The continuing saga of the Gildan Activewear Board of Directors’ fight with its investors backing the company’s former CEO opened the next chapter of their dispute on Monday as the Board finally agreed to the special shareholder meeting that large investors requisitioned earlier in the month. But there is still an issue: the meeting will not occur until the end of May – if at all – and the shareholders were pushing for a March meeting. And then the Board pulled a Lucy with the football and set in motion actions that would cancel the meeting.

The back and forth between Gildan’s Board and a group of large investors has involved a weekly, sometimes daily, back and forth of claims and counter-claims as to the legitimacy of the Board’s decision to fire the company’s former CEO and co-founder in favor of a newcomer to the Gildan business who was slated to start in February. That plan changed as the Board then worked to get him in the building on January 15 so he could gain a foothold in Gildan’s business.

Investment group Browning West and a group of other investors comprising nearly 40 percent of all shares of the company has repeatedly upped the ante in their dispute with the Board, first looking for the reinstatement of the former CEO, the termination of the agreement with the new CEO, a shareholder meeting, and the removal of five Board members to be replaced by the shareholders. The group also sought to removal the Board chair.

As the weeks progressed, the demands became sharper and more focused on specific Board members, resulting in a change in demands that would result in the shareholders putting forth eight Board nominees that would equal the majority of the Board.

For their part, Gildan also kept upping the ante, pushing back hard against the shareholder demands, making it personal with the former CEO, and publicly stating their case against him that he challenged and disputed.

The Board then went deeper and investigated the emails and files of the former CEO. They then attempted to use what they found and bundled it as proof that his ouster was warranted. For those keeping score, they went looking for evidence AFTER they terminated him,

Not to sit idly by, the Board went after the shareholders themselves, claiming in a press release that Browning West illegally acquired Gildan shares to increase their stake to a level that enabled it to requisition a special meeting of shareholders..

In the latest salvo, Browning West, which beneficially owns approximately 5.0 percent of the company’s outstanding shares, responded to Gildan’s announcement on Monday, January 29 that its Board of Directors had called for an annual and special meeting of shareholders to be held on May 28, 2024. The release initially started with what could be an olive branch and gave many some hope that the offer that the parties would sit down and listen to each other’s positions and get to know the Board candidates and new CEO in effort to resolve the differences. The company then announced their Lucy strategy in the same press release, revealing that it had filed an application with a Canadian court asking for a preliminary ruling regarding the legality of the Browning West share purchase so it could cancel the now scheduled special meeting of shareholders in May.

So, this is where we are. Nothing will happen for another four months unless the court rules in Gildan’s favor. If not, both sides will most likely continue to build their war chests and dig in their defenses as they plan for the special meeting.

The back and forth is nearly impossible for the media to report on any more as each side lobs a boulder over the wall at their adversary, only to have another come right back. The company needs someone to step in, someone seasoned and savvy enough to play Secretary of State to resolve the matter between the parties before employees, stakeholders, customers and consumers head for the exit. They deserve better.

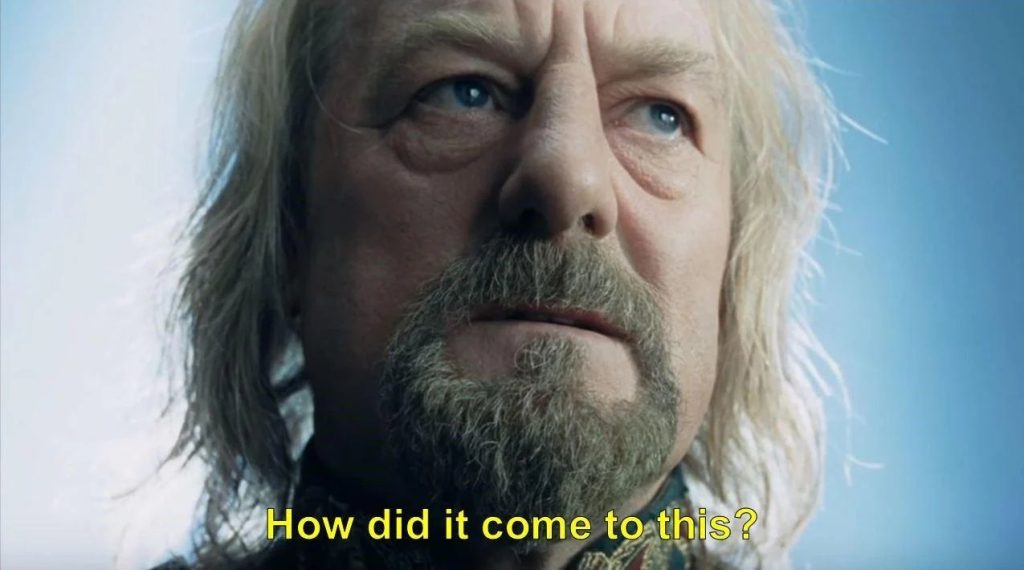

The whole mess has this editor thinking of the despair felt by Theoden before riding into the Battle of the Pelennor Fields in The Twin Towers.

How did it come to this?

Read more SGB Media coverage of the Gildan saga, below.

EXEC: Gildan Activewear Board Releases Info to Justify CEO’s Ouster

Gildan Activewear Board Makes Extraordinary Next Move in Investor Fight

Gildan Board Saga Continues as Shareholders Look to Take Action

Gildan Board Responds to CEO Ouster Backlash Coming from One-Third of Shareholders

Gildan Investor Wildfire Spreads as More Firms Join the Call to Reinstate CEO