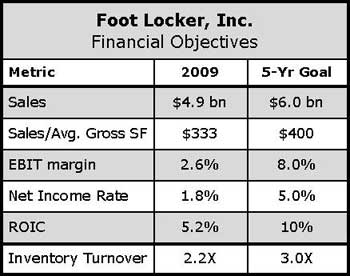

Foot Locker Inc. is betting that a renewed focus on apparel and the overall run category will help it reach its goal of achieving annual sales of $6 billion and net income margin of 5% over the next five years. Beyond running -toning, court and skate footwear will receive more attention. Other components of the five year strategic plan announced last week include a push for greater differentiation of banners; an increasing focus on value with more entry-level priced shoes; and eventually extending its target group at its core Foot Locker chain to a slightly older customer. The move is part of an overall effort to reach a broader range of customers.

At the retailers annual investor conference last week at Foot Locker, Inc. headquarters in New York City, Foot Lockers new Chairman, President and CEO Ken Hicks said the companys growth potential was limited with its over-emphasis on basketball while categories such as running were growing and represented sizeable markets. Right now were too focused on a particular business-basketball, said Hicks.

Were going to keep that power position, but were going to grow other areas, and were going to be the place for sneakers. It’s what were known for. We have opportunities unlike some of our competitors in running and toning and court and a leadership position in one of the largest segments, that of basketball. Hicks added, Our customer base got too small, were going to expand that.

To better pursue the running opportunity, Hicks believes the chain needs a better assortment of running shoes, a better understanding of running shoe technology by store associates, and a deeper apparel offering. While acknowledging the Foot Locker chain wont likely reach the marathoner or run techie who demands run specialty attention, Hicks sees a big opportunity reaching the wider group of run enthusiasts who need basic knowledge .

If you walk into any Golds Gym or 24-Hour-Fitness, you can see how many people are running and its a lot more than the marathon runners, Hicks told Sports Executive Weekly after the meeting. They will come into Foot Locker and what they need is an assortment and they need people who understand the basics of running technology. So were training them that this is for a pronator, this one is for stability and how important that is. But were also training them on how to talk to that customer.

He also noted that Foot Locker doesnt get credit enough for its title sponsorship of the Cross Country Championships as well as sponsorship of the New York and San Francisco Marathons. An elite run concept, RUN by Foot Locker, is being tested on 14th Street in Manhattan that will also offer lessons on the run opportunity for the rest of the chain while gauging whether the concept or a modified version can be expanded to reach the ‘run techie.

Hicks also said he could see the Foot Locker chains demographic broadening, partly to pursue the runner or the older active consumer represented by the emergence of yoga and the toning category. Foot Locker has a very young customer base but we trade broadly, he noted. He suspects that Foot Lockers target may skew upwards much the way Lady Foot Locker has.

Lady Foot Locker is 25 to 35 so what well trade is from 15 to 35 because those are the people who are buying sneakers and thats what will happen with Foot Locker, said Hicks. Right now, Foot Locker is 15 to 25 year old males. Next year couple years it goes up to 15 to 30 and then 15 to 35. We dont want to give up that kid but we have to expand in order to get the growth we need.

But a major part of the store productivity improvement is expected to come from greater differentiation of banners through different products, in-store presentations and marketing messages. Hicks noted that during the downturn, many banners focused on best sellers and consequently began carrying the same product. As part of that push, Foot Lockers flagship banner will shift from being the ‘Home of Basketball to the ‘Home of Sneakers.

This broader base is far more sustainable and allows us to appeal to many more customer segments explained Dick Johnson, the new president and CEO, of the Foot Locker U.S. businesses. We will achieve this move by maintaining our leadership position in basketball and complementing it with a compelling assortment of running shoes and apparel, along with training shoes, and of course our great assortment of classic and casual sneakers.

Differentiation plans among other banners include:

- Lady Foot Locker, aimed at ‘Active Women, has already started offering a broader range of technical and performance products, both in shoes and apparel, and will put a major emphasis around the toning opportunity.

- Kids Foot Locker will expand its range beyond smaller sizes of traditional adult styles found at Foot Locker. An example is Skechers Twinkle Toes program.

- Footaction, which Johnson lamented has lost its identity in the marketplace, is changing the assortment and altering how product is displayed in the store to reach the ‘Style Enthusiast. Said Johnson, Footaction will have our fastest assortment and give us great opportunity to work with new vendors as we move with this customer.

- Champs, targeting the ‘Ultimate Sports Fan, will work to identify partnerships with vendors and various sports entities to build on its fan apparel positioning. An example is the launch of NBA in-store-shops through adidas.

- Eastbay, targeting the ‘Elite Varsity Athlete, will focus on connecting with athlete at an early age.

At the same time, Foot Locker plans to broaden its range of ‘value across the banners, which includes product exclusivity, design/style, customer service and price. As part of that, it plans to bring in more lower-priced items. Hicks said Foot Lockers price range will remain the same but in the past its lowest priced footwear tended to be markdowns and not all sizes were available for the clearance items.

Were going to have some shoes that we will always have so a customer who wants to buy a $50 or $60 sneaker – which by the way most of America does not consider inexpensive-will be able to find their size, said Hicks. Well still have clearance in there, but we will have an ongoing assortment of shoes, and were working with all of our brands for that. We at the same time are going to maintain our position as the place to get marquee shoes – basketball, running, all of the different categories. Therefore, we dont see our average selling price changing. It may go up a little bit as we continue to improve our inventory position.

Regarding apparel, Hicks noted that about half of its sales decline over the last couple of years came from the category and its being counted on to lift margins for the company. An ample apparel assortment also supports the footwear side.

It’s an important business because it helps sell more shoes, said Hicks. It’s an important business because people buy apparel more often than they do shoes, and to get them to return to us.

More trend-right apparel is being sought from existing and new brands while fabrications and fashion content is being upgraded in private label. But a particular focus will be around better coordinating color-driven hook-ups and making lifestyle statements in stores. For instance, if pink shoes are hot for women, matching tops will be available. Also, apparel offerings in general will be shown closer to shoes. More merchandising around ideas such as lightweight or colors will likewise be emphasized in shoes.

Other strategies outlined at the meeting:

- Growth opportunities include e-commerce and international. Western Europe has the potential to increase its store base by 50%. In the U.S., both House of Hoops by Foot Locker and CCS are viewed as having the potential to reach over 100 doors.

- Nike is expected to remain a significant part of the business. Said Hicks, Nike didnt get into the position or we didnt get in the position with Nike because Nike was weak. We got there because Nike was strong and some of the other brands were not as strong. We now see the other brands coming up.

- Foot Locker will be investing a bit more on marketing, but plans to make better use of its marketing spend. Investments are being planned in social network sites and mobile shopping.

- A customer survey will be introduced to measure engagement. More time will be spent training store associates on messages around price, value and breadth of offering with a focus on conversion. More emphasis will be placed on replenishment over initial orders with the expectation that this will help reduce out-of-stocks on sizes. Analyzing local demographics is expected to improve sizing by store.

No acquisitions are being planned. Said Hicks, We put up a plan that is internally focused, as it should be because weve got a lot of opportunity. We got a lot of work to do. If we do those things, those will present other opportunities and we explore those opportunities as they present themselves. But right now, our focus is executing this plan and if the opportunity presents itself, well look and consider it, but weve got more than enough to chew on with what we have.