Gander Mountain is shifting its investment from  brick and mortar expansion and advertising to direct sales, shrinking its recently launched power sports business and dedicating more space to branded outdoor footwear in the wake of plummeting fourth-quarter profits and comparable store sales.

brick and mortar expansion and advertising to direct sales, shrinking its recently launched power sports business and dedicating more space to branded outdoor footwear in the wake of plummeting fourth-quarter profits and comparable store sales.

The company said sales declined 2.8% to $317.6 million during the quarter, while the companys average customer ticket increased 4.8% to $62.41, comparable stores sales fell 11.9%. The retailer reported that net income fell 62% to $5.8 million, or 25 cents per share for the quarter ended Feb. 2, compared to $15.3 million, or 85 cents per share in the same quarter a year ago. The losses included $1.2 million from Overtons Inc., an online and catalogue retailer acquired in December. CEO Mark Baker said comp stores sales rebounded in the first quarter, declining mid-singles.

Sales of traditionally strong categories like firearms and hunting products were weak for the quarter as was apparel, said Baker. Sales were soft in all geographic regions, including the South, which had been a strong performer in the first half of the year and where the company is focusing store expansion this year.

Drilling down further, Rick Vazquez, EVP of merchandising and marketing, said sales of ammo, black powder, paintball and lighting were weak. Fishing was a bright spot due to strong ice fishing conditions. Apparel and fieldwear comps were negative, but down less than overall comps. Footwear posted solid positive comps for the quarter.

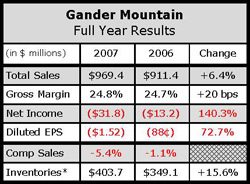

The company ended the year with $404 million of inventory, up 10% from a year earlier. About $19 million came from the acquisition of Overtons, while additional stores and the companys entry last spring into Powersports (motor boats and ATVs), accounted for the rest.

Gross profits as a percent of sales increased 18 basis points to 24.8% for the year, reflecting general improvement in pricing structure, improved clearance management, benefits of scale, and higher penetration of owned-brand merchandise. Initial margins rose 98 basis points, reflecting greater assortment of private label products.

SG&A as a percentage of sales increased 200 basis points for the fiscal year to 24.8% due to lower comparable store sales.

To improve performance in 2008, GMTN will shift much of its focus to the direct marketing side of its business, which will soon include a new Gander Mountain web site and catalogue and the newly acquired Overtons. For instance, the company shifted advertising dollars from the fourth quarter toward adding 44 pages of Gander Mountain-branded merchandize to Overtons 250-page May catalogue, which will be mailed and distributed at stores.

On the bricks-and-mortar front, GMTN will seek to grow its gun club, expand field wear, everyday apparel and denim workwear offerings; shrink the number of stores carrying power sports and increase space allocated to footwear by as much as 25%. Much of that space will go to casual footwear, cross trainers and hikers. “We will focus on action wear footwear, not sports and athletics,” said Vasquez.

These efforts will focus on improving operations at 25 stores. The company closed two underperforming stores on the last day of the first quarter. It will replace those and add three more in Florida and Virginia in the coming year. On the expense side, Vazquez said the company has reduced its SKUs for spring by as much as 20% in a bid to improve inventory turnover.