Foot Locker, Inc. reported first-quarter results came in below Wall Street targets and significantly reduced the retailer’s 2023 outlook as sales “softened meaningfully” since March. The chain also named a new chief financial officer.

Earnings on an adjusted basis of 70 cents per share in the first quarter compared with Wall Street’s consensus estimate of 78 cents. Sales of $1,927 million were short of analysts’ consensus estimate of $1.983.4 million.

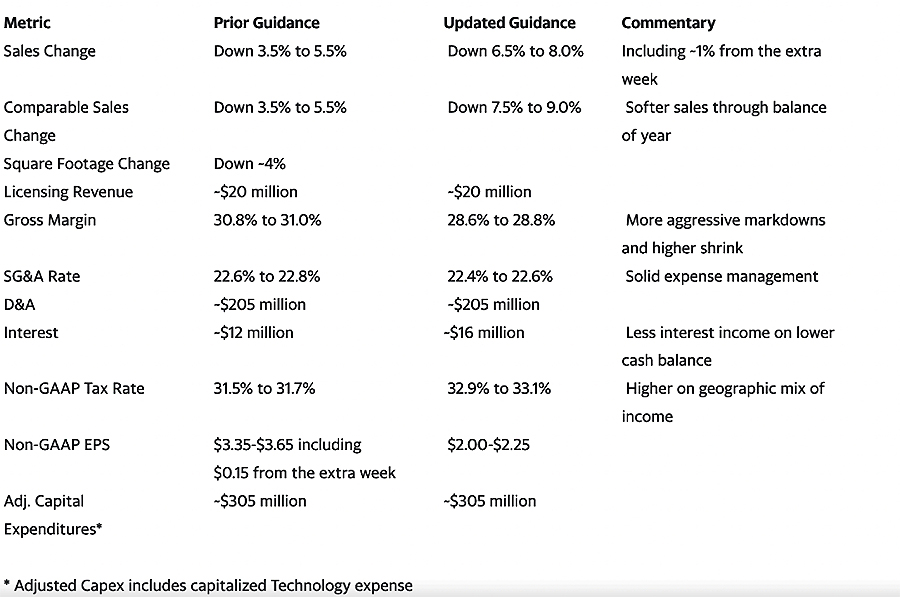

For the year, Foot Locker now expects sales to decline 6.5 percent to 8.0 percent after previously expecting a decline in the range of 3.5 percent to 5.5 percent. Adjusted EPS for the year is now expected to range between $2.00 to $2.25 compared to guidance between $3.35 and $3.65 previously.

“Coming off the recent launch of our Lace Up Strategy at our Investor Day in March, we are making early progress in building a strong foundation to return to sustainable growth beyond this year,” said Mary Dillon, president and chief executive officer. “However, our sales have since softened meaningfully given the tough macroeconomic backdrop, causing us to reduce our guidance for the year as we take more aggressive markdowns to both drive demand and manage inventory.”

Dillon continued, “Despite the challenging near-term trends, we remain committed to our long-term strategy, including making the necessary investments to drive our Lace Up plan and maintain conviction in our ability to execute against our new strategic imperatives.”

First Quarter Results

- Comparable-store sales decreased by 9.1 percent, driven by macroeconomic headwinds, including lower income tax refunds in the United States, the changing vendor mix and the repositioning of Champs Sports.

- Total sales decreased by 11.4 percent, to $1,927 million, compared with sales of $2,175 million in the first quarter of 2022. Excluding the effect of foreign exchange rate fluctuations, total sales for the first quarter decreased by 10 percent.

- Gross margin declined by 400 basis points compared with the prior-year period, driven by a combination of higher markdowns compared to historically low levels in the prior year and occupancy deleverage, as well as an increase in theft-related shrink.

- SG&A increased by 110 basis points as a percentage of sales compared with the prior year, with savings from the cost optimization program more than offset by underlying deleverage on the sales decline, inflation, and investments in front-line wages and technology.

- Net income decreased to $36 million as compared with $133 million in the first quarter of fiscal 2022. Non-GAAP net income decreased to $66 million from $155 million in the prior-year period.

- EPS decreased to $0.38 per share versus $1.37 in the first quarter of fiscal 2022. Non-GAAP EPS decreased to $0.70 per share compared with non-GAAP EPS of $1.60 in the prior-year period.

Regional Metrics

In North America, sales declined 14.5 percent currency-neutral to $1,389 million versus a year ago and were down 12.8 percent on a same-store basis. By banner in North America, Foot Locker sales were down 7.2 percent currency-neutral to $744 million and declined 5.5 percent on a same-store basis. Champ Sports sales were down 27.3 percent currency-neutral to $328 million and declined 24.6 percent on a same-store basis. Kids Foot Locker sales were down 7.2 percent currency-neutral to $167 million and gave back 7.7 percent on a same-store basis.. WSS sales were up 8.7 percent on a currency-neutral basis to $150 million but down 3.7 percent on a same-store basis.

In EMEA, sales were up 1.0 percent currency-neutral to $393 million while easing 0.1 percent on a same-store basis. By banner, Foot Locker sales were up 3.7 percent currency-neutral to $379 million and gained 2.1 percent on a same-store basis. Sidestep sales tumbled 41.7 percent currency-neutral to $14 million and declined 37.8 percent on a same-store basis..

In the Asia Pacific region, sales were up 10.6 percent currency-neutral to $145 million and gained 8.9 percent on a same-store basis. Foot Locker sales grew 12.9 percent currency-neutral to $98 million and moved ahead 11.2 percent on a same-store basis. Atmos sales were up 6.1 percent in constant currencies to $47 million ad gained 2.7 percent on a same-store basis.

Balance Sheet

At quarter-end, the company’s cash and cash equivalents totaled $313 million, while debt on its balance sheet was $451 million. As of April 29, 2023, the company’s merchandise inventories totaled $1,758 million, 25 percent higher than at the end of the first quarter last year.

Dividend and Share Repurchases

During the first quarter of 2023, the company paid a quarterly dividend of $0.40 per share for a total of $38 million. The Board of Directors declared a quarterly cash dividend on the company’s common stock of $0.40 per share, which will be payable on July 28, 2023, to shareholders of record on July 14, 2023.

Store Base Update

During the first quarter, the company opened 13 new stores, remodeled or relocated 18 stores, and closed 35 stores. As of April 29, 2023, the company operated 2,692 stores in 29 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 163 franchised stores were operating in the Middle East and Asia.

2023 Financial Outlook

Fiscal year 2023 represents the 53 weeks ending February 3, 2024. The company’s full-year 2023 outlook, which includes the 53rd week, is summarized in the table below.

Chief Financial Officer Appointment

Today, Foot Locker, Inc., announced it hired Mike Baughn as executive vice president and chief financial officer, shown right, effective June 12, 2023.

Today, Foot Locker, Inc., announced it hired Mike Baughn as executive vice president and chief financial officer, shown right, effective June 12, 2023.

Baughn, most recently, was the EVP of Finance & Treasurer at Kohl’s. He brings to Foot Locker more than 15 years of experience in various financial leadership roles across Kohl’s. Baughn will report directly to Dillon and oversee Foot Locker, Inc.’s financial initiatives. Robert

Robert Higginbotham, interim CFO, will resume his role as senior vice president of Investor Relations and Financial Planning & Analysis, reporting to Baughn.

“Following a rigorous search process, we are thrilled to welcome to our leadership team Mike Baughn, whose role will be instrumental in delivering our Lace Up plan,” said Dillon. “I am confident Mike will further accelerate our new set of strategic imperatives and financial objectives designed to set us up for the next 50 years of growth. Let me also thank Rob for his leadership of the finance organization while we conducted the search, ongoing contributions, and critical role in launching our strategy at our Investor Day.”

“Foot Locker is a cultural staple that has led the footwear category for nearly 50 years. I am honored to join this incredible team as CFO at such a pivotal time for the company as they deliver the Lace Up plan,” said Baughn. “Foot Locker has a rich heritage to build upon, and I am looking forward to working closely with Mary Dillon and the leadership team to ensure great customer experiences, as well as value for our stakeholders.”

Photos courtesy Foot Locker/Mike Baughn