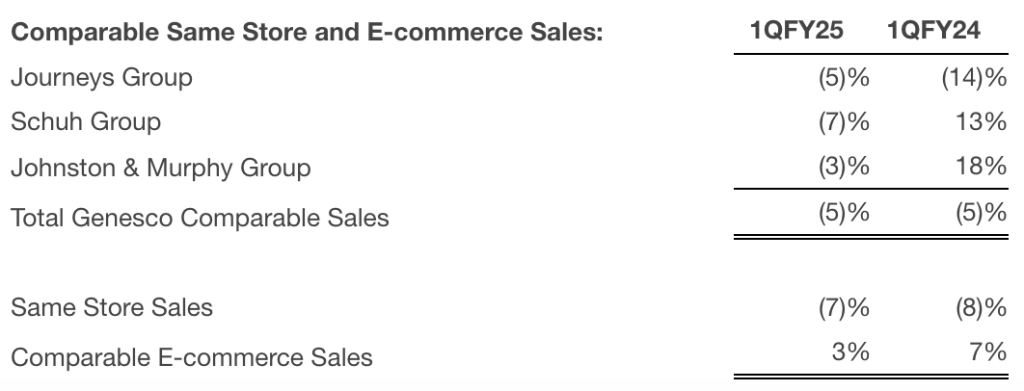

Genesco, Inc., the parent of Journeys, Schuh and Johnston & Murphy, reported net sales for the first quarter of Fiscal 2025 amounted to $458 million, a 5 percent year-over-year decrease compared to $483 million in the first quarter of Fiscal 2024.

The company reported its Q1 sales decrease was driven by a decline in store sales, decreased wholesale sales and the impact of net store closings, partially offset by a 3 percent increase in e-commerce comparable sales and a favorable foreign exchange impact. Excluding the impact of lower foreign exchange rates, net sales decreased 6 percent for the first quarter of Fiscal 2025 compared to the first quarter of Fiscal 2024.

The overall sales decrease for the first quarter compared to the first quarter of Fiscal 2024 was driven by decreases of 5 percent at Journeys, 1 percent at Schuh, 4 percent at Johnston & Murphy, and a 25 percent, or $9 million, decrease at Genesco Brands.

Schuh sales were down 4 percent for the first quarter this year on a constant-currency basis.

For additional SGB Media coverage of the Journeys Group turnaround plan, go here:

EXEC: Genesco CEO Outlines the Journeys Turnaround Plan and Progress

Consolidated first quarter gross margin this year was 47.3 percent of net sales, flat compared with last year’s Q1 period. Adjusted gross margin for the first quarter this year increased 30 basis points as a percentage of sales compared to last year. The increase as a percentage of sales compared to Fiscal 2024 is due primarily to fewer markdowns at Journeys and a greater mix of direct-to-consumer sales, partially offset by a brand mix shift at Schuh.

Selling and administrative expenses for the first quarter this year increased 220 basis points as a percentage of sales compared with last year. The increase in sales percentage compared to fiscal 2024 reflects the deleverage of expenses, especially occupancy expenses, selling salaries, professional fees, and depreciation expenses, which are a result of decreased revenue in the first quarter of fiscal 2025.

In absolute dollars, selling and administrative expenses declined in the first quarter this year compared to last year, reflecting the impact of cost savings initiatives, including store closures.

Genesco’s GAAP operating loss for the first quarter was $32.1 million, or negative 7.0 percent of sales, this year, compared with an operating loss of $23.0 million, or negative 4.8 percent of sales, in the first quarter last year. Adjusted for the Excluded Items in all periods, the operating loss for the first quarter was $30.0 million this year compared to $22.7 million last year. Adjusted operating margin was a loss of 6.5 percent of sales in the first quarter of Fiscal 2025 compared to a loss of 4.7 percent in the first quarter last year.

The effective tax rate for the quarter was 26.7 percent in Fiscal 2025 compared to 23.7 percent in the first quarter last year. The adjusted tax rate, reflecting Excluded Items, was 26.0 percent in Fiscal 2025 compared to 23.3 percent in the first quarter last year. The higher adjusted tax rate for the first quarter this year compared to the first quarter last year reflects an increase in the applicable statutory tax rate in its UK jurisdiction from 24 percent to 25 percent and an increase in the number of foreign losses for which the company is unable to recognize a tax benefit.

GAAP loss from continuing operations was $24.3 million in the first quarter, compared to $18.9 million in the first quarter last year. Adjusted for various excluded items in all periods, the first quarter loss from continuing operations was $22.9 million, or $2.10 per share, in Fiscal 2025, compared to $18.7 million, or $1.59 per share, in the first quarter last year.

Cash, Borrowings and Inventory

Cash was $19.2 million at quarter-end, compared with $31.8 million as of April 29, 2023. Total debt at the end of the first quarter of Fiscal 2025 was $59.4 million compared with $118.2 million at the end of last year’s first quarter. Inventories decreased 17 percent year-over-year, reflecting decreased inventory for Journeys and Johnston & Murphy, partially offset by small increases at Schuh and Genesco Brands.

Capital Expenditures and Store Activity

For the first quarter this year, capital expenditures were $6 million, related primarily to retail stores and digital and omni-channel initiatives. Depreciation and amortization was $13 million.

During the quarter, the company opened one store and closed 21 stores. The company ended the quarter with 1,321 stores compared with 1,396 stores at the end of the first quarter last year, or a decrease of 5 percent. Square footage was down 4 percent on a year-over-year basis.

Share Repurchases

The company did not repurchase any shares during the first quarter of Fiscal 2025. During the second quarter of Fiscal 2025, through May 30, 2024, the company repurchased 7,700 shares for $0.2 million, or $24.90 per share. The company has $51.9 million remaining shares on its expanded share repurchase authorization announced in June 2023.

Store Closing and Cost Savings Update

Genesco, Inc. closed 17 Journeys stores in the first quarter of Fiscal 2025 and reported it continues to evaluate up to 50 Journeys store closures in Fiscal 2025.

The company’s cost savings program is reportedly on track to achieve a reduction in the annualized run rate of $45 million to $50 million by the end of Fiscal 2025.

Fiscal 2025 Outlook

For Fiscal 2025, the company reported the following:

- Continues to expect total sales to decrease 2 percent to 3 percent compared to Fiscal 2024, or down 1 percent to 2 percent excluding the 53rd week in Fiscal 2024.

- Continues to expect adjusted diluted earnings per share from continuing operations in the range of $0.60 to $1.00.

- Guidance assumes no further share repurchases and a tax rate of 26 percent.

Image courtesy Genesco