Foot Locker, Inc. CEO Mary Dillon reported that the company’s continued focus on execution drove positive comparable sales trends and meaningful gross margin expansion in the third quarter ended November 2, but top- and bottom-line performance fell short of internal expectations. The company also fell short of Wall Street’s expectations, missing the analyst consensus estimate of 41 cents the Street estimate of $2.02 billion in sales.

“Consumer spending trends softened following the peak back-to-school period in August, and the promotional environment was more elevated than anticipated,” Dillon offered in a media release. “At the same time, we continued to demonstrate progress with our Lace Up Plan, including further cementing our leadership position at the heart of basketball and sneaker culture.”

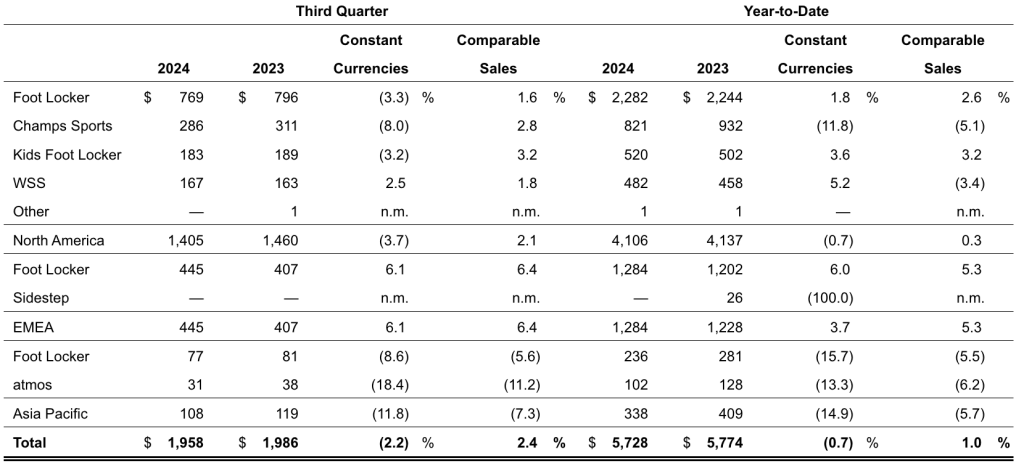

Total sales were down 1.4 percent to $1.96 billion in the quarter, compared with sales of $1.99 billion in the third quarter of 2023. Excluding the effect of foreign exchange rate fluctuations, total sales for the third quarter decreased by 2.2 percent year-over-year (y/y).

Comparable sales increased 2.4 percent y/y for the quarter, including global Foot Locker and Kids Foot Locker comparable sales growth of 2.8 percent, stymied in part by its International business. The company noted that Champs Sports and WSS banners saw positive comparable sales growth of 2.8 percent and 1.8 percent, respectively, for the period.

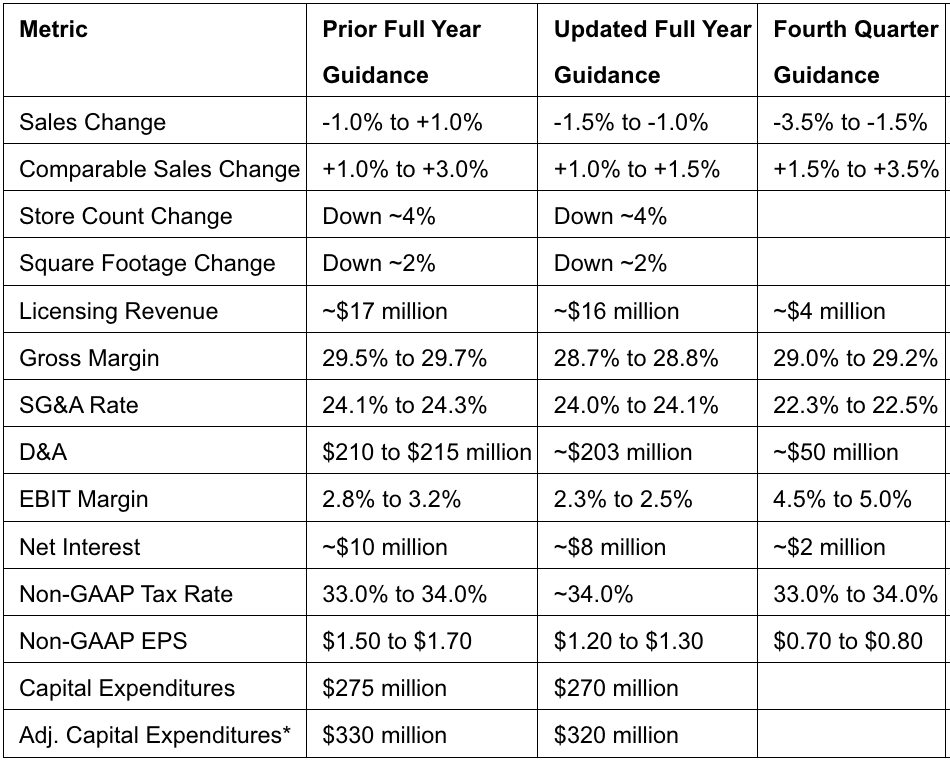

“While our trends in early November landed below our expectations as consumers held back their spending ahead of the holiday season, we saw a meaningful and positive acceleration over the key Thanksgiving week period, especially in stores. Despite that strong performance, we are taking a more cautious view and are lowering our full-year sales and earnings outlook due to a more promotional environment and softer consumer demand outside of key selling periods,” Dillon revealed. “We are confident that our strategies will drive sustainable shareholder value creation as we progress towards our 8.5 [percent] to 9 percent EBIT margin target by 2028.”

The company cited approximately $100 million in top-line headwinds in the fourth quarter and full year from the ability to include the 53rd week of operation in the 2023 fiscal retail calendar.

Income Statement Summary

Gross margin increased by 230 basis points y/y, reportedly led by reduced markdown levels. Gross margin trends accelerated from the second quarter of 2024, but performance was said to be below expectations given an elevated promotional environment.

SG&A, as a percentage of sales, increased by 210 basis points y/y, driven by technology and brand-building investments partially offset by savings from the cost optimization program and ongoing expense discipline.

Third quarter net loss was $33 million, or a loss of 34 cents per share, as compared with net income of $28 million, or EPS of 30 cents per share, in the prior-year Q3 period.

On a non-GAAP basis, net income was $31 million, or EPS of 33 cents per share, for the third quarter, as compared with net income of $28 million, or EPS of 30 cents per share, in the corresponding prior-year period.

Non-GAAP results exclude, among other items, non-cash impairment charges of $25 million related to the Atmos trade name following a strategic review of the Atmos business and a charge of $35 million related to impairment to the carrying value of a minority investment, which is regularly assessed whenever events or circumstances indicate that the carrying value may not be recoverable.

Balance Sheet

- The company’s cash and cash equivalents totaled $211 million at quarter-end.

- Total debt was $445 million.

- Merchandise inventories were $1.7 billion at quarter-end, or 6.3 percent lower than at the end of last year’s third quarter.

- Excluding the effect of foreign currency fluctuations, merchandise inventories decreased 6.9 percent year-over-year.

Lowering 2024 Sales and Non-GAAP EPS Outlook

In addition to the headwinds of approximately $100 million from comparisons to the 53-week calendar in 2023, Foot Locker also noted the impact of promotional pressure on gross margin and investment spending on the SG&A line.

Non-GAAP EPS includes a 9-cent drag from a non-recurring FLX charge in the second quarter and the Adjusted Capital Expenditures line includes approximately $50 million in technology investment reflected in operating cash flows. Adjusted Capital Expenditures also include Software-as-a-Service contracts amortized through operating expenses over the company’s contract terms.

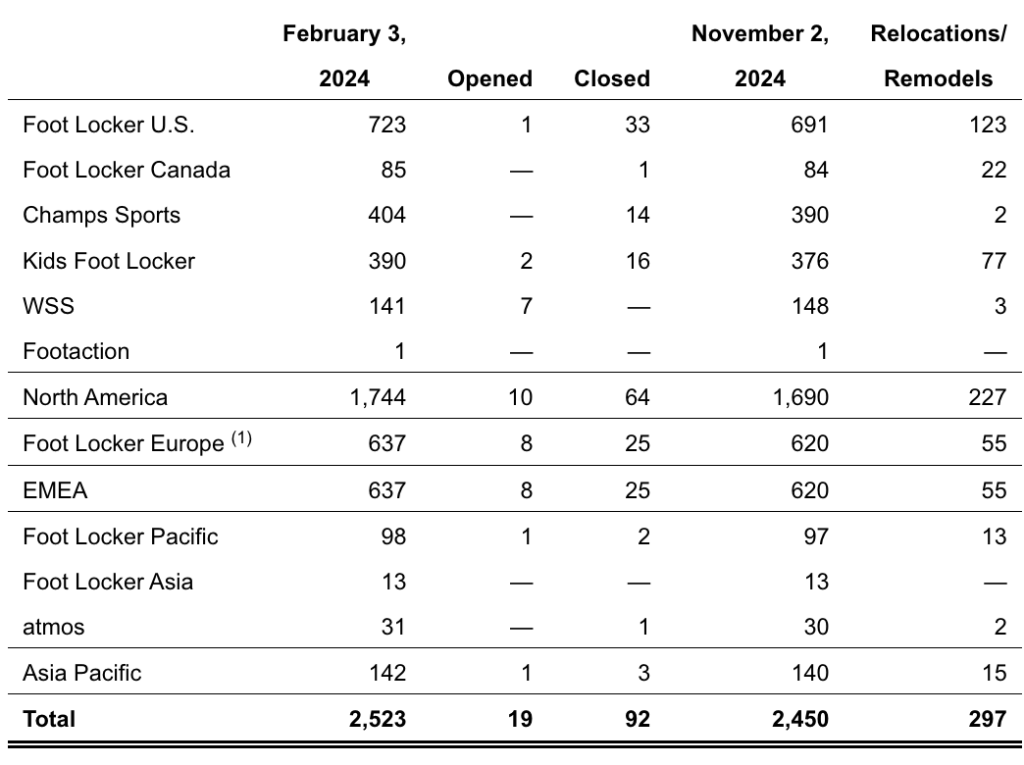

Store Base Update

During the third quarter, the company opened 10 new stores and closed 24 stores. It also remodeled or relocated 20 stores and refreshed 167 stores to its updated design standards, which incorporate key elements of current brand design specifications.

As of November 2, 2024, the company operated 2,450 stores in 26 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 214 licensed stores were operating in the Middle East and Asia.

Stores by Banner

Image courtesy Foot Locker, Inc.