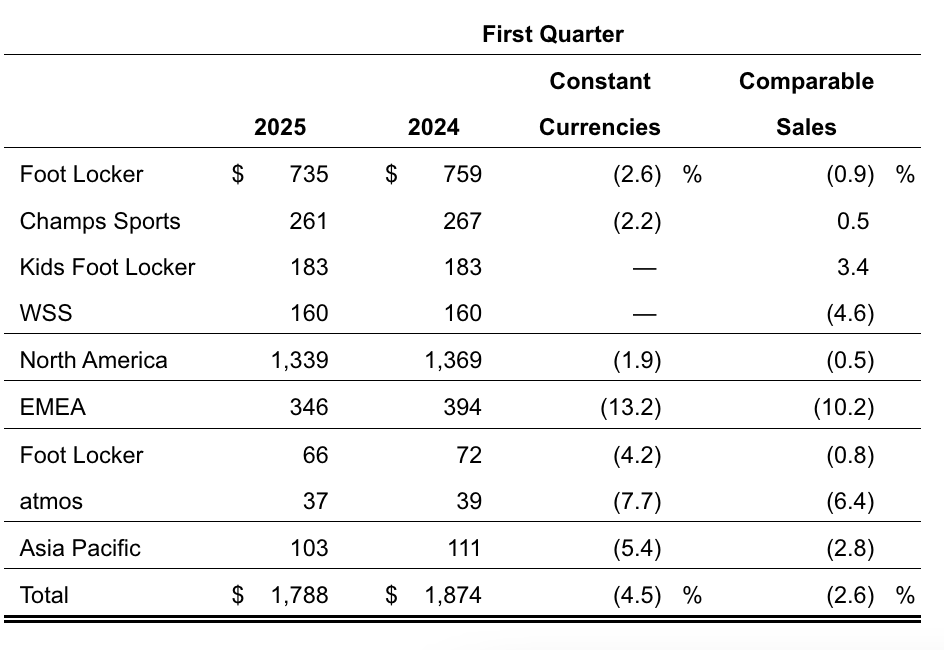

Foot Locker, Inc. reported fiscal first quarter total sales were down 4.6 percent to $1.79 billion, as compared with sales of $1.87 billion in the first quarter of 2024. Excluding the effect of foreign exchange rate fluctuations, total sales for the first quarter decreased by 4.5 percent year-over-year (y/y).

Comparable sales decreased 2.6 percent y/y, with comparable sales in the North American region decreasing by 0.5 percent. Comparable sales in the company’s International businesses decreased by 8.5 percent, led by softness in Foot Locker Europe.

“As we noted at the time we reported preliminary first quarter results, we experienced softer traffic trends globally that impacted our performance,” offered Mary Dillon, CEO, Foot Locker, Inc. “During the quarter, we remained focused on the rollout of our Reimagined and Refresh programs to elevate our in-store experience, enhancing our digital offerings, deepening customer engagement through our FLX program and leveraging our strong brand partnerships to generate excitement for our customers. As we have executed these and other initiatives to further advance our strategy, our teams have also remained nimble to navigate the uncertain macroeconomic environment, including managing our promotional levels, inventories, and expenses and remaining disciplined with our cash flows.”

Sales by Retail Banner

(in $ millions)

Gross margin decreased 40 basis points compared with the prior-year period. Merchandise margins decreased 10 basis points, while occupancy as a percentage of sales increased by 30 basis points as compared to the prior-year period.

SG&A as a percentage of sales increased by 100 basis points as compared with the prior-year period, due to underlying deleverage on the sales decline and investments in technology which more than offset the cost optimization program and ongoing expense discipline. Compared to the prior year, SG&A dollars were down 0.7 percent.

Net loss for the quarter was $363 million, compared with net income of $8 million in the prior-year period. On a non-GAAP basis, net loss was $6 million for the first quarter, as compared with net income of $21 million in the corresponding prior-year period.

First quarter loss per share was $3.81, as compared with earnings per share of 9 cents in the first quarter of 2024. Non-GAAP loss was 7 cents per share in the first quarter, as compared with non-GAAP earnings per share of 22 cents in the corresponding prior-year period.

Non-GAAP net loss and net loss per share exclude non-cash impairment charges totaling $276 million and primarily reflect a $140 million charge related to a trade name and a goodwill impairment charge of $110 million. Additionally, the company said it recorded a full valuation allowance on its deferred tax assets and deferred tax costs related to certain of the company’s European business totaling $124 million, which is excluded from non-GAAP results.

Balance Sheet Summary

Foot Locker, Inc. had cash and cash equivalents of $343 million at quarter-end on May 3, 2025

Total debt was $445 million at quarter-end.

As of May 3, 2025, the company’s merchandise inventories were $1.67 billion, 0.4 percent higher than at the end of the first quarter last year. Excluding the effect of foreign currency fluctuations, merchandise inventories decreased by 0.7 percent as compared with the first quarter of last year.

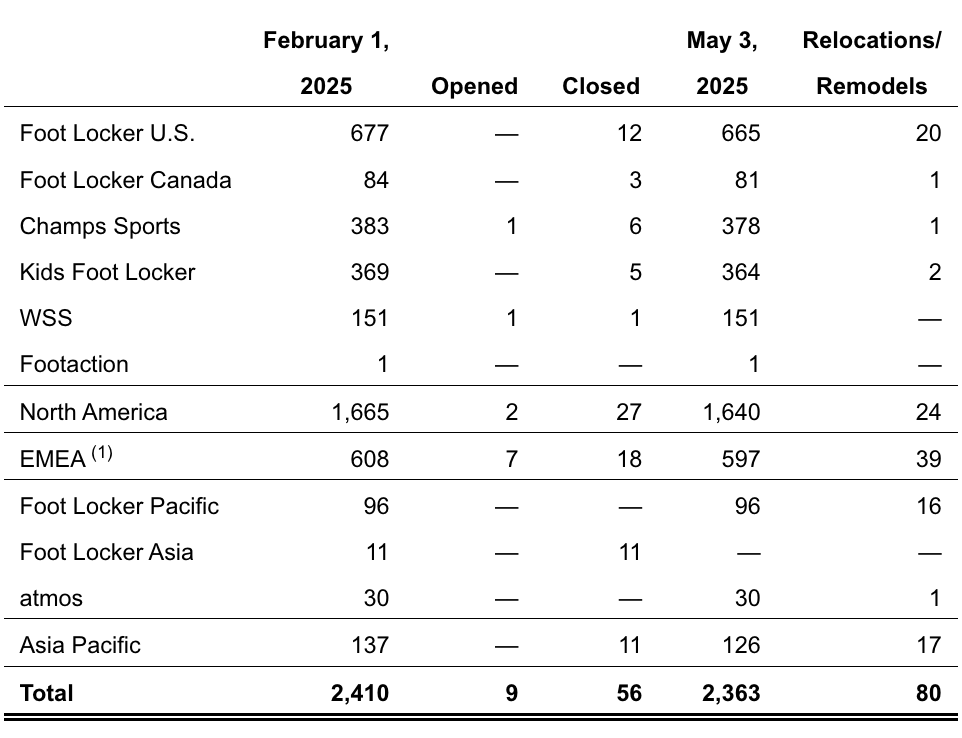

Store Base Update

During the first quarter, the Company opened nine new stores and closed 56 stores, including its stores that operated in South Korea, Denmark, Norway, Sweden, Greece, and Romania. Also during the quarter, the company remodeled or relocated 11 stores and refreshed 69 stores to the company’s updated design standards, which incorporate key elements of its current brand design specifications.

As of May 3, 2025, the company operated 2,363 stores in 20 countries in North America, Europe, Asia, Australia, and New Zealand. In addition, 236 licensed stores were operating in the Middle East, Europe, and Asia. The licensed operations include the Greece and Romania business that was sold to the company’s license partner in April 2025.

Due to Dick’s Sporting Goods’ pending acquisition of Foot Locker, Inc., the company will not hold its regular earnings conference call with analysts for the first quarter.

Image, data and tables courtesy Foot Locker, Inc.

See below for additional information on the Dick’s SG acquisition of Foot Locker, Inc.:

EXEC: Dick’s SG Senior Execs Talk Foot Locker Deal, Tariffs and Guidance

EXEC: Dick’s SG and Foot Locker Confirm $2.4 Billion Merger Deal