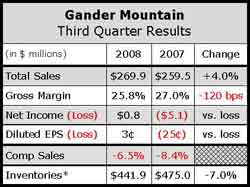

Following on the heels of a record-setting second quarter, Gander Mountain continued to see revenues grow for the third quarter despite a substantial decline in same-store sales. The outdoor retailers reported revenues increased 4% to $269.9 million from $259.5 million in the year-ago period.

Comps for Gander Mountain fell 6.5% on a 1.6% decline in sales from the retail business, which fell to $255.5 million from $259.5 million in the third quarter of 2008. A $7.9 million reduction in retail SG&A costs helped deliver a retail net income of $3.7 million compared to a net loss of $5.1 million for retail in Q3 last year.

Gander Mountains direct business, which kicked off following the December 2007 acquisition of Overtons, was boosted by the August launch of Gandermountain.com. Management said the company has already seen online traffic surpass Overtons highest reported traffic rate. The website launched with an initial selection of more than 11,000 SKUs and the company distributed 2 million catalogs during the third quarter.

The direct segment, which management said had been significantly impacted by the tough economy and one-time investment costs, reported a net loss of $2.9 million on revenues of $14.4 million. Management said they are encouraged by the potential of the direct segment and are looking forward to “a considerably stronger approach in 2009.”

Despite losses sustained in the direct segment, consolidated third quarter net income for the company was $765,000, or 3 cents per share, compared to a net loss of $5.1 million, or 25 cents per share, in the third quarter of 2007. Per share information for the third quarter of 2008 reflects the issuance of an additional 4.1 million shares of common stock in December 2007, the proceeds of which were used to partially fund the Overtons acquisition.

Margins remained relatively flat for the quarter at 26% of total sales, and management for Gander Mountain noted that several key reductions regarding SG&A costs were largely offset by expenses related to one time start-up costs related to Gander Direct. Consolidated SG&A expenses were $65 million, virtually flat compared with last years Q3.

Consolidated inventory ended at $442 million versus $475 million from the year-ago period on a 11.4% decline in retail segment inventory. Average ticket prices for the quarter increased 3.3% to $65.42.

As of Dec. 5, 2008, current availability under the companys credit facility was up 9% to $59 million compared with $54 million for the same period last year.

Regarding outlook, Chairman and CEO David Pratt said the company had established three initiatives to improve financial performance. To boost traffic, Pratt said that Gander Mountain will continue to augment its advertising efforts, which has already had an immediate and significant effect on sales volumes.

Additionally, Pratt said the company will “make every effort to drive sales and profitability per square foot in 2009” by improving merchandising. Finally, Pratt said Gander Mountain is currently managing expenditures by continuing to find ways to cut costs and by being more “fiscally disciplined.”

Pratt added that over the long term the company expects growth to be fueled primarily by remerchandising efforts that will be supported by target marketing and heightened efforts within the advertising department. Gander Mountain also expects the expansion of the Gander Direct segment to bolster future revenues.