Fox Factory Holding Corp., the maker of suspension products primarily for mountain bikes and other vehicles, reported

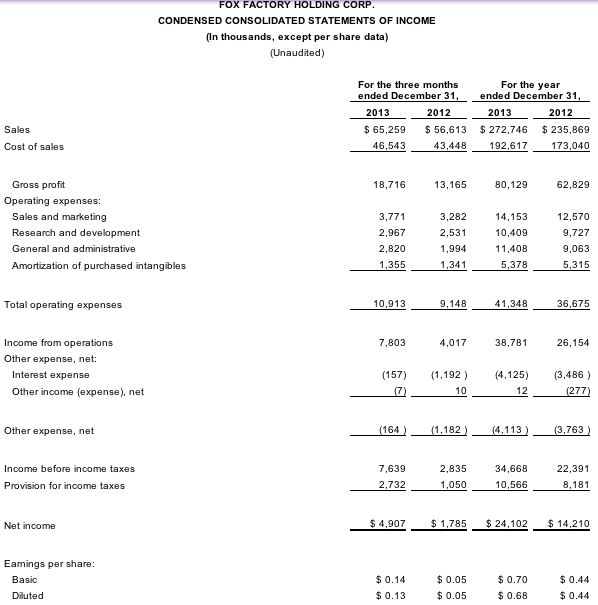

sales increased 15.3 percent in the fourth quarter, to $65.3 million compared to $56.6 million. The gains were driven by strong sales growth for both mountain bike and powered vehicle products.

Gross margin increased 540 basis points to 28.7 percent compared to 23.3 percent in the same period last fiscal year

Net income increased 174.9 percent to $4.9 million compared to $1.8 million in the same period last fiscal year

Non-GAAP adjusted net income increased 118.4 percent to $5.9 million compared to $2.7 million in the same period last fiscal year

Adjusted EBITDA increased 68.1 percent to $10.8 million compared to $6.4 million in the same period last fiscal year

“We are pleased to deliver a strong financial performance for the fourth quarter and full year 2013. Our results reflect the demand for our premium mountain bike and powered vehicle products and improved margins, underscoring our ability to leverage our infrastructure across higher sales volume,” stated Larry L. Enterline, FOX's Chief Executive Officer. “We are also excited about our recent announcement to acquire the assets of Sport Truck USA, which will strengthen our position in the truck suspension aftermarket with the addition of lift kits.”

Enterline continued, “In fiscal year 2014, we remain focused on executing our long-term, multi-faceted growth strategy of continued penetration in existing and potential new vehicle categories, capitalizing on international growth opportunities, and expanding our brand into relevant adjacencies while continuing to focus on further margin improvements. We remain confident in our ability to deliver strong results in fiscal year 2014.”

Sales for the fourth quarter of fiscal 2013 were $65.3 million, an increase of 15.3 percent from sales of $56.6 million in the fourth quarter of fiscal 2012. Sales of mountain bike and powered vehicle products increased 14.2 percent and 17.2 percent, respectively, for the fourth quarter of fiscal 2013 compared to the prior year period. Fourth quarter 2013 sales included approximately $3 million of sales that were originally scheduled to occur in early 2014.

Gross margin was 28.7 percent for the fourth quarter of fiscal 2013, a 540 basis point increase from gross margin of 23.3 percent in the fourth quarter of fiscal 2012. Approximately 220 basis points of the improvement in gross margin relates to the company's successful execution of initiatives designed to improve operating efficiencies. The remaining 320 basis points is largely due to additional warranty and other related costs incurred in the fourth quarter of 2012 to upgrade certain dampers contained in the company's suspension products which costs did not recur in 2013.

Total operating expenses were $10.9 million, or 16.7 percent of sales, for the fourth quarter of fiscal 2013, compared to $9.1 million, or 16.2 percent of sales, in the fourth quarter of the prior year. Operating income was $7.8 million for the fourth quarter of fiscal 2013, a 94.2 percent increase compared to operating income of $4 million in the fourth quarter of fiscal 2012.

Net income in the fourth quarter of fiscal 2013 was $4.9 million, an increase of 174.9 percent compared to $1.8 million in the fourth quarter of the prior fiscal year. Earnings per diluted share for the fourth quarter of fiscal 2013 was $0.13, calculated on 37.6 million weighted average diluted shares outstanding, compared to $0.05 earnings per diluted share, calculated on 34 million weighted average diluted shares outstanding in the fourth quarter of fiscal 2012.

Non-GAAP adjusted net income in the fourth quarter of fiscal 2013 was $5.9 million, an increase of 118.4 percent compared to non-GAAP adjusted net income of $2.7 million in the fourth quarter of the prior year. Non-GAAP adjusted earnings per diluted share for the fourth quarter of fiscal 2013 was $0.16, calculated on 37.6 million weighted average diluted shares outstanding, compared to non-GAAP adjusted earnings per diluted share of $0.08, calculated on 34 million weighted average diluted shares outstanding in the fourth quarter of fiscal 2012.

Adjusted EBITDA in the fourth quarter of fiscal 2013 was $10.8 million, a 68.1 percent increase compared to $6.4 million in the fourth quarter of the prior year. Adjusted EBITDA margin in the fourth quarter of fiscal 2013 improved 520 basis points to 16.6 percent, compared to 11.4 percent in the fourth quarter of fiscal 2012, reflecting the company's ability to leverage its operating platform and the aforementioned damper warranty issue.

Fiscal Year 2013 Results

Sales for the full year ended December 31, 2013, were $272.7 million, an increase of 15.6 percent compared to fiscal 2012. Sales of mountain bike and powered vehicle products increased 14.4 percent and 18.2 percent, respectively, for the fiscal 2013 full year compared to the prior year.

Gross margin was 29.4 percent in fiscal 2013, a 280 basis point improvement compared to gross margin of 26.6 percent in fiscal 2012. Approximately 160 basis points of the improvement in gross margin relates to the company's successful execution of initiatives designed to improve operating efficiencies and the remaining 120 basis points is largely due to the aforementioned damper warranty issue.

Net income in fiscal 2013 was $24.1 million, an increase of 69.6 percent compared to $14.2 million in the prior year. Earnings per diluted share for fiscal 2013 was $0.68, calculated on 35.7 million weighted average diluted shares outstanding, compared to $0.44 earnings per diluted share, calculated on 32.5 million weighted average diluted shares outstanding in fiscal 2012.

Non-GAAP adjusted net income in fiscal 2013 was $29.2 million, an increase of 63.3 percent compared to non-GAAP adjusted net income of $17.9 million in the prior year. Non-GAAP adjusted earnings per diluted share for fiscal 2013 was $0.82, calculated on 35.7 million weighted average diluted shares outstanding, compared to non-GAAP adjusted earnings per diluted share of $0.55, calculated on 32.5 million weighted average shares outstanding in fiscal 2012.

Adjusted EBITDA increased 37.9 percent to $49.6 million in fiscal 2013, compared to $36 million in fiscal 2012. Adjusted EBITDA margin in fiscal 2013 improved 290 basis points to 18.2 percent compared to 15.3 percent in fiscal 2012.

Balance Sheet Highlights

As of December 31, 2013, the company had cash and cash equivalents of $1.7 million. Total debt was $8.0 million, compared to $59.3 million as of December 31, 2012. Inventory was $42.8 million as of December 31, 2013, compared to $34.3 million as of December 31, 2012 primarily due to the increased level of business during the year ended December 31, 2013. As of December 31, 2013, accounts receivable and accounts payable were $33.8 million and $24.3 million, respectively, compared to $25.2 million and $19.6 million as of December 31, 2012, respectively, also primarily due to the increased level of business during the three months ended December 31, 2013, in which the latter part of the quarter was significantly stronger.

Company Acquisitions

On March 5, 2014, the company entered into a definitive agreement to acquire the assets of Sport Truck USA (“Sport Truck”), a full service, globally recognized distributor of aftermarket suspension solutions. Sport Truck primarily designs, markets, and distributes high quality lift kit solutions through its brands, BDS Suspension and Zone Offroad Products. The transaction is subject to approval by the employee stock ownership plan shareholders of Sport Truck and is also subject to customary closing conditions. The company will acquire the assets of Sport Truck in an asset purchase transaction for approximately $44 million due at closing. The transaction is being financed with debt and includes a potential earn-out opportunity of up to a maximum of $29.3 million payable over the next three years contingent upon the achievement of certain performance based financial targets. The transaction is expected to close by the end of March 2014. The transaction is expected to be slightly accretive to FOX's full year fiscal 2104 earnings excluding transaction related costs with the majority of the financial benefit to be realized in full year fiscal 2015.

Fiscal 2014 Guidance

The company is reaffirming guidance previously provided on February 3, 2014. For the fiscal 2014 first quarter the company expects sales in the range of $53 million to $57 million and earnings per diluted share in the range of $0.07 to $0.10 and non-GAAP adjusted earnings per diluted share in the range of $0.09 to $0.12. For the fiscal year 2014 the company expects net sales in the range of $275 million to $295 million and earnings per diluted share in the range of $0.70 to $0.80 and non-GAAP adjusted earnings per diluted share in the range of $0.79 to $0.89 based on 38 to 39 million weighted average diluted shares outstanding. The guidance excludes the after tax impact of approximately $0.02 per share of transaction costs related to the acquisition of Sport Truck. The company expects to incur these costs in the first quarter of 2014. If completed, this transaction is anticipated to close by the end of March. Upon successful completion of the transaction, the company will provide updated guidance for fiscal 2014.