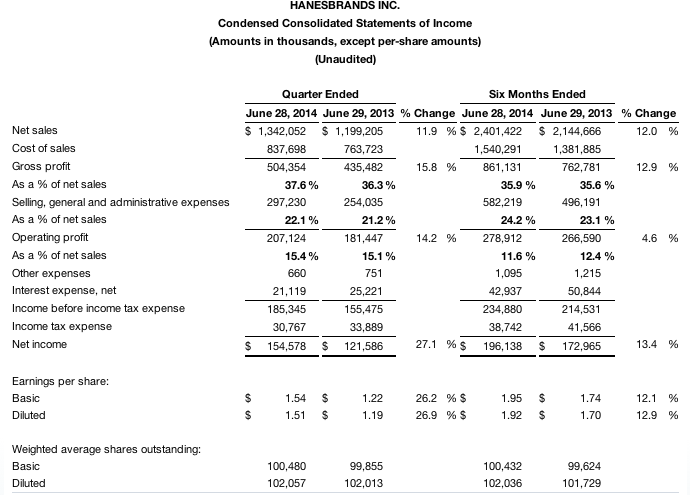

For the second-quarter ended June 28, 2014, net sales increased 12 percent to $1.34 billion, adjusted operating profit excluding actions increased 27 percent to $231 million, and adjusted diluted EPS excluding actions increased 44 percent to $1.71. (Unless noted, all consolidated measures and comparisons in this news release are adjusted to exclude second-quarter 2014 pretax charges of $24 million related to the acquisition of Maidenform Brands, Inc., and other actions. On a GAAP basis, operating profit increased 14 percent to $207 million, and diluted EPS increased 27 percent to $1.51. See the GAAP reconciliation section below.)

Primary contributors to the record quarterly results despite a continuing uncertain economic environment were increased margins and operating profit as a result of the company’s Innovate-to-Elevate strategy; strong Activewear segment results; increased supply chain manufacturing efficiencies; tight control of selling, general and administrative costs; and successful integration of Maidenform Brands, Inc., which was acquired in October 2013.

As a result of strong second-quarter 2014 results, the company has raised its 2014 full-year financial guidance. Increased full-year expectations include adjusted EPS of $5.20 to $5.40, up $0.40; adjusted operating profit of $710 million to $730 million, up $45 million; and net cash from operating activities of $500 million to $600 million, up $25 million. The company has refined its expectations for net sales for the year to approximately $5.075 billion.

“Our record first-half results are a testament to the value we are creating through our Innovate-to-Elevate, self-owned supply chain, and acquisition strategies,” Hanes Chief Executive Officer Richard A. Noll said. “We remain confident in our business model and our performance momentum. We increased our operating profit margin by 200 basis points in the first half, and we raised our full-year EPS guidance for the second quarter in succession.”

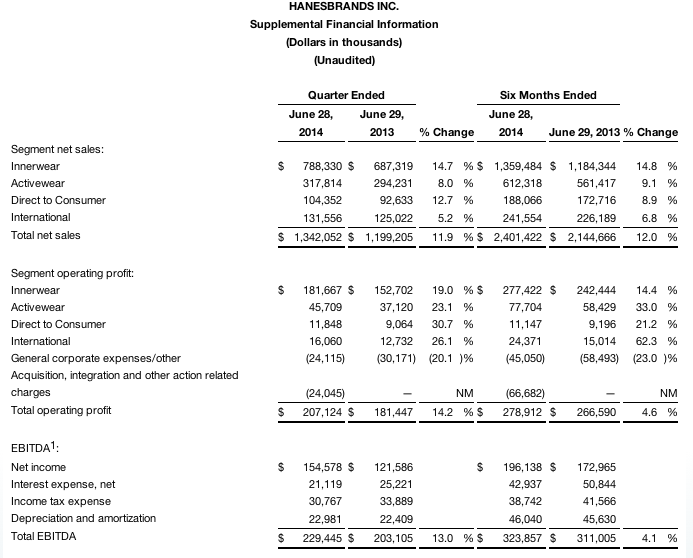

Second-Quarter 2014 Financial Highlights and Business Segment Summary

Key accomplishments for the second quarter include:

Sales Growth in Each Business Segment. Each business segment contributed to the total net sales increase of $143 million in the second quarter. Significant contributions came from Activewear segment growth and Maidenform benefits to each of the other segments. Excluding the Maidenform acquisition, net sales on a constant currency basis increased nearly 1 percent versus the year-ago quarter.

Innovate-to-Elevate Drives Margin Improvement. Hanes’ Innovate-to-Elevate strategy, which harnesses synergies from combining the company’s brand power, supply chain leverage, and product innovation platforms, drove adjusted gross margin improvement in the second quarter of 160 basis points and adjusted operating margin improvement of 210 basis points. The company’s adjusted operating profit margin of 17.2 percent was a second-quarter record.

Significant SG&A Leverage. Despite adding the acquired Maidenform operations, Hanes’ adjusted selling, general and administrative expenses increased by only $23 million in the quarter versus a year ago. As a percentage of sales, Hanes improved its adjusted SG&A leverage by 60 basis points 20.6 percent of sales in the quarter versus 21.2 percent a year ago.

Maidenform Integration Milestones Achieved. The integration of Maidenform is progressing on schedule. In July, Hanes began the first production of Maidenform bra styles in its self-owned intimate apparel supply chain plants. In the first quarter, all Maidenform financial reporting, forecasting, ordering, inventory, purchasing and direct-to-consumer operations moved onto Hanes’ financial and operating systems.

Business Momentum Built on Innovate-to-Elevate, Self-Owned Low-Cost Supply Chain, and Acquisitions. Hanes’ record first-half results and guidance for the full year are based on the company’s business model to create value through executing its Innovate-to-Elevate strategy, relying on its self-owned low-cost global supply chain, and making disciplined acquisitions.

“Our innovation strategy is succeeding, our supply chain is a competitive advantage, and we have developed strong integration capabilities,” said Richard D. Moss, Hanes chief financial officer. “We are achieving SG&A savings from the Maidenform integration ahead of schedule, and we have announced our intention to acquire DBApparel of Europe. The soundness of our strategies coupled with our strong balance sheet and disciplined use of free cash flow gives us confidence in the value-creation potential of our business model for many years to come.”

Key business highlights include:

Innerwear Segment. Innerwear net sales increased 15 percent in the second quarter, driven by the Maidenform acquisition as well as intimate apparel growth in the base business. Operating profit increased 19 percent with significant contributions from Maidenform and base business intimate apparel and basics.

Retail Environment. Sales in the quarter were affected by a continued uneven and challenging retail environment, even with the Easter holiday selling period occurring in the second quarter of 2014 versus the first quarter in 2013. Intimate apparel sales performed better than underwear basics. However, innovation platforms, including ComfortBlend and X-Temp underwear and Flexible Fit bras, continued to outperform their respective categories.

Strong Profit Increase. Despite a difficult selling environment, operating profit increased as a result of Innovate-to-Elevate. The segment’s operating profit margin increased 80 basis points to 23 percent of sales.

Activewear Segment. The Activewear segment continued to deliver strong sales and profit performance in both the first and second quarters. Net sales increased 8 percent in the second quarter and 9 percent for the first half. Sales growth was magnified into operating profit growth of 23 percent in the second quarter and 33 percent for the first half.

Record Profitability. The segment’s operating profit was a record for both the first and second quarters. The segment’s operating profit margin of 14.4 percent in the quarter increased 180 basis points over the prior-year quarter, and the first-half operating profit margin of 12.7 percent was up 230 basis points.

Strength across Businesses. All of the segment’s businesses retail, branded printwear, and Gear for Sports delivered sales and profit growth in the second quarter and first half of 2014. The segment has benefitted from increased channel penetration and shelf-space gains, innovation platform success, and supply-chain leverage through increased internalized production.

International Segment. Currency continued to have a significant negative impact on International net sales and profits. On a constant-currency basis, International net sales increased 11 percent in the second quarter and operating profit increased 35 percent. As reported, International net sales increased 5 percent and operating profit increased 26 percent.

Direct to Consumer Segment. Net sales for the Direct to Consumer segment increased 13 percent and operating profit increased 31 percent in the second quarter, with the acquisition of Maidenform contributing to both comparisons versus the year-ago quarter.

Maidenform Acquisition Integration. Maidenform contributed net sales of approximately $141 million in the second quarter.

Acquisition synergies. Hanes expects to achieve full synergies from the Maidenform acquisition within three years. After full synergies, the acquisition is expected to annually contribute more than $500 million in net sales and $80 million in operating profit.

Integration progressing on schedule. Hanes substantially completed its integration of Maidenform headquarter business functions in the second quarter 2014. All Maidenform financial reporting and business operations have moved onto Hanes’ financial and operating systems. The company anticipates closing the Maidenform Fayetteville, N.C., distribution center by the end of 2014. The first internalized production of select Maidenform bra styles in Hanes’ self-owned supply chain began in July as planned.

DBApparel Acquisition Announcement. During the second quarter, Hanes announced that it intends to acquire DBApparel, a France-based leading European marketer of intimate apparel, hosiery and underwear that used to be a sister division to Hanes under previous corporate ownership.

The acquisition is contingent upon completion of consultations with European and French works councils representing DBA employees as well as customary closing conditions. The works consultations are under way, and Hanes continues to believe that the all-cash acquisition could close as soon as the third quarter of 2014.

2014 Guidance

The company’s guidance for full-year performance measures does not include any potential contribution from the pending acquisition of DBApparel. Any contribution would depend upon the timing of the acquisition and would be communicated after closing.

Based on second-quarter results, Hanes has increased its profit outlook for 2014 and updated its sales outlook compared with previous guidance issued when first-quarter results were announced April 24, 2014.

For 2014, Hanes expects net sales to be approximately $5.075 billion, refined from previous guidance of slightly less than $5.1 billion. Adjusted operating profit excluding actions is expected to be $710 million to $730 million, an increase of $45 million across the range; adjusted EPS excluding actions is expected to be $5.20 to $5.40, an increase of $0.40 across the range; and net cash from operating activities is expected to be $500 million to $600 million, an increase of $25 million across the range.

The company expects its acquisition of Maidenform to contribute approximately $500 million in sales and operating profit of approximately $35 million to $40 million in 2014, up from a previous estimate of approximately $30 million.

Interest expense and other expense are expected to be approximately $85 million combined. Inherent in the company’s guidance is a full-year tax rate in the low teens. As is typical, Hanes expects its tax rate will fluctuate by quarter, with the rate being lower in the second half of the year.

The company expects to make pension contributions of approximately $60 million and has refined its guidance for net capital expenditures to approximately $70 million.

The company expects slightly more than 103 million weighted average shares outstanding in 2014.

Charges for Actions and Reconciliation to GAAP Measures

Adjusted EPS, adjusted net income, adjusted operating profit (and margin), adjusted SG&A, adjusted gross profit (and margin), and EBITDA are not generally accepted accounting principle measures. Hanes has chosen to provide these non-GAAP measures to investors to enable additional analyses of past, present and future operating performance and as a supplemental means of evaluating company operations. Non-GAAP measures should not be considered a substitute for financial information presented in accordance with GAAP and may be different from non-GAAP or other pro forma measures used by other companies.

Hanes incurred pretax charges of $24 million in the second quarter and $43 million in the first quarter for actions related to the acquisition and integration of Maidenform and for actions primarily related to supply chain optimization and regional alignment of commercial operations.

Adjusted EPS is defined as diluted earnings per share excluding actions and the tax effect on actions. Adjusted EPS for the second quarter 2014 was $1.71, while on a GAAP basis, diluted EPS was $1.51 in the quarter versus $1.19 a year ago.

Adjusted operating profit is defined as operating profit excluding actions. Adjusted operating profit for the second quarter was $231 million, while on a GAAP basis, operating profit for the quarter was $207 million versus $181 million a year ago.

Adjusted net income is defined as net income excluding actions and the tax effect on actions. Adjusted gross profit is defined as gross profit excluding actions. Adjusted SG&A is defined as selling, general and administrative expenses excluding actions. The company believes that these measures provide investors with additional means of analyzing the company’s performance absent the effect of acquisition-related expenses and other actions.

See Table 5 attached to this press release to reconcile adjusted measures with their respective GAAP measures.

EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Although the company does not use EBITDA to manage its business, it believes that EBITDA is another way that investors measure financial performance. See Table 2 attached to this press release to reconcile EBITDA with the GAAP measure of net income.

For the company’s 2014 guidance, which does not include any potential contribution from the pending acquisition of DBApparel, adjusted EPS is defined as diluted EPS excluding actions and the tax effect on actions, and adjusted operating profit is defined as operating profit excluding actions. Hanes’ current estimate for pretax charges in 2014 for the Maidenform acquisition and other actions is approximately $80 million to $100 million, but actual charges could vary significantly. The company believes guidance for adjusted EPS and adjusted operating profit provides investors with an additional means of analyzing the company’s performance absent the effect of acquisition-related expenses and other actions.

On a GAAP basis, which also does not include any potential contribution from the pending acquisition of DBApparel, full-year 2014 diluted EPS will vary depending on actual performance, charges and tax rate. GAAP diluted EPS could be in the range of $4.35 to $4.75. GAAP operating profit for 2014 could be in the range of $610 million to $650 million.